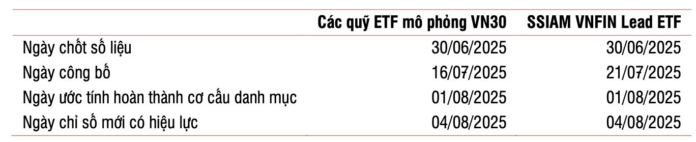

For the Q3/2025 reconstitution, the capitalization-weighted and industry indexes of the HOSE-Index, including the VN30 and VNFIN Lead indexes, will undergo basket changes. Meanwhile, the VNDiamond , VNFIN Select , and VNX-Index families will only update data and recalculate portfolio weights.

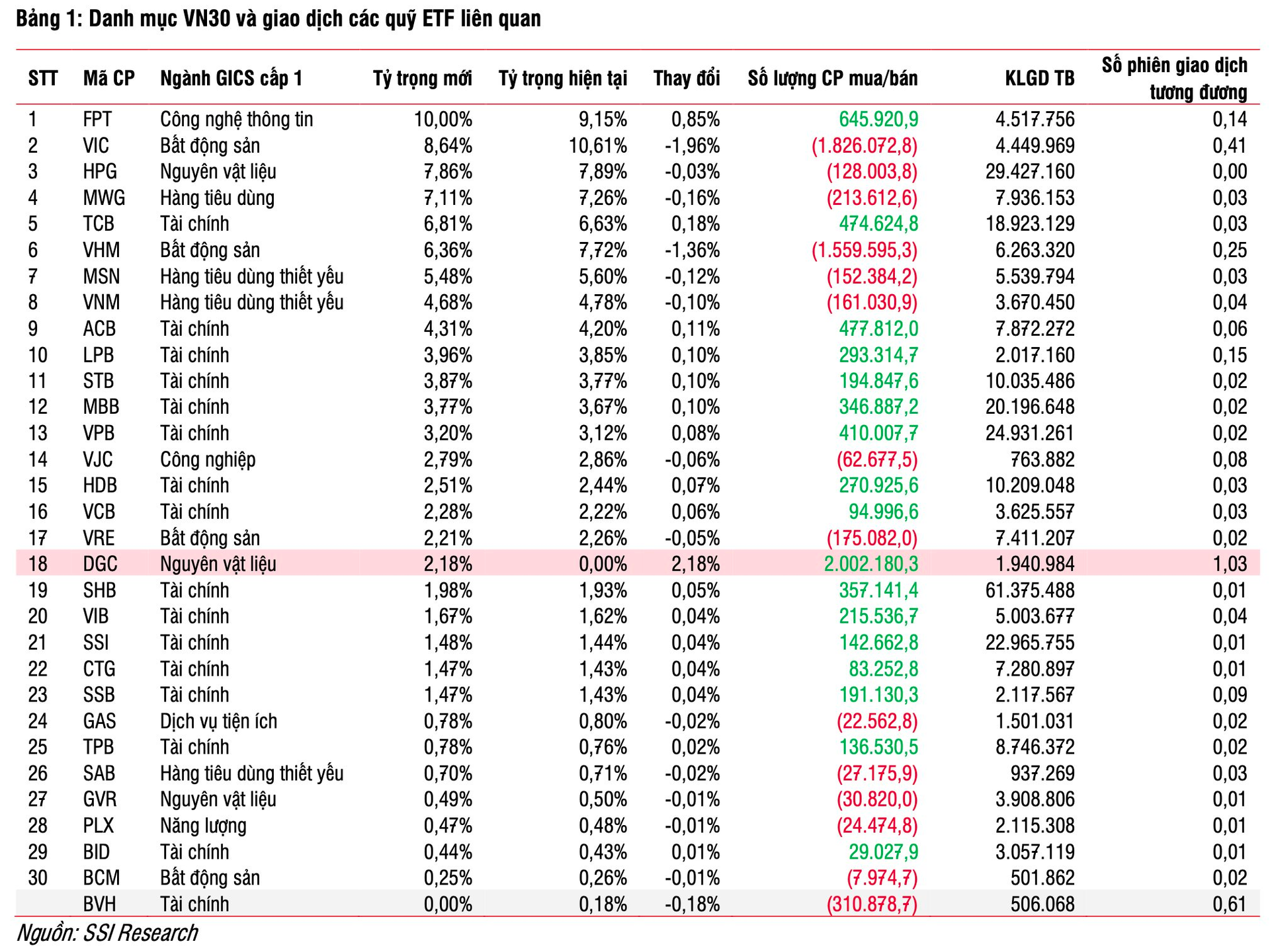

Regarding the VN30 index , according to SSI Research estimates updated as of June 25, 2025 , DGC (Duc Giang Chemical) is likely to be added to the VN30, replacing BVH (Bao Viet) due to insufficient liquidity.

As of the reporting date, BVH’s 12-month average trading value barely met the 30 billion VND threshold, as stipulated in the HOSE Index Version 4.0 rules. In contrast, DGC has fulfilled all liquidity, capitalization, and free-float ratio criteria, paving the way for its inclusion in the VN30 basket this period.

Additionally, Vingroup’s VIC and VHM are expected to witness a reduction in their weights within the VN30 due to their market capitalization surpassing the allowable limit (10% for a single stock and 15% for related groups) following substantial stock price increases. Conversely, VRE is no longer considered related to VIC for index calculation purposes, as Vingroup’s ownership stake in VRE currently stands below 20%.

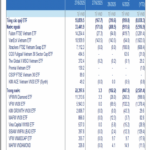

Presently, four ETFs track the VN30 index: DCVFM VN30 ETF, SSIAM VN30 ETF, KIM Growth VN30 ETF, and MAFM VN30 ETF. Their combined assets under management (AUM) are estimated at approximately VND 8,910 billion (USD 341 million) as of June 25, 2025. According to SSI Research estimates, these ETFs may offload 1.8 million VIC shares, 1.5 million VHM shares, and their entire holding of 310,000 BVH shares while purchasing 2 million DGC shares.

Notably, BSR (Binh Son Refining and Petrochemical) – a large-cap stock that recently listed on HoSE on January 17, 2025 – meets the requirements for size, liquidity, and business results but falls short of the minimum listing duration criterion (6 months) for inclusion in the VN30 this reconstitution. Consequently, BSR will be monitored further and may emerge as a strong candidate for the next reconstitution.

Turning to VPL (Vinpearl), which listed on HOSE on May 13, 2025, the stock has fulfilled the basic criteria of capitalization, free-float ratio, and business results but falls short of the minimum listing duration (6 months) and liquidity requirements.

