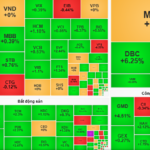

The Vietnamese stock market witnessed a highly volatile session on July 1st, with strong fluctuations throughout the day. The VN-Index opened on a positive note, maintaining its upward trajectory for most of the morning. However, intense profit-taking pressure towards the end of the morning session caused the index to suddenly plunge into negative territory. It was only in the late afternoon, thanks to strong buying support, particularly in the banking sector, that the VN-Index managed to recover and close in the green.

At the close of the July 1st session, the VN-Index posted a modest gain of 1.77 points, ending the day at 1,377.84. In contrast, the HNX-Index and the UPCoM-Index fell, closing at 228.45 and 100.64, respectively.

Trading volume on the market improved compared to the previous session, with a combined value of nearly VND 22,900 billion on the three exchanges. Notably, the HoSE exchange witnessed a significant increase in trading volume, reaching nearly VND 21,000 billion, an increase of over VND 2,000 billion from the previous session.

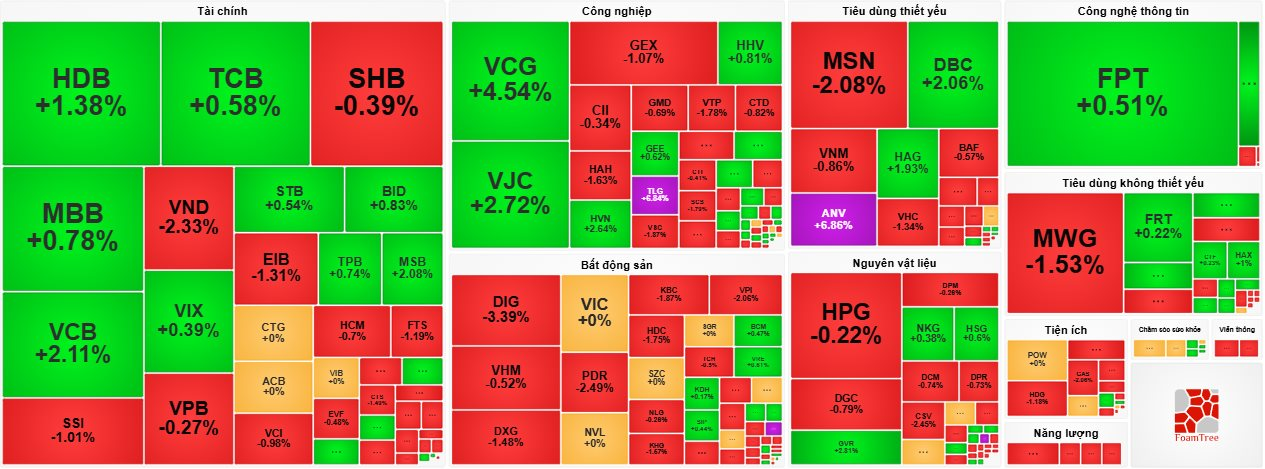

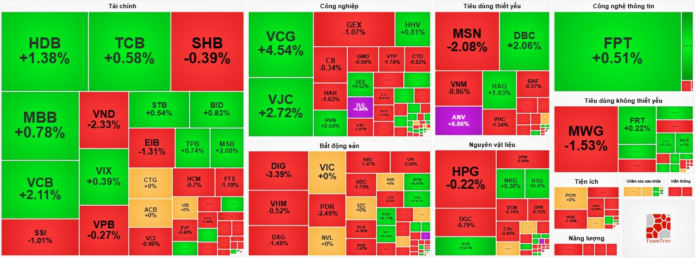

A mixed performance was witnessed across the market during the July 1st session.

The banking sector was the main catalyst behind the VN-Index’s recovery, with notable gainers including VCB (+2.11%), HDB (+1.38%), and MSB (+2.08%). Other large-cap stocks in various sectors also contributed to the index’s performance, with smaller gains of less than 1%, such as MBB, TCB, STB, TPB, BID, OCB, and NAB, among others.

Similarly, the aviation sector attracted strong investment interest, with HVN and VJC posting gains of 2.64% and 2.72%, respectively.

