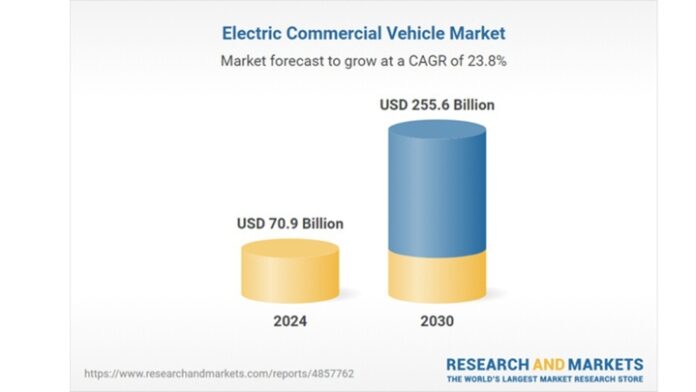

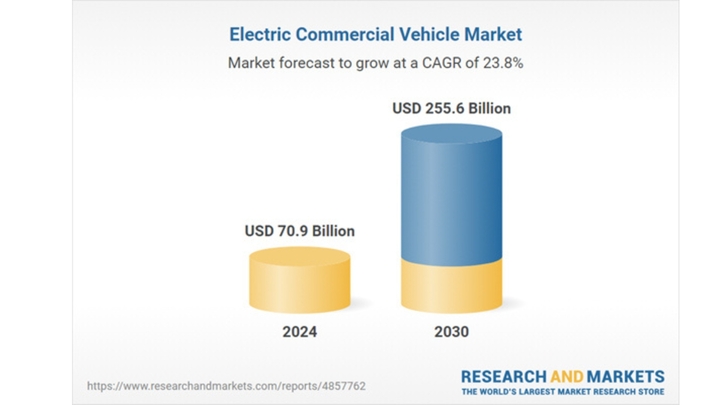

The Electric Vehicle Market Reaches $255.6 Billion by 2030

According to the latest report from ResearchAndMarkets.com, the global electric commercial vehicle market is entering an explosive growth phase. The market size is expected to reach $255.6 billion by 2030, a significant surge from $70.9 billion in 2024, with a compound annual growth rate (CAGR) of up to 23.8%.

The electric commercial vehicle market grows at a CAGR of 23.8%.

The medium and heavy-duty electric truck (eHGV) segment is considered the “spearhead” of the green transition in logistics. New-generation lithium-ion battery technology is enabling many eHGV models to achieve a range of over 500 km on a single charge.

The growth momentum stems from three key factors: strong government incentives, pressure to reduce greenhouse gas emissions, and remarkable advancements in battery technology. Electric commercial vehicles – including pickup trucks, medium and heavy-duty trucks, and buses – are gaining dominance due to significantly lower operating costs compared to internal combustion engine (ICE) vehicles.

Milence – a joint venture between Daimler Truck, Volvo Group, and TRATON – also inaugurated the first dedicated eHGV charging station in the UK, capable of accommodating up to 32 trucks. This move is seen by experts as an affirmation that electric trucks are ready for large-scale commercialization.

Leading manufacturers such as BYD (China), Mercedes-Benz (Germany), Volvo (Sweden), and Ford (USA) are also racing to launch new products in the electric truck segment. Notable models include the Mercedes-Benz eActros, Volvo FL Electric, BYD T-Series, and Rivian R1T, which are being favored by logistics companies in Europe and the USA.

Additionally, new financial models – ranging from monthly rentals, all-inclusive service contracts, to government investment support packages – are helping businesses overcome initial cost barriers. This is a crucial factor in accelerating the transition to electric trucks.

2025 – The Pivotal Year for Electric Trucks

Mike Brown, Vice President of VEV Fleet Electrification Consulting, shared his insights: “2025 will be the pivotal year for electric trucks. We are witnessing a true Net Zero revolution in transportation.”

According to Brown, three significant trends are simultaneously shaping the market:

Firstly, legal pressure from global climate targets is forcing commercial vehicle manufacturers to transform. To meet the goal of reducing CO₂ emissions by 45% by 2030, merely improving diesel engines is insufficient. Companies must accelerate the development of electric vehicles.

Secondly, the consumer market is evolving. When Amazon announced the deployment of 150 eHGVs, and Kuehne + Nagel declared an end to diesel vehicle purchases, the entire supply chain began to react. These are no longer isolated experiments but long-term strategies.

Thirdly, the economic equation is gradually being solved. The total cost of ownership for electric vehicles is becoming more competitive. Innovative financial models, including long-term truck leasing, monthly operating services, and government financial support, are helping businesses overcome initial investment barriers.

Brown emphasized that transportation companies should act now or risk falling behind. “Don’t wait until the market saturates. 2025 is the golden time to take action,” he stressed.

Vietnam’s Transportation Industry Embarks on the Green Journey

In Vietnam, the wave of transition to electric trucks is spreading from large enterprises to individual drivers.

Recently, GOZO Joint Stock Company signed a contract to purchase 2,000 small electric trucks, VinFast EC Van, from Xanh SM, to integrate into the GOZO Express delivery network.

In the initial phase, GOZO placed an order for 500 vehicles and expects to receive all 2,000 trucks by 2025. These EC Vans will be deployed in Hanoi and Ho Chi Minh City, gradually expanding to other provinces.

GOZO Express to purchase 2,000 VinFast EC Vans from Xanh SM.

At the signing ceremony, Mr. Phan Duy Minh, CEO of GOZO Express, shared his vision: “GOZO and Xanh SM are setting a new standard for the logistics industry. Operational efficiency must go hand in hand with environmental responsibility. We expect VinFast EC Van to help reduce CO₂ emissions and fuel costs for the entire delivery network.”

It’s not just large enterprises; many individual truck drivers are also showing interest in the green transportation model.

Mr. Nguyen Van Loi (35 years old, a truck driver in Hanoi) shared his perspective: “I used to think that electric vehicles were only suitable for passenger cars, and electric trucks might not have enough payload or battery range for long-distance trips. But after seeing the EC Van, I believe that for intracity delivery routes, electric trucks make perfect sense. The cost of charging is much lower than refueling.”

Similarly, Mr. Tran Quoc Hung (40 years old, a delivery driver in Ho Chi Minh City) stated: “If the company supports the initial investment cost and provides charging stations, I am ready to switch to electric trucks. It will reduce fuel expenses and eliminate the worry of being banned from entering the city center during peak hours due to emissions.”

Who is the Big Spender That Ordered 2,000 VinFast Electric Trucks Just a Month After Their Launch?

This is the first large-scale deal in Vietnam’s logistics industry featuring an all-Vietnamese electric truck fleet.

Electric Motorcycle Brand Dat Bike Raises $4 Million: Who’s Behind It, What’s It For and Is It a Game-changer?

Dat Bike, a prominent Vietnamese electric motorcycle brand, has secured a substantial $4 million convertible loan from InfraCo Asia. This significant investment will empower Dat Bike to elevate its production capacity and enhance its automation processes. With this funding, the company is poised to revolutionize the electric motorcycle industry in Vietnam and beyond.

“A Wise Move: VinFast’s Decision to Postpone US Factory and Focus on Asian Markets”

“This decision will afford the electric car maker more time to prepare and increase its agility in responding to the electric vehicle market’s fluctuations,” said Joshua Cobb, a senior automotive analyst at BMI, to TechinAsia.