January 23, 2026: Warrant Market Continues to Show Divergence

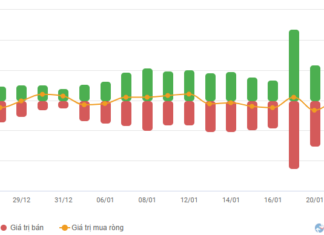

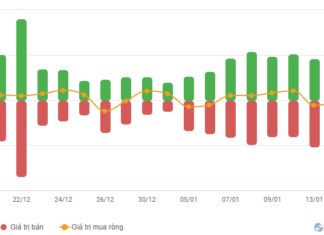

As the trading session closed on January 22, 2026, the market witnessed 110 stocks advancing, 165 declining, and 48 remaining unchanged. Foreign investors continued their net selling streak, offloading a total of VND 3.08 billion worth of shares.

Derivatives Market on January 22, 2026: Is the Situation Taking a Turn for the...

On January 21, 2026, most VN30 and VN100 futures contracts closed lower. The VN30-Index traded sideways, forming a small-bodied candlestick pattern accompanied by fluctuating trading volume, indicating investor uncertainty.

Market Volatility Persists: Stock Market Outlook for January 19-23, 2026

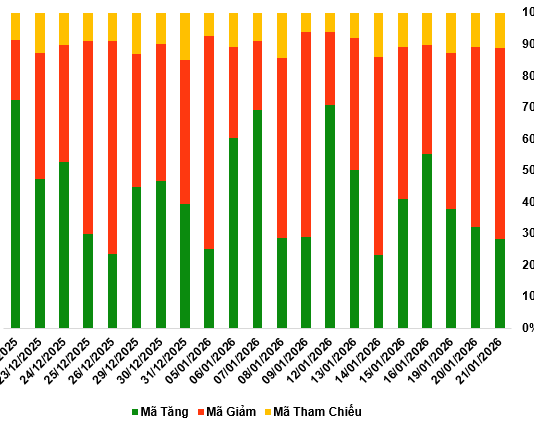

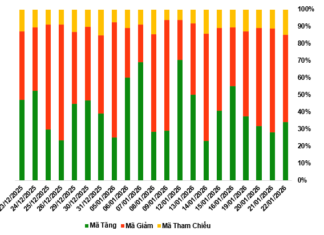

The VN-Index paused its upward momentum last week, experiencing four consecutive sessions of adjustment. Investor sentiment turned cautious, with a notable divergence in market flows as the 1,900-point threshold remains a significant short-term challenge.

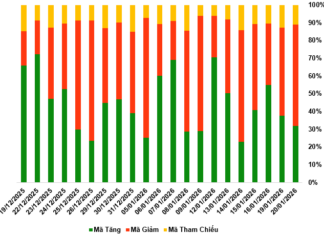

Stock Market Week 12-16/01/2026: Capital Rotation in Focus

The VN-Index rebounded in the final session of the week, capping off a volatile trading period marked by intense tug-of-war dynamics. Despite facing corrective pressures at elevated price levels, market breadth remained relatively balanced, supported by agile capital rotation across various stock groups. Moving forward, the VN-Index is likely to require additional time to absorb supply pressures and establish a new price equilibrium in the upcoming week.

Warrant Market Update for January 21, 2026: Continued Divergence

As the trading session closed on January 20, 2026, the market witnessed 99 stocks advancing, 177 declining, and 34 remaining unchanged. Foreign investors continued their net selling streak, offloading a total of VND 1.26 billion worth of shares.

Derivatives Market Week 19-23/01/2026: Overall Market Liquidity Continues to Improve

On January 16, 2026, most VN30 and VN100 futures contracts closed higher. The VN30-Index reversed its trend, forming a small-bodied candlestick pattern amid declining trading volume, indicating investor hesitation.

Exclusive Close-Up: Mercedes-Benz E300 Auctioned in Da Nang, Starting Bid at Just 282 Million...

The once-prestigious Mercedes government vehicle, which failed to sell at multiple auctions, now shows significant signs of deterioration after prolonged storage.

Today’s Coffee Prices (Jan 16): Robusta Surges Past $4,000/Ton in 4 Consecutive Sessions

Coffee prices surged across major exchanges today, with March-delivery Robusta climbing to $4,003 per ton.

Strikingly Designed Headphones: A Stunning Audio Experience for Just $215

Experience all-day comfort with our open C-bridge Design clip-on headphones, engineered for a lightweight, ergonomic fit.

America’s Paradox: Transforming a Gold Mine into a Massive Cold Storage for an “Odorless,...

"This marks our inaugural venture into a project of such magnitude," shared Lluís Miralles Verge, the project lead.