On June 27, with nearly 93% of delegates’ approval, the National Assembly passed the Law amending and supplementing a number of articles of the Law on Credit Institutions. The law takes effect from October 15. This amendment has legalized three groups of policies under Resolution 42/2017/QH14.

First, credit institutions are entitled to seize secured assets with the borrower’s consent.

Second, the debtor’s assets used as collateral for non-performing loans will only be seized to enforce court rulings on alimony or compensation for health and life, or with the consent of the credit institutions.

Third, for secured assets that are evidence in criminal cases, after completing the procedure for confirming evidence and ensuring no impact on the handling and execution of the case, the prosecuting agency shall return these assets to the credit institutions.

In its explanatory report, the State Bank of Vietnam (SBV) affirmed that legalizing the right to seize secured assets would protect the interests of banks, thereby encouraging them to lend more and reduce lending rates due to lower costs in handling and recovering debts. This will enable businesses and individuals to access and mobilize capital at reasonable interest rates to develop production and business activities, thereby increasing state budget revenues.

To prevent abuse, the Law stipulates that the seizure of secured assets is not a unilateral and unconditional action but must comply with the scope, limits, and conditions for seizure. It also regulates the order and procedure for seizure, ensuring fairness, transparency, and protecting the legitimate rights and interests of the obligated parties, credit institutions, and related parties.

During the seizure process, credit institutions must not apply measures that violate legal prohibitions or social ethics; they can only authorize the seizure to their asset management and exploitation companies. Organizations buying and selling debts can only authorize the seizure to the selling bank, its asset management, and exploitation company…

In a recent analysis, VISRating stated that restoring the right to seize secured assets for banks would help speed up bad debt recovery, improve asset quality, and enhance banks’ profitability, especially for retail banks and those with less project lending in the speculative segment.

According to VISRating, the law amendment will help banks recover bad debts faster, improve asset quality, and enhance profitability, especially for retail banks.

