According to a recent announcement by the Hanoi Stock Exchange (HNX), Nova Group Joint Stock Company (Novaland, stock code: NVL, listed on HoSE) has disclosed information regarding its bond principal and interest payments.

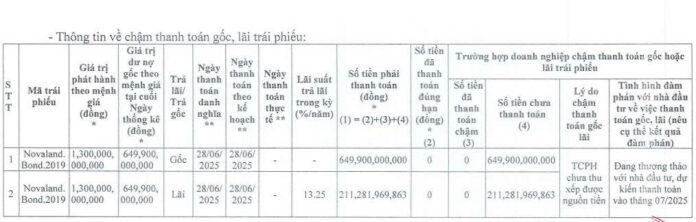

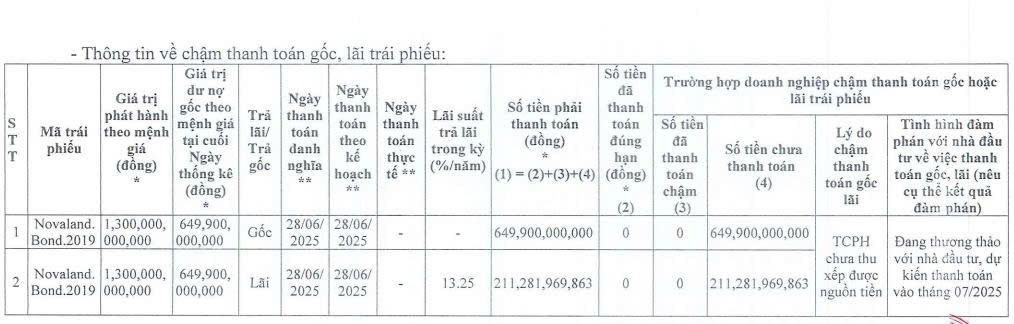

As per the schedule, on June 28, 2025, Novaland was due to make payments totaling VND 861.2 billion in principal and interest for the bond lot with the code NOVALAND.BOND.2019. This included VND 649.9 billion in principal and nearly VND 211.3 billion in bond interest.

Source: HNX

However, Novaland was unable to make the above payments due to a lack of funds. The company is currently in negotiations with investors regarding the settlement of the bond’s outstanding balance, with an expected payment date in July 2025.

The NOVALAND.BOND.2019 bond lot comprises 13,000 bonds, each with a face value of VND 100 million, totaling VND 1,300 billion in issuance value. These bonds were issued by Novaland on June 28, 2019, with a maturity of 6 years and a due date of June 28, 2025.

In a similar development, Novaland was scheduled to make payments of nearly VND 84.9 billion in principal for the bond lot with the code NVLH2123013 on March 17, 2025. However, due to a lack of funds, the company has only been able to pay over VND 11 billion, with the remaining VND 73.9 billion outstanding.

Novaland is continuing negotiations with investors regarding the delayed payment of the aforementioned bond lot’s outstanding balance.

The NVLH2123013 bond lot consists of over 4.3 million non-convertible, non-warrant-attached, asset-backed bonds, with a total issuance value of VND 430.7 billion. These bonds were issued by Novaland on September 28, 2021, with an 18-month maturity and an expected maturity date of March 28, 2025.

The proceeds from the issuance of this bond lot were intended for capital scale expansion for the company and/or its subsidiaries. Additionally, the funds were to be invested in programs and projects in the NovaWorld Ho Tram area in Ba Ria Vung Tau province and/or other eligible programs and projects to meet the requirements for bond capital mobilization.

In other news, July 4, 2025, is set as the record date for determining shareholders’ eligibility to attend Novaland’s upcoming extraordinary general meeting of shareholders (EOGM). The EOGM is tentatively scheduled for August 7, 2025, with the venue and format to be detailed in the invitation letter. The meeting agenda includes the approval of a plan to issue shares for debt conversion and other matters (if any).

“Developer of Aqua City Project Defaults on VND 502 Billion Bond Principal Payment”

The Aqua City project, a brainchild of the Aqua City Corporation, faces financial hurdles as it struggles to repay its bondholders. The company has defaulted on principal payments totaling VND 502 billion for the bond code TPACH2025004, citing challenges in arranging funds. This development raises concerns about the corporation’s financial stability and prompts a reevaluation of their capacity to honor their commitments.

“Vingroup Offers High-Yield Bonds with an Annual Interest Rate of 12%”

“Vingroup successfully issued 1,000 billion VND of bonds with a term of 36 months and an interest rate of 12% per annum. This issuance showcases the company’s strong standing in the market and the trust investors have in Vingroup’s financial stability and growth potential. With this successful bond offering, Vingroup reinforces its position as a leading Vietnamese conglomerate, committed to driving innovation and delivering long-term value.”

“Foreign Investors Continue Buying Spree, Pumping Over a Hundred Billion, Contrasting the Heavy Sell-Off of Bank Stocks”

“Foreign trading continues to be a positive factor with a net buy of over 132 billion VND across the market.”