Additionally, several large-cap stocks in various sectors witnessed strong accumulation by investors, including VCG (+4.54%), HAG (+1.93%), and DBCC (+2.06%), to name a few.

On the other hand, the real estate sector faced profit-taking pressure, with notable decliners such as DIG (-3.39%), PDR (-2.49%), DXG (-1.48%), VPI (-2.06%), KBC (-1.87%), and VHM (-0.52%), among others.

The securities sector also witnessed a broad-based decline, with VND (-2.33%), SSI (-1.01%), FTS (-1.19%), CTS (-1.49%), BSI (-1.1%), and VDS (-1.74%) all ending in the red.

The oil and gas sector continued to face selling pressure, with GAS (-2.06%), PVD (-1.5%), PLX (-0.94%), PVT (-1.12%), and BSR (-0.28%) among the notable losers.

Moreover, several large-cap stocks in other sectors also witnessed significant declines, including MSN (-2.08%), MWG (-1.53%), EIB (-1.31%), GEX (-1.07%), VTP (-1.78%), and VHC (-21.34%), to name a few.

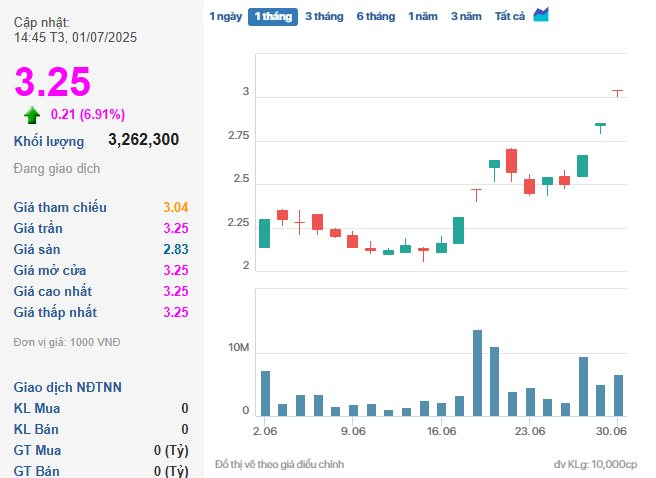

Amidst the market’s volatility, LDG stock of LDG Investment JSC continued its remarkable upward trajectory, posting its fourth consecutive trading session with the maximum allowable gain.

At the close of the July 1st session, LDG stock traded at VND 3,250 per share, surging by the daily limit of 6.91% from the previous session, with a matching volume of nearly 3.3 million shares.

This was the fourth consecutive session of LDG stock hitting the ceiling price, resulting in a significant increase in the company’s market capitalization, which now stands at over VND 830 billion.

LDG stock has been on a remarkable upward trajectory, posting four consecutive ceiling-hitting sessions.

LDG stock’s stellar performance comes on the back of positive developments within the company, particularly following the reappearance of its former Chairman, Nguyen Khanh Hung, at the company’s 2025 Annual General Meeting of Shareholders held on June 26th.

According to the company, Mr. Hung is expected to rejoin the new leadership team in the near future.

Previously, Mr. Hung had faced legal issues related to a real estate project in Dong Nai province and was sentenced to 16 months in prison.

Foreign investors, who had net bought nearly VND 600 billion in the previous session, turned net sellers in the July 1st session, offloading over VND 330 billion on the HoSE exchange. Notably, they aggressively sold VJC shares, with a net sell value of over VND 368 billion. Other stocks that witnessed net selling by foreign investors included HDB (VND 219.48 billion), HPG (VND 94.06 billion), PVS (VND 53.63 billion), and GEX (VND 52.31 billion), among others.

On the buying side, foreign investors showed strong interest in HVN, net buying over VND 70 billion worth of shares. Other stocks that witnessed net buying included MSN (VND 61.15 billion), IDC (VND 59 billion), FPT (VND 51.95 billion), and DBC (VND 45.48 billion), among others.

“VNDirect Raises VN-Index Projection to 1,450 Points: Identifying the Key Sectors”

“VNDirect forecasts a robust profit growth of 14-15% for listed companies this year, reinforcing the VN-Index’s valuation at an estimated forward P/E of 13.5 times by year-end.”

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-150x150.jpg)

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-100x70.jpg)