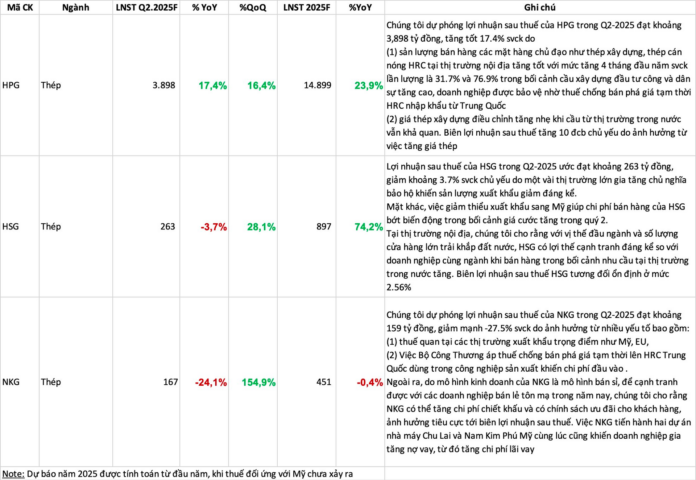

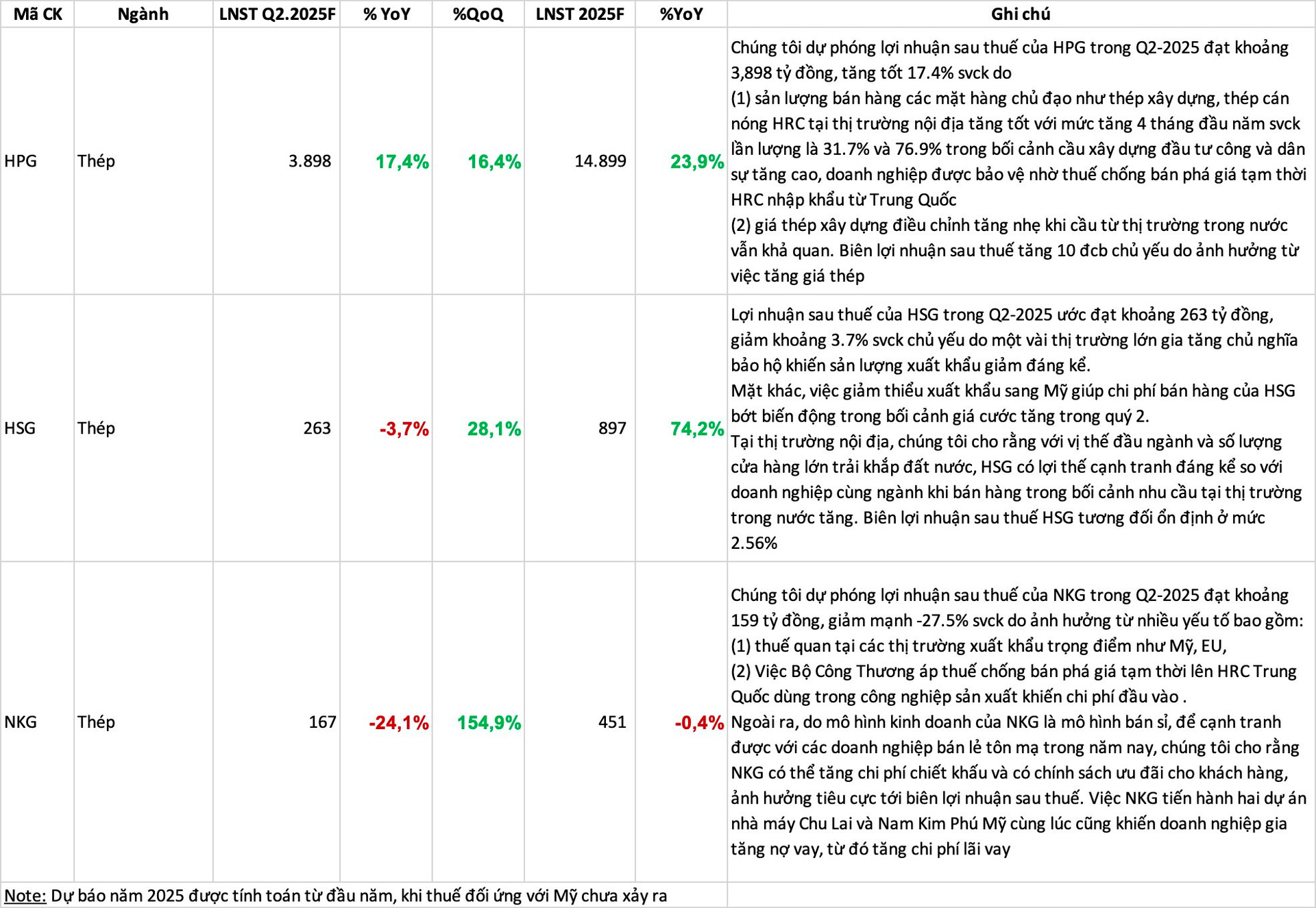

The steel industry’s second-quarter financial results, including leading companies like Hoa Phat (HPG), Hoa Sen (HSG), and Nam Kim (NKG), are eagerly awaited to gauge the impact of recent events on their performance. In a recent report, NHSV provided surprising estimates for the steel companies’ Q2 earnings.

For Hoa Phat, NHSV forecasts a 17.4% svck increase in net profit for the second quarter of 2025, reaching approximately VND 3,898 billion. This growth is attributed to a slight increase in construction steel prices, as domestic market demand remains favorable. The company’s after-tax profit margin improved by 10 dcb, influenced by the rise in steel prices.

Additionally, Hoa Phat experienced a significant increase in sales volume for its key products, including construction steel and hot-rolled steel (HRC), in the domestic market. The four-month svck growth rates were 31.7% and 76.9%, respectively, amid robust demand from public and private construction projects. The temporary anti-dumping duties on HRC imports from China further bolstered the company’s performance.

Regarding Hoa Sen, NHSV estimates a slight decrease in net profit for the second quarter of 2025, amounting to approximately VND 263 billion, representing a 3.7% svck decline. This is primarily due to increased protectionism in some major export markets, leading to a significant drop in export volume. Moreover, reducing exports to the US helped stabilize HSG’s selling expenses despite rising freight rates during the quarter.

