The Flow of Funds: Will the Market Break Through After Consecutive Failures at the...

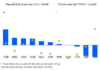

Over the past five trading sessions, the VN-Index has made two attempts to breach the 1,300-point mark, but to no avail. The surge in trading volume during these failed attempts leaves a stark impression of distribution activities.

The Bottom Fishing Trap: Unveiling the Secrets of Stock Market Profits in the Deep

Patience among sidelined funds snapped any recovery attempts today. Only steeper price dips would reveal larger order volumes. Liquidity remains extremely low after last weekend's session, which could be deemed a positive sign as those most eager to cut losses have already exited.

The Capital Flows In: MSN and FPT Witness Billion-Dollar Liquidity

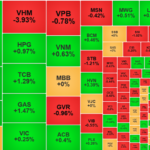

A surge in trading activity this morning saw a 34% jump in liquidity across both exchanges compared to yesterday, with the breadth of the market showing a widespread upward trend. While the money flow was not distinctly pervasive, it was concentrated on a group of strong stocks. FPT and MSN, for instance, attracted enormous buying power from both domestic and foreign investors, accounting for 23.2% of the total matched value on the HoSE and nearly 37% of the VN30 basket.

The Ever-Rising Dollar: Can Gold Prices Catch a Break?

A forecast predicts that gold prices could dip to the $2,500/oz region in the coming months, but it's expected to remain elevated through 2025.

Stock Market Blog: Short-Term Psychology Returns, Mid and Small-Cap Stocks Underperform

The enthusiastic upward momentum in the morning triggered short-term profit-taking trades in the afternoon, creating noticeable pressure. The VNI once again climbed close to the 1300 mark, and a defensive stance emerged.

The Ever-Rising Bridge of Prices: Green Electric Board

Although the VN-Index only slightly increased by 3.24 points (+0.25%) during the morning session, the index remained above the reference level for the entire period. This can be attributed to a strong buying force, with investors willing to accept higher prices. Blue-chip stocks are leading the way in terms of both index points and liquidity, accounting for over half of the market.

Stock Market Blog: Uncovering Bottom-Fishing Opportunities in Deep-Value Territory

The stalemate of waiting capital has interrupted any recovery rhythm today. It's only when prices plunge that larger order volumes are revealed. Liquidity remains extremely low following last weekend's session, which could be deemed a positive sign, as those most eager to cut losses have already exited.

The Capital Flows In: MSN and FPT Witness Billion-Dollar Liquidity

A surge in trading activity this morning pushed the matched liquidity of the two exchanges up 34% compared to yesterday's morning session, with the breadth of the rally evident across the board. However, the money flow was not well-spread and was instead concentrated on a group of strong stocks. FPT and MSN received massive buying pressure from both domestic and foreign investors, accounting for 23.2% of the matched value on the HoSE and nearly 37% of the VN30 basket.

Is China’s Economic Slowdown a Concern for the Vietnamese Stock Market?

Vietnam and China share a deep economic interdependence, with many sectors potentially impacted by this relationship, including aviation, tourism and hospitality, agricultural exports, and the construction industry.

Gold Prices Tumble as the US Dollar Surges for the 6th Straight Session.

A forecast predicts that gold prices could dip to the $2,500/oz region in the coming months, but it's expected to remain elevated through 2025.