President Donald Trump’s unpredictable trade and economic policies have caused global investors to question the longstanding safe-haven status of US assets.

The Dollar Index, which measures the strength of the USD against a basket of six other major currencies, including the British pound, euro, Japanese yen, Swiss franc, Canadian dollar, and Swedish krona, has fallen nearly 11% in the past six months. This decline marks the worst first half for the greenback since the end of the Bretton Woods gold standard regime and the largest six-month drop since 2009.

In the first six months of 1973, the US dollar fell 15%.

“The US dollar has borne the brunt of the impact from the unpredictable policy moves of Trump administration 2.0,” said ING bank strategist Francesco Pesole to the Financial Times.

Mr. Pesole added that Trump’s constant imposition and subsequent reversal or reduction of tariffs, along with the massive US government borrowing needs and concerns about the independence of the Federal Reserve, have weakened the appeal of the US dollar as a safe haven for investors. The currency fell 0.4% on Monday (June 30th) as the US Senate prepared to vote on Trump’s “big, beautiful” tax cut bill.

According to some estimates, this landmark bill is expected to add another $3.2 trillion to the already massive federal government debt over the next decade. This prospect has raised concerns about the sustainability of US public debt and led to a significant withdrawal from the US Treasury bond market in recent times.

The US dollar’s slide this year contradicts widespread predictions earlier that Trump’s trade wars would inflict more damage on other economies and push US inflation higher, thus strengthening the dollar against other currencies.

However, what has transpired is that the euro – which some Wall Street banks predicted would fall to parity with the dollar this year – has risen 13% to above $1.17 to the euro. As investors worry about risks to growth in the world’s largest economy, the demand for safe-haven assets has shifted from the US to European markets, such as German government bonds.

“The market has been shocked by the US tariff retaliation,” said Andrew Balls, global chief investment officer for fixed income at bond investment giant Pimco.

Mr. Balls argued that there is currently no significant threat to the US dollar’s position as the world’s de facto reserve currency. However, he added that this “doesn’t mean the dollar can’t weaken significantly,” emphasizing that many global investors are hedging their USD-denominated assets against currency risks, which, in itself, puts downward pressure on the dollar.

The expectations of a more aggressive Fed easing to support the US economy, as urged by Trump, have also put downward pressure on the dollar this year. The futures market indicates that the Fed may cut rates at least five times between now and the end of 2026, with a reduction of 0.25 percentage points each time.

While betting on lower interest rates has boosted the stock market, allowing it to surpass trade war and Middle East conflict concerns to reach record highs in recent sessions, the US dollar’s depreciation means that the S&P 500 lags behind its European counterparts when profits are calculated in the same currency.

Major investors, from pension funds to central bank foreign exchange reserve managers, have declared their intentions to reduce their holdings of USD and American assets. They also question whether the dollar remains a safe haven during market turmoil.

“Foreign investors are hedging their USD-denominated assets more, and this is another factor preventing the dollar from following the US stock market recovery,” Mr. Pesole stated.

Contrary to the deep and continuous depreciation of the US dollar, gold prices have repeatedly hit new highs this year as central banks and other investors continue to buy gold amid concerns about the depreciation of USD-denominated assets.

The Dollar Index currently stands at 96.7, its lowest level in over three years. With the rapid decline of the USD and the popularity of bets on its depreciation, some analysts believe that the US dollar’s exchange rate will stabilize.

“There have been too many bets on the dollar’s decline, and I think the pace of the dollar’s decline will slow in the coming period,” said Guy Miller, a strategist at Zurich Insurance, to the Financial Times.

Why Do Social Housing Prices Tend to Rise?

The social housing prices in Hanoi are on an upward trend, with some projects reaching an unprecedented price range of 26-27 million VND per square meter. This surge in prices for affordable housing, originally intended for low-income earners, calls for immediate and effective solutions to stabilize this market segment.

Diamond Land Records Robust Sales at Vinhomes Golden City Rap Event

On June 26, 2025, Vinhomes Golden City hosted its first ‘condo-building’ event. In less than an hour, the entire first batch of units was successfully ‘built’, showcasing the project’s appeal in the southern real estate market of this historic port city.

“Vietstock Daily Recap: Liquidity Woes Persist”

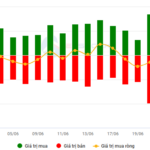

The VN-Index eased slightly after a tug-of-war session, with trading volume continuing to plunge below the 20-day average. This reflects investor caution as the index hovers at its highest level in over three years. The Stochastic Oscillator, a momentum indicator, has now entered the overbought territory and is starting to flash a sell signal. Investors should remain vigilant in the coming days as a drop below this level could trigger increased short-term corrective pressure.