Technical Analysis for Thursday, August 8: A Tug-of-War Market

The VN-Index and HNX-Index both surged, with a significant spike in trading volume during the morning session, indicating a shift in investor sentiment towards optimism.

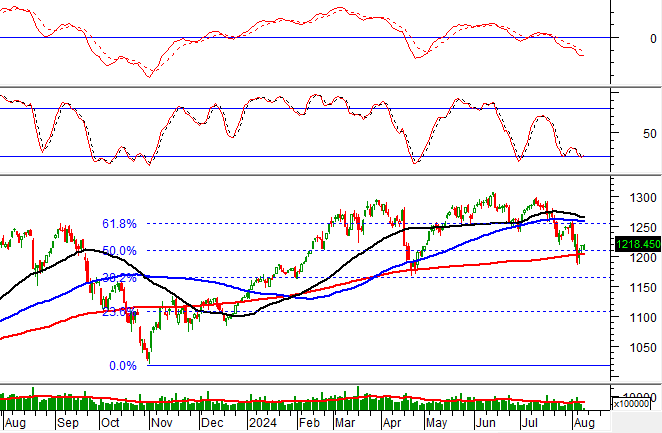

The VN-Index’s Sweet Spot for Late 2024: 1,236-1,420

The August 2024 strategy report by Rong Viet Securities Analysis Center (VDSC) highlights profit growth as the key driver for the stock market. The reasonable range for the VN-Index is 1,236-1,420, reflecting the growth in business results for 2024 compared to the previous year.

“MSCI Recognizes Vietnam’s Efforts for Market Upgrade”

Continuing her itinerary in Singapore, on August 8, Chairwoman of the State Securities Commission of Vietnam (SSC) Vu Thi Chan Phuong and the SSC delegation met with Morgan Stanley Capital International (MSCI), a leading market index provider, to discuss strategies for upgrading the Vietnamese stock market from a frontier market to an emerging market status.

The Market Turns Sour: Foreigners Sell-Off Over $1.1 Billion

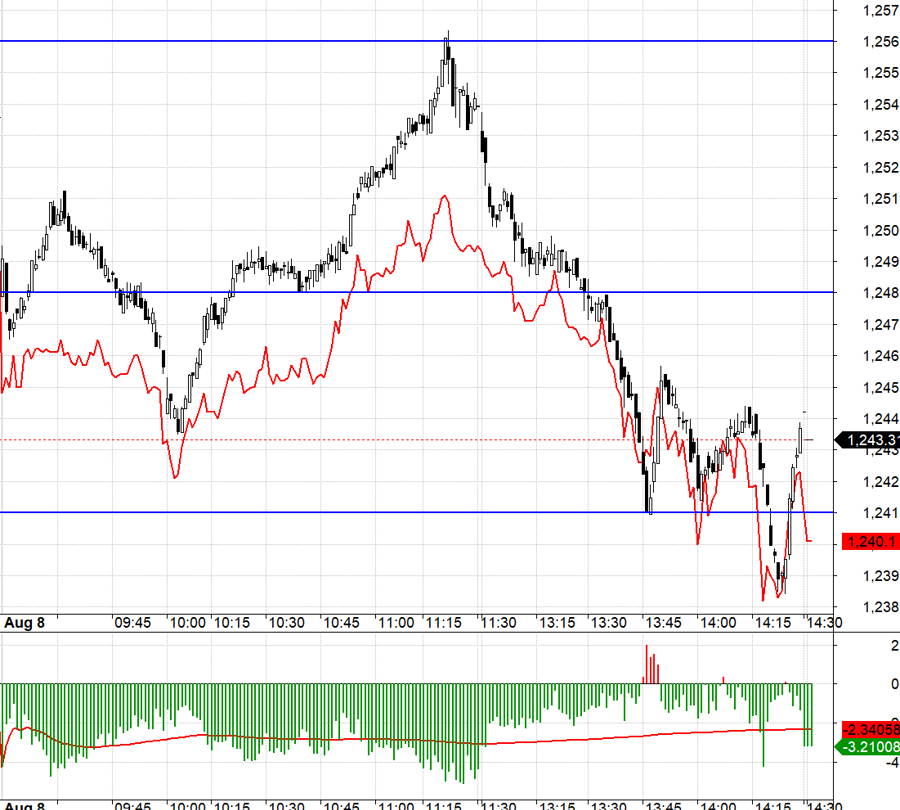

The afternoon rally was cut short as selling pressure intensified. The VN30 blue-chip stocks struggled, with the majority of shares, including the pillars, witnessing a significant decline in their highs. Small-cap stocks also faced heavy selling, with some experiencing high liquidity at the floor price.

