Selling pressure intensified during the afternoon session, with the VN-Index dipping to its intraday low at 2:15 PM. Efforts to prop up the market were successful, pushing the index back into positive territory, but most other stocks remained in the red. Nearly a hundred stocks closed with losses of over 1%.

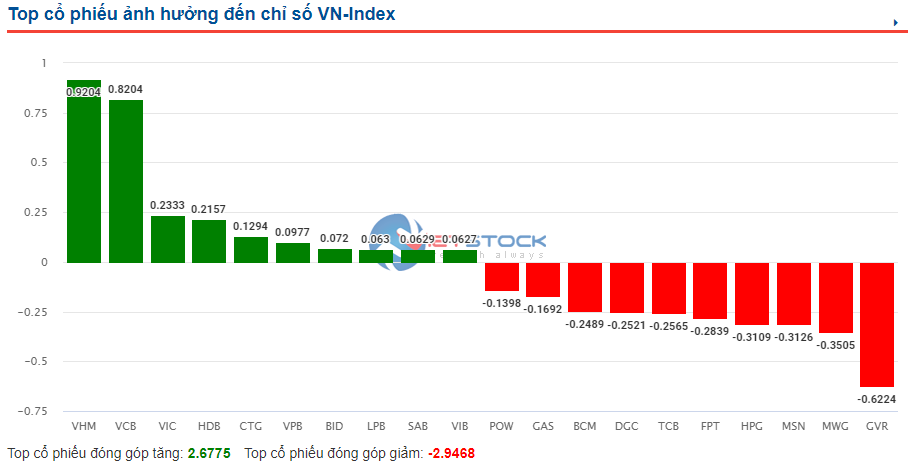

For most of the afternoon session, the VN-Index fluctuated around the breakeven point. The index touched an intraday low of 6.3 points but managed to close with a gain of 1.77 points. The final push primarily impacted the largest stocks by market capitalization, including VIC, VHM, BID, and CTG.

Around 2:10 PM, VIC fell as much as 2.2% but quickly rebounded in the final minutes. At the close of the continuous matching session, VIC even showed a slight gain of 0.42% compared to the reference price. VHM followed a similar pattern, falling as much as 2.48% before recovering to close 0.52% lower. CTG also touched a similar low, dropping by 0.84% before bouncing back to the reference price. BID, which had been relatively resilient, briefly retreated to near the reference price before surging higher, ultimately closing up by 0.83%.

