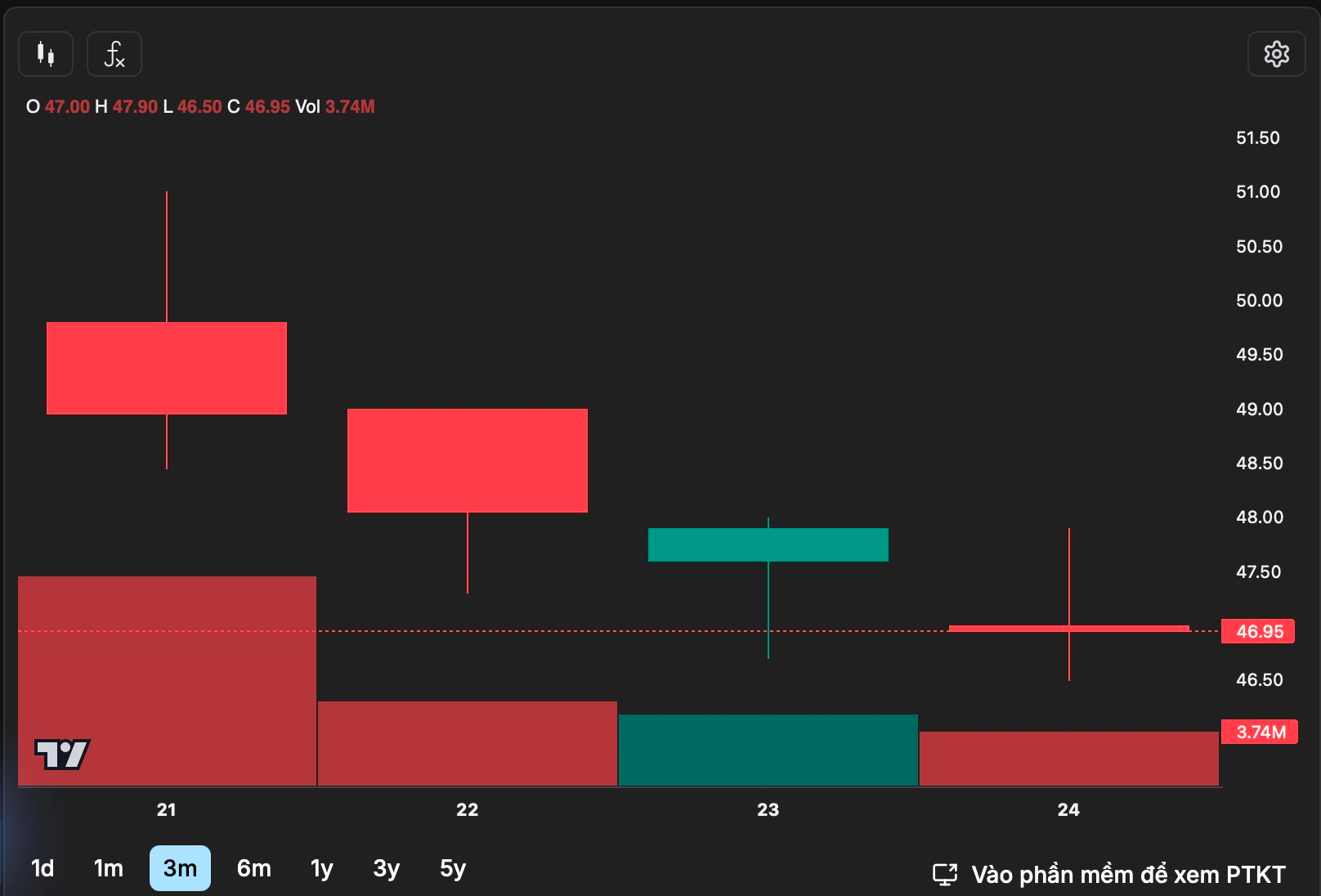

Following its dazzling debut on October 21st, reaching a peak of 51,000 VND, Techcombank Securities’ (TCBS) stock, TCX, experienced a sharp decline over the subsequent three sessions. By the close of trading on October 24th, TCX settled at 46,950 VND per share, nearly aligning with its IPO price of 46,800 VND. Investors who participated in the IPO are currently seeing minimal gains.

TCBS was one of the most anticipated IPOs of 2025, boasting a staggering valuation exceeding 4 billion USD. The brokerage successfully offered 231.15 million shares to 26,099 investors. Of these, 112.2 million shares were allocated to 26,014 domestic investors, while the remaining 109.9 million shares were acquired by 85 foreign investors.

At the offering price of 46,800 VND per share, TCBS raised a total of 10.8 trillion VND, netting over 10.7 trillion VND after expenses. The capital raised is earmarked for two primary purposes: 70% for proprietary trading and 30% for brokerage services, margin trading, and securities lending.

Upon completion of the offering, TCBS’s chartered capital increased from 20.802 trillion VND to 23.133 trillion VND, marking the highest chartered capital among Vietnamese securities firms. This figure is set to rise further following the company’s dividend distribution. On October 30th, TCBS will finalize its shareholder list for a written vote on the 2024 dividend plan, which includes a 5% cash dividend and a 20% stock dividend.

According to reports, TCBS’s pre-tax profit for Q3 2025 reached 2.024 trillion VND, an 85% increase year-over-year and the highest since its inception. For the first nine months, the company’s pre-tax profit totaled 5.067 trillion VND, up 31% from the same period in 2024, achieving nearly 90% of its annual profit target.

TCBS is the first securities firm in Vietnam with outstanding loans surpassing 40 trillion VND, an increase of nearly 8 trillion VND from the end of Q2, maintaining its leading position in market share for margin lending. Beyond its capital size and financial strength, TCBS also ranks among the top three stockbrokers on HoSE with a 7.75% market share and second on HNX with an 8.81% share.

Prime Minister: Maximizing Deployment of Highly Skilled Officials for Railway Projects

Prime Minister Pham Minh Chinh has urged relevant agencies to maximize resource mobilization, particularly by deploying highly skilled, capable, and responsible officials and civil servants to lead specialized tasks in railway projects and infrastructure development. He also emphasized the need to review and establish appropriate mechanisms, policies, and incentives to ensure effective implementation.

2021-2025 Term: Government Resilience and Lasting Values

Perhaps no term in the history of the Vietnamese government has begun amidst such formidable challenges. As the 2021–2025 administration assumed office, the COVID-19 pandemic was at its peak, global supply chains were disrupted, the world economy had plunged into recession, and pressing issues like climate change, geopolitical conflicts, energy crises, and food security loomed large.