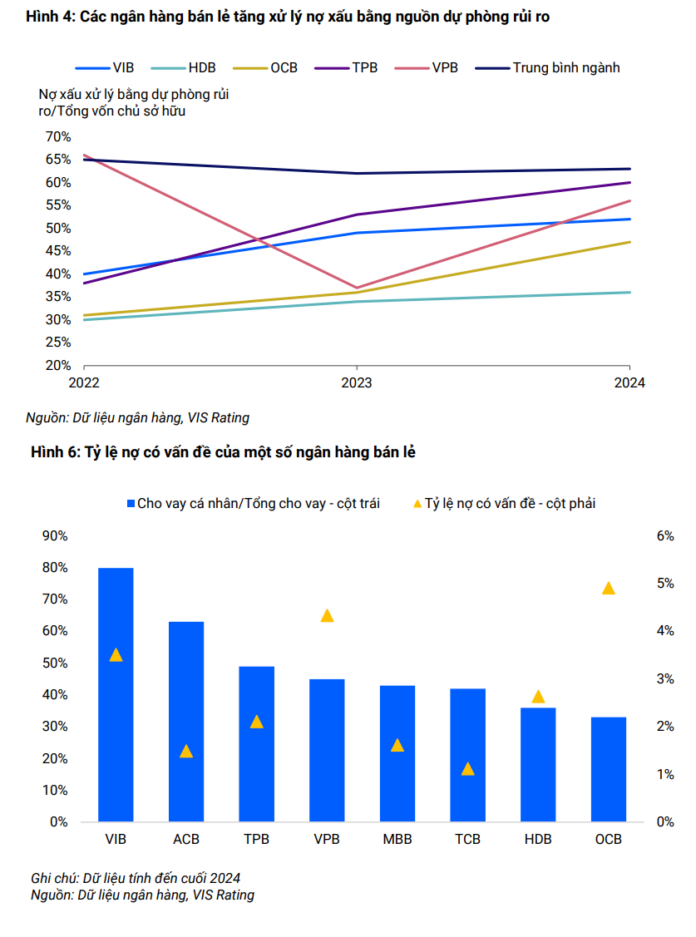

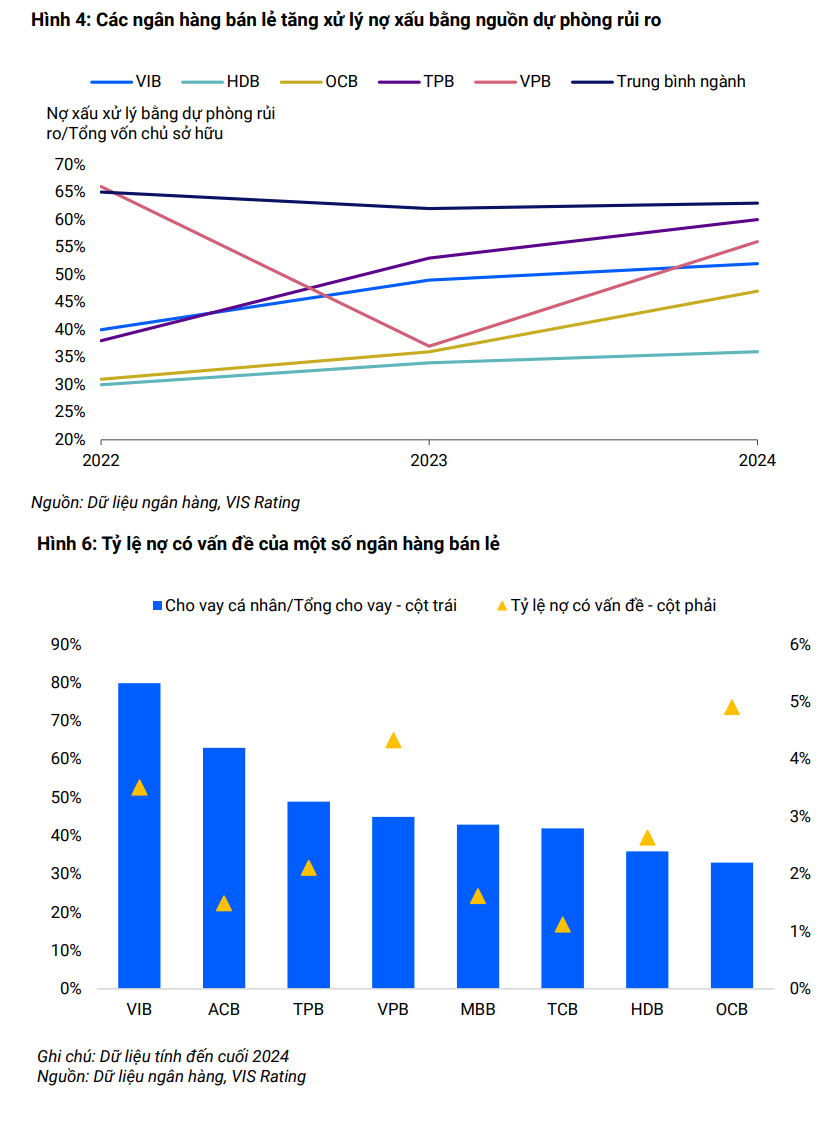

According to VISRating, in the first half of 2024, half of the bad debts were handled by the banks through risk provisioning and debt write-offs, averaging 30-40% of total equity. Additionally, the stagnant real estate market has reduced income from bad debt handling to 27% in 2024 from 40% in the 2021-2022 period.

Moreover, according to some banks (e.g., VPB), less than 30% of cases are accepted and resolved by the courts. Legal proceedings can also take 5-7 years.

From 2022 to 2025, the problem loan ratio at banks such as ACB, HDB, OCB, VIB, VPB, and MBB increased on average from 1.6% to 2.2% for mortgage loans and household business loans. While the liquidation of residential real estate is supported by strong demand, banks face challenges with secured assets related to real estate projects in the resort/speculative segment due to oversupply and market caution.

The analysis team expects the law amendment to support bank profits by improving debt recovery and reducing operating costs. This will be further boosted by the recovery of the real estate market in 2025.

Unlocking Affordable Housing: The Power of Targeted Credit

“There is a focused effort to direct credit towards affordable housing, as confirmed by Ms. Ha Thu Giang, Director of the Credit Department for Economic Sectors at the State Bank of Vietnam. She highlights that the banking sector is employing multiple strategies to prioritize credit flow and implement comprehensive solutions to help young people achieve homeownership.”

“F88: Focus on 3 Key Growth Pillars, Targets UPCoM Listing in Q3”

F88 is set to officially commence trading on the UPCoM exchange towards the end of July or early August. For 2025, the company has outlined ambitious growth plans, centered around three key pillars: expanding their sales channels, diversifying their product and service offerings, and investing significantly in technology.

Unveiling VietinBank’s Performance in H1 2025: Credit Growth at 10% and Climbing Profits

On June 19, 2025, in Hanoi, the Vietnam Industrial and Commercial Bank (VietinBank) held a conference to review the Party’s work and business operations in the first half of the year and deploy tasks for the second half of 2025.

Unlocking Real Estate Credit Growth: Navigating the Cycle

In the face of ongoing external uncertainties, the Government maintains an ambitious GDP growth target of over 8%. To achieve this goal, in addition to promoting public investment, unlocking capital for the real estate sector is crucial. The current low-interest-rate environment and ample credit room are conducive to attracting funds back into the real estate market.