In the domestic market, HSG’s dominant position and extensive network of stores nationwide provide a competitive edge over its peers in capturing the growing local demand. The company maintained a steady after-tax profit margin of 2.56%.

For Nam Kim, NHSV projects a significant decline in net profit for the second quarter of 2025, reaching approximately VND 159 billion, a 27.5% svck drop. This downturn is influenced by multiple factors, including (1) tariffs in key export markets such as the US and the EU, and (2) the temporary anti-dumping duties imposed by the Ministry of Industry and Trade on Chinese HRC used in industrial production, resulting in higher input costs.

Furthermore, Nam Kim’s wholesale business model may lead to increased discounting and customer incentives to compete with retail-focused peers this year, potentially impacting its after-tax profit margin. The concurrent development of the Chu Lai and Nam Kim Phu My projects has also increased the company’s debt and, consequently, its interest expenses.

Should You Buy or Sell When the VN-Index Nears 1,400 Points?

The business results for the first half of the year, alongside the looming deadline for the postponement of the reciprocal tax agreement between Vietnam and the US, are set to impact the stock market in the week ahead.

Is the SIP Chairman Planning to Transfer 3.5 Million Shares to His Wife and Children?

Mr. Tran Manh Hung, Chairman of the Board of Directors of Saigon VRG Investment Joint Stock Company (HOSE: SIP), announced his plan to transfer 3.5 million SIP shares through a negotiated agreement.