Fig. 1: Pork Imports and Exports in Vietnam, 2024-2025

According to Vietnam’s Ministry of Industry and Trade, the country’s imports of chilled or frozen pork reached approximately 56,000 tons in the first five months of 2025, with a total value of $149.66 million. This marks a significant increase of 78% in volume and 112% in value compared to the same period last year.

The average import price of chilled or frozen pork into Vietnam during this period was $2,661 per ton, equivalent to VND 69,000 per kg, representing a 19.5% surge from last year.

Vietnam sourced its pork imports from 19 markets, with Russia being the largest supplier, accounting for 50% of the total imported volume. Brazil and Spain followed closely, contributing 30.51% and 5.43%, respectively.

Animal husbandry experts attribute the surge in frozen pork imports to the increased demand for processed meat products during the second quarter, which coincides with the peak tourism season. This includes popular items such as sausages, pork chops, and ham.

On the export front, Vietnam shipped 3,620 tons of chilled, frozen, or fresh pork, generating $27.75 million in revenue. While the export volume witnessed a 10.4% decline, the export value rose by 17.3% compared to the same period in 2024.

Hong Kong remained the primary market for Vietnamese pork exports, despite a 5.6% decrease in volume. However, the export value to this market increased by 20.5%. Conversely, exports to Malaysia and Singapore witnessed a decline compared to the previous year.

According to the Ministry of Agriculture and Environment, pig farming accounted for 60-64% of the livestock structure in the 2020-2024 period, significantly higher than the global average of 40%. In 2024, the output of live pig exports reached 5.18 million tons, a 6.6% increase from 2023.

Looking ahead, the ministry anticipates challenges for Vietnam’s pig farming industry in the 2025-2026 period due to shifting consumer preferences towards other types of meat. This shift is expected to lead to a decrease in the demand for pork and pork-derived products. Additionally, the economic downturn makes poultry a more affordable and attractive option for consumers, further impacting the demand for pork.

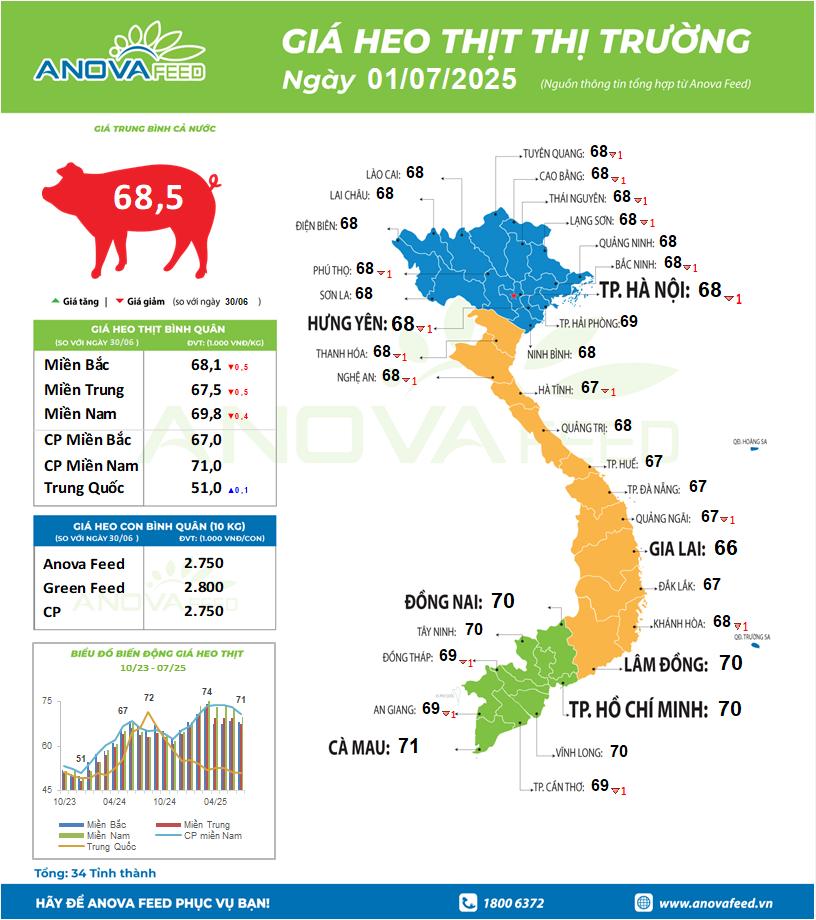

Fig. 2: Domestic Pork Prices in Vietnam

On a global scale, pork exports are estimated to decrease by 1.4% in 2025, reaching 10.2 million tons. While Brazil’s exports are expected to increase, they won’t be enough to offset the decline from the EU, the US, and Canada.

Brazilian exports are projected to grow by 5% as the country continues to offer competitive prices and expand its market reach. In contrast, EU exports are estimated to drop by 4% due to reduced export volumes and intensified competition in key markets. Canadian exports are also forecast to decrease by 4%.

Global pork imports are predicted to reach 9.1 million tons in 2025, reflecting a modest 1.0% increase from the previous year. Pork consumption is expected to rise slightly by 0.5% in 2025, from 115.1 million tons to 115.6 million tons.

The First-Ever Economic Ranking Index for 34 Provinces and Cities: Unveiling the Latest Provincial Power Rankings

“Ho Chi Minh City, Hanoi, Haiphong, Quang Ninh, and Dong Nai continue to be the nation’s outstanding growth poles, playing a pivotal role in the country’s value chain.”

The Gambling Insurance Executive: A Tale of High-Stakes and Female Empowerment

“In a shocking development, local authorities raided a gambling operation, catching the Head of Regional Insurance, PJICO Gia Lai Insurance Company, red-handed. Accompanying him were nine other individuals, all female, engaged in a high-stakes game of Xì Lát, a popular card game in the region. This brazen act of illegal gambling has sent shockwaves through the community, as the involvement of a prominent figure has left many reeling.”