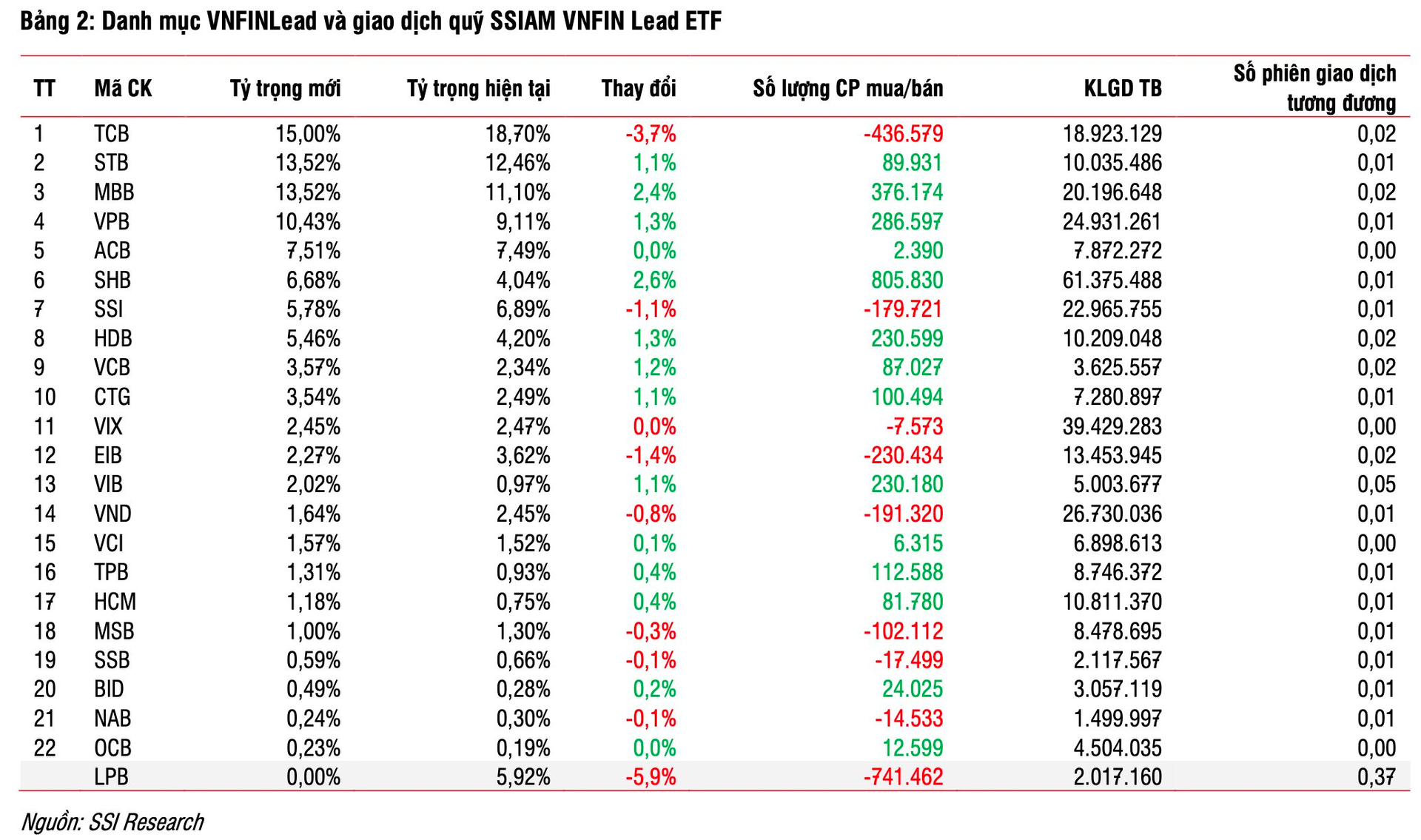

Concerning the VN-Finlead index , SSI Research anticipates that LPB might be removed from the portfolio, and no new stocks are expected to be added during this reconstitution. The SSIAM VNFIN Lead ETF currently manages total assets (AUM) worth approximately VND 398 billion (nearly USD 15 million) as of June 25. According to estimates, the ETF may offload over 741,000 LPB shares while purchasing nearly 806,000 SHB shares, more than 376,000 MBB shares, and substantial amounts of other bank stocks, including VPB, STB, ACB, HDB, VCB, and CTG.

“Securities Firms Hike Fees Starting Tomorrow”

As June draws to a close, the VN-Index soars to new heights, reaching a remarkable 1,376 points in today’s session. The market is painted in a sea of green, particularly for mid-cap and small-cap stocks. A new chapter begins tomorrow, July 1st, as multiple brokerage firms are set to increase their service charges.

The Alluring Art of Refining: Estimating the Bank Stock Sell-Off by ETFs in the Upcoming Reconstitution

The latest estimates from BSC indicate that ETFs have offloaded all their shares in BVH and made significant sales in other stocks. The data reveals that up to 10.79 million VIB shares, 7.9 million ACB shares, 4.9 million VRE shares, 1.7 million OCB shares, and 4.9 million HDB shares were also sold by ETFs.

The Great ETF Exodus: Unraveling the Sudden Outflow of Funds from Vietnam, Particularly from Thailand

The Vietnam equity market witnessed another week of outflows, with ETFs investing in the country’s stock market experiencing net withdrawals of over VND 360 billion, a surge of 55% compared to the previous week.

The Ultimate Guide to Stock Market Investing: Navigating the Tumultuous Tides

Today’s trading session (June 25th) saw VHM continue its upward trajectory, albeit at a slower pace compared to the previous session. While the momentum behind the rally showed signs of easing, profit-taking pressure at the peak levels remained relatively subdued. The VN-Index once again failed to breach the 1,370-point mark.