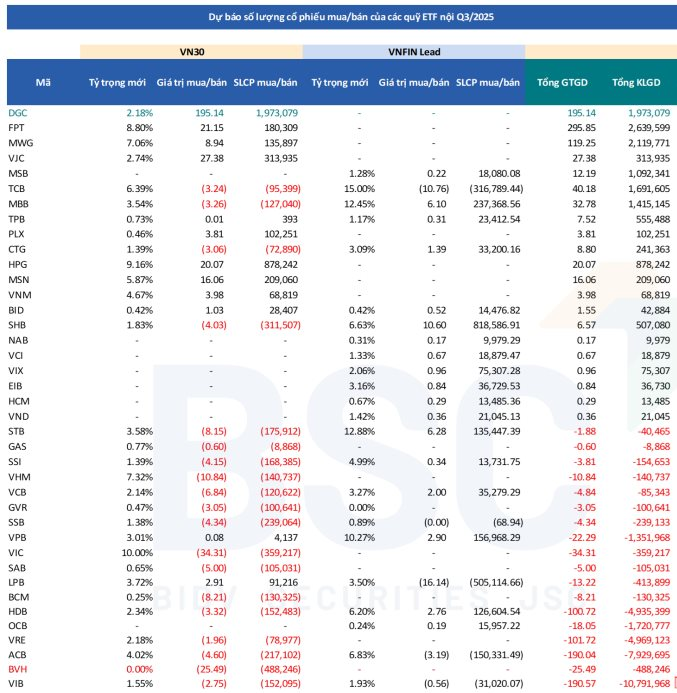

VN30 and VNFINLead Index Updates: Predictions and Market Impact

Vietnam’s stock market is gearing up for some exciting changes as we approach the third quarter of 2025. On July 16, the VN30 index will announce its basket for the upcoming quarter, followed by VNFINLead on July 21. The ETFs tracking these indices will then have until August 1 to complete their portfolio restructuring. In anticipation of these events, BSC has released a report predicting notable adjustments to the index constituents.

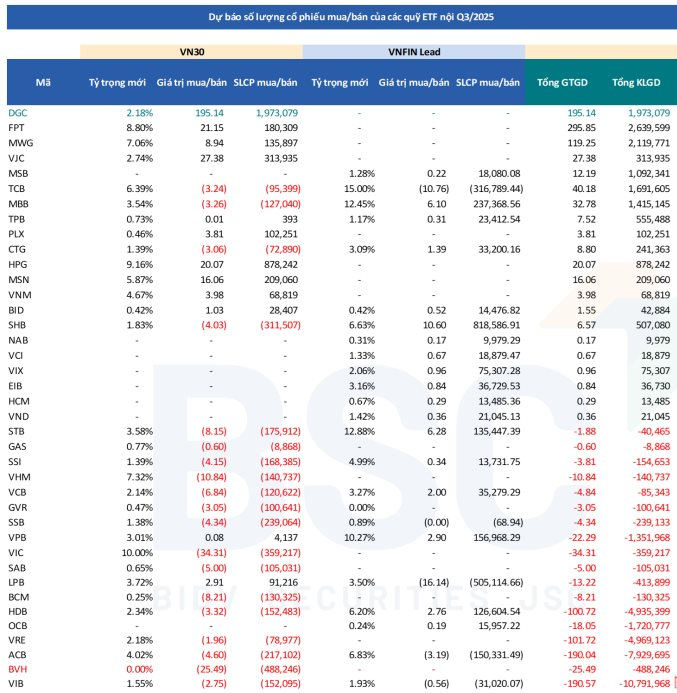

VN30 Index Changes: BSC anticipates that DGC may be added to the VN30 basket, replacing BVH which could be removed due to insufficient trading volume and value. BSR, being a recent listing, is not yet eligible for inclusion as it hasn’t met the minimum six-month trading requirement.

With nearly VND 8,700 billion in assets under management, four ETFs are currently tracking the VN30 index: E1VFVN30, FUEKIV30, FUEMAV30, and FUESSV30. BSC estimates that these ETFs will collectively purchase nearly 2 million DGC shares for their portfolios. HPG is another stock that may see significant buying interest, with an estimated purchase of 880,000 shares.

On the other hand, stocks like VIC, SSB, ACB, and SHB are expected to witness selling pressure during this restructuring phase.

VNFINLead Index Stability: Unlike the VN30 index, BSC predicts no changes in the constituents of the VNFINLead index for this review period. However, they caution that LPB may be at risk of removal from the index if it fails to meet the turnover rate criteria. In such a scenario, BSC estimates that over 940,000 LPB shares could be offloaded.

Source: BSC Research

Quarter 1/2026 Review: Key Considerations

The report also offers insights into potential adjustments to the VN30 index for the Quarter 1/2026 review. While these predictions are based on data as of December 31, 2025, market movements in the remaining six months of the year will play a decisive role.

In the first scenario, BSC anticipates that ACV will uplist from UPCoM to HOSE after September 2025. If this occurs, ACV will only be eligible for inclusion in the VN30 index from the July 2026 review onwards. As a result, Vinpearl’s VPL stock is likely to be added to the VN30 basket in Quarter 1 of next year, while TPB may face removal. Additionally, if BSR can boost its average trading capitalization, it could also enter the index, potentially replacing DGC.

In the second scenario, if ACV uplists to HOSE between July and September 2025, both ACV and VPL are expected to be included in the VN30 index. Similarly, if BSR demonstrates improved trading capitalization, it will be a strong contender for inclusion. The addition of these new stocks would necessitate the removal of TPB, DGC, and SHB from the index.

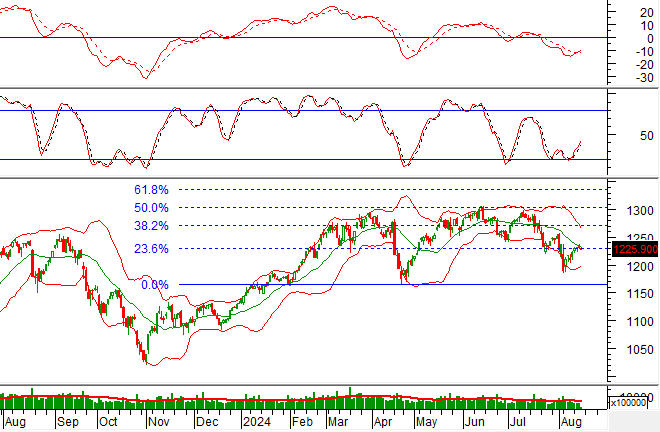

VPS Analytics Director: VN-Index Surges Towards 1450 Points, Finance and Securities Sector Leads the Wave

The VN-Index has surpassed the 1350-point milestone and is now on an upward trajectory, aiming for even higher targets. Specifically, the index is poised to reach the 1400-1450 point range, a level that signifies a significant leap forward.