Steel Scrap Imports: A Vital Resource for Vietnam’s Economy

Preliminary statistics from Vietnam’s General Department of Customs reveal that the country’s steel scrap imports witnessed a slight dip in May 2025, with volumes reaching 500,184 tons, valued at over $170 million. This signifies a 23.7% decrease in volume and a 14.9% drop in value compared to the previous month.

However, looking at the bigger picture, Vietnam’s steel scrap imports for the first five months of 2025 paint a different story. During this period, the country imported a substantial 2.53 million tons of steel scrap, amounting to a value of $812.52 million. These figures represent a notable surge of 27.6% in volume and a 7.1% increase in value compared to the same period last year. The average import price for steel scrap during this period stood at $320.49 per ton, reflecting a decrease of nearly 16% from the previous year.

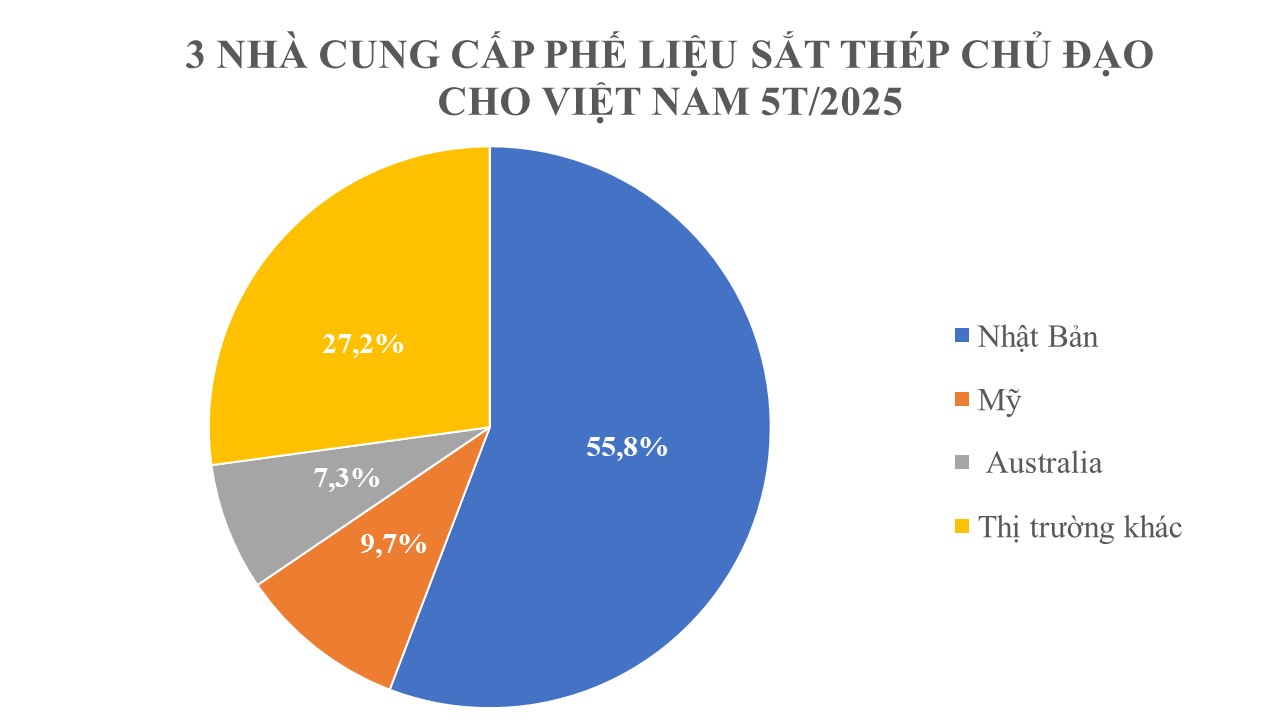

Delving into the import markets, Japan retains its position as Vietnam’s primary supplier of steel scrap during the first five months of 2025, accounting for 55.8% market share. Imports from Japan totaled over 1.41 million tons, valued at nearly $480 million, marking significant increases of 38.9% in volume and 17% in value year-on-year. Despite the rise in volume, the average price dropped to $339.25 per ton, a decrease of nearly 15.7% compared to the first four months of 2024.

Global Steel Scrap Market Insights

The United States secured the second spot as a key supplier of steel scrap to Vietnam, contributing 245,900 tons, worth $76.11 million. This accounted for a 9.7% market share of Vietnam’s total steel scrap imports and reflected increases of 28.3% in volume and 5.37% in value. However, the average price dipped to $309.5 per ton, a 17.8% decrease compared to the same period in 2024.

Australia, the third-largest supplier, witnessed a significant surge in exports to Vietnam, with volumes reaching 186,200 tons, valued at $65.13 million. These figures translate to increases of 57.27% in volume and 33.11% in value. Despite the substantial growth, the average price per ton decreased by 15.3% to $349.8.

Steel scrap imports play a pivotal role in Vietnam’s economy, serving as a vital resource for recycling and manufacturing raw materials. The utilization of steel scrap offers a multitude of benefits, including cost savings, reduced energy consumption, and a diminished environmental footprint.

Vietnam’s legal framework ensures that only high-quality steel scrap, free from hazardous substances, industrial waste, radiation, or pollutants, is permitted for import and manufacturing. Each shipment undergoes rigorous quality and safety inspections to safeguard the environment and maintain standards.

The categories of steel scrap approved for import into Vietnam encompass cast iron scrap (HS code 7204 10 00), stainless steel scrap (HS code 7204 21 00), other alloy steel scrap (HS code 7204 29 00), tin-coated iron or steel scrap (HS code 7204 30 00), and other uncoded scrap (HS codes 7204 41 00 and 7204 49 00). These codes ensure the proper classification and regulation of steel scrap imports.

Japan and the United States remain the foremost suppliers of steel scrap to Vietnam, with their imports holding significant importance for the country’s steel industry and overall economy.

In terms of import tariffs, while Vietnam and the United States have not established a bilateral free trade agreement, imports from the US generally benefit from preferential tax rates. Consequently, the import tax rates for steel scrap with HS codes 72041000, HS 72044100, and HS 72044900 stand at approximately 3% for products originating from the US. Conversely, imports from Japan enjoy a preferential tax rate of 0% under the MFN tariff regime.

According to the Vietnam Steel Association (VSA), Vietnam boasts an impressive global ranking in steel production, holding the 12th position worldwide and the top spot in ASEAN. In 2024, the country’s finished steel production reached an estimated 29.44 million tons, signifying a 6.1% year-on-year increase. Looking ahead, both production and consumption of steel in 2025 are projected to witness double-digit growth, with estimates reaching 32.9 million tons and 32.5 million tons, respectively.

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-218x150.jpg)

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-150x150.jpg)

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-100x70.jpg)