The Stock Market Blog: A Tug-of-War of Differentiation

Today's blue-chip stocks are underperforming, with some key pillars experiencing significant pressure, notably TCB. However, the overall market is merely exhibiting typical fluctuations under the T+ effect of bottom-fishing trades. The low trading volume indicates a retreat in buying rather than overwhelming selling pressure.

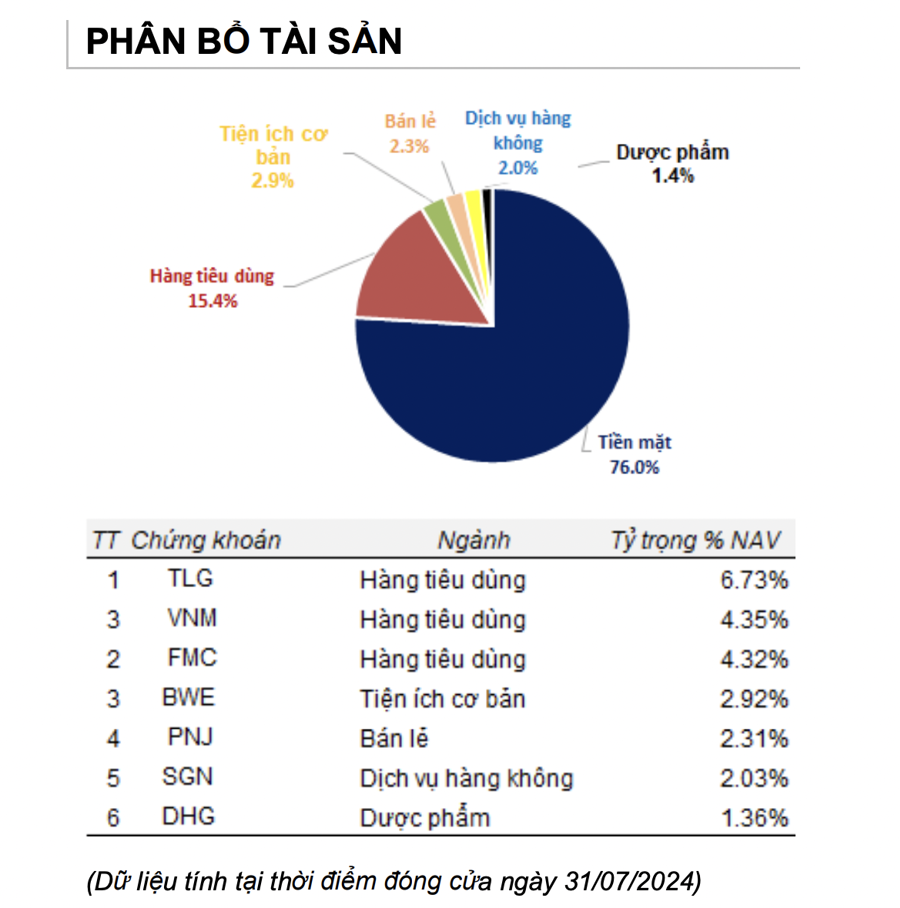

The Impatient Capital Fund: SGI’s Swift Move Despite Calls for Patience

In its recent update, SGI Capital provided a macro outlook on the domestic and global economy, warning investors of market risks and advising patience in awaiting opportunities towards the year-end. However, the fund has swiftly deployed capital, gradually reducing its cash holdings...

The Stock Market Conundrum: A Sea of Green Amidst a Tide of Uncertainty and...

The seesaw-like pattern of the stock market this morning, with prices dipping and then surging, presented an enticing opportunity for bottom-fishing. At its lowest point, the VN-Index showed a three-to-one ratio of declining to advancing stocks. However, by the end of the session, the tables had turned, and hundreds of stocks had climbed above the reference level.