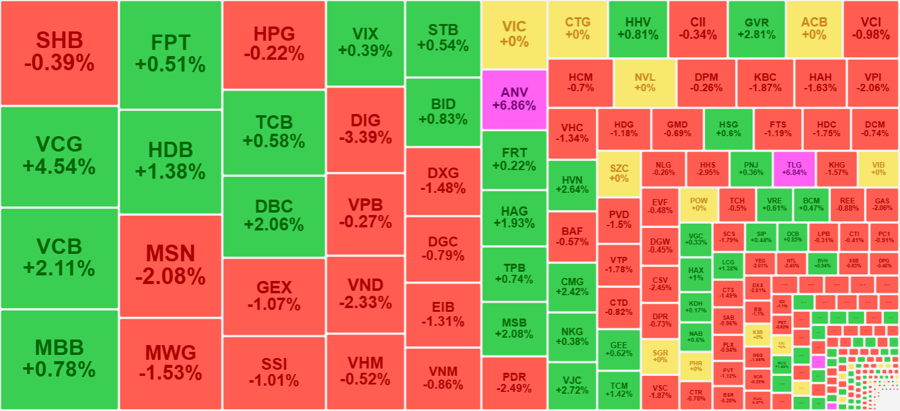

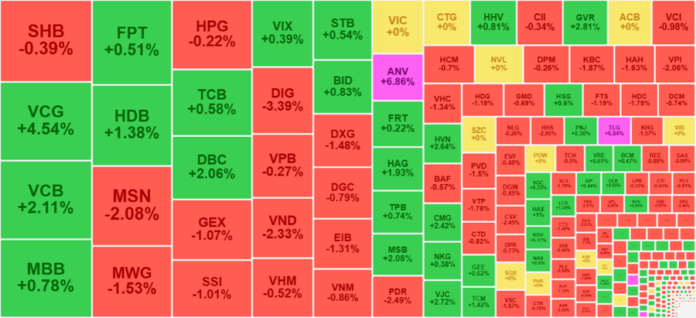

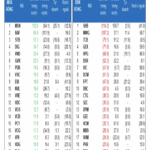

Although only a few stocks exhibited significant volatility in the final minutes, they are among the largest by market capitalization. As a result, regaining a few points for the VN-Index was not an issue. However, the VN30-Index failed to recover, closing 1.4 points lower. The impact of the late rally was not evident in the broader market: At the intraday low, the HoSE saw 86 gainers and 229 losers, but at the close, there were only 117 gainers against 196 losers.

Importantly, the extent of the damage in the remaining stocks was notable. Among the 196 losers, 97 stocks fell by more than 1%. This group accounted for approximately 28% of the total trading value on the HoSE. Nearly twenty stocks witnessed liquidity exceeding one hundred billion VND, confirming aggressive selling pressure.

In the VN30 basket, MSN contributed to the decline with a 2.08% drop and a trading value of 515.7 billion VND. MWG fell by 1.53% with a trading value of 461.8 billion VND, while SSI slipped by 1.01% with a value of 371.7 billion VND. In the Midcap segment, GEX declined by 1.07% with a value of 391.7 billion VND. DIG tumbled by 3.39% with a value of 330.4 billion VND, followed by VND with a 2.33% loss and a value of 298 billion VND. DXG and EIB also witnessed notable declines, falling by 1.48% and 1.31%, respectively, with corresponding values of 254.3 billion VND and 238.9 billion VND.

Overall, the real estate and securities sectors underperformed in this session. While there were always stocks that bucked the trend, they did not represent the majority. For instance, VCG, LDG, LHG, and SZN showed strength, but the number of stocks falling by over 1% was more than double the number of gainers. In the securities sector, a few small-cap stocks like APS, IVS, SBS, and PSI performed well, but nearly two dozen others fell by over 1%. Even in the banking sector, where VCB, BID, TCB, MBB, HDB, and MSB provided support to the index, only four stocks posted gains of over 1%, and the number of losers accounted for almost half of the group.

This divergence indicates that investors are currently more focused on specific stocks rather than the broader market. The fact that VCB, VIC, VHM, BID, and TCB are offsetting each other’s losses provides a favorable backdrop for individual speculative flows. This afternoon, liquidity on the HoSE increased by nearly 10% compared to the morning session, but the breadth did not improve, and the overall price level weakened (77 stocks fell by over 1% in the morning session).

Currently, the VN-Index is exhibiting a noisy trend as it gradually inches higher, but stocks are starting to feel the impact of rotational money. With the breadth narrowing, stocks are being subject to profit-taking depending on their previous price movements, and this trend is becoming more widespread, with the T+ cycle shortening.

Foreign investors significantly increased their buying activity in the afternoon session, with net purchases of 1,281 billion VND, 60% higher than in the morning session, while selling decreased by 51%. Net buying value reached 483 billion VND, compared to net selling of over 814 billion VND in the morning. Large transactions in VJC and HDB were absent. Stocks that saw additional selling pressure included HPG, GEX, HDG, HAH, and FRT. On the buying side, net purchases were made in SHVN, MSN, FPT, DBC, NLG, CTG, and VCB, among others.

“Securities Firms Hike Fees Starting Tomorrow”

As June draws to a close, the VN-Index soars to new heights, reaching a remarkable 1,376 points in today’s session. The market is painted in a sea of green, particularly for mid-cap and small-cap stocks. A new chapter begins tomorrow, July 1st, as multiple brokerage firms are set to increase their service charges.

“Bond Default: NVL Fails to Repay Debt Obligations”

“The company is in advanced discussions with investors regarding the settlement of its outstanding NOVALAND.BOND.2019 debt. The bond repayment is expected to be completed by July 2025, according to sources close to the negotiations. This development underscores the company’s commitment to meeting its financial obligations and fostering positive relationships with its investors.”

“Massive Windfall for Savvy Investors: A Whopping $1.8 Billion Haul in a Week”

The domestic institutional investors recorded a net sell-off of VND 3,099.3 billion, while their net buying value on matched orders was VND 1,794 billion.

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-150x150.jpg)

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-100x70.jpg)