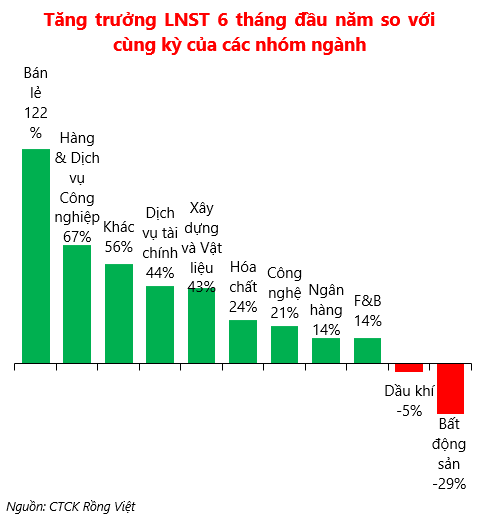

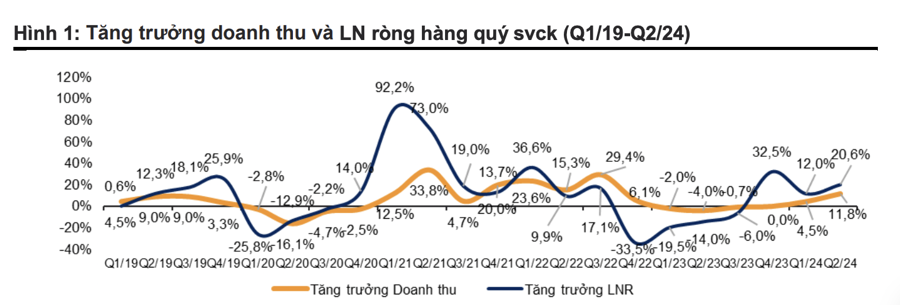

The Business Landscape in Q2 2024: A Comprehensive Overview

The net profit of listed companies on the three stock exchanges, HOSE, HNX, and UPCoM, saw a collective surge of 20.6% year-on-year, bolstered by a discernible economic rebound and the low base effect from the second quarter of 2023.

“REE to Mortgage up to 15.65 Million VSH Shares for Bank Loan”

REE has authorized its subsidiary, REE Energy, to mortgage up to 15.65 million shares of Vinh Son - Song Hinh Hydropower Joint Stock Company owned by REE Energy to secure the debt obligations (including principal, interest, and fees) of Vinh Son - Song Hinh Hydropower Joint Stock Company at Vietnam International Commercial Joint Stock Bank (VIB).

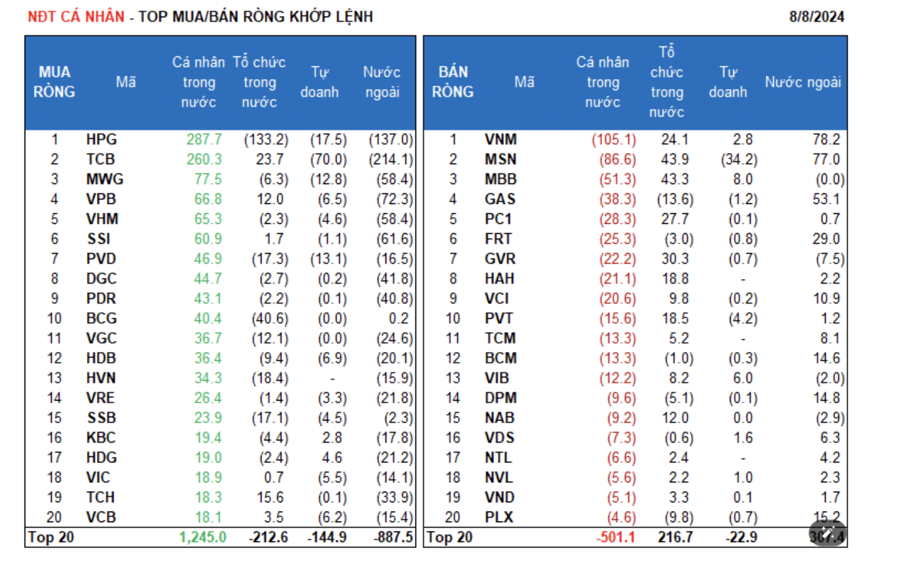

The Bold Investor: Diving Deep to Snatch Up Bank Stocks

Individual investors posted a net buy position of VND 644.5 billion, with a net buy position of VND 991.2 billion in matched orders. Focusing on matched orders, they net bought 14 out of 18 sectors, mainly in the Banking sector.