The latest business report of Mobile World Investment Corporation (MWG) recorded a 11% decrease in the full-year revenue of 2023 to VND 118,280 billion. The company achieved 88% of its target. In December, the revenue grew by 5% compared to the previous month and also the second month in 2023 with a positive growth of 5% compared to the same period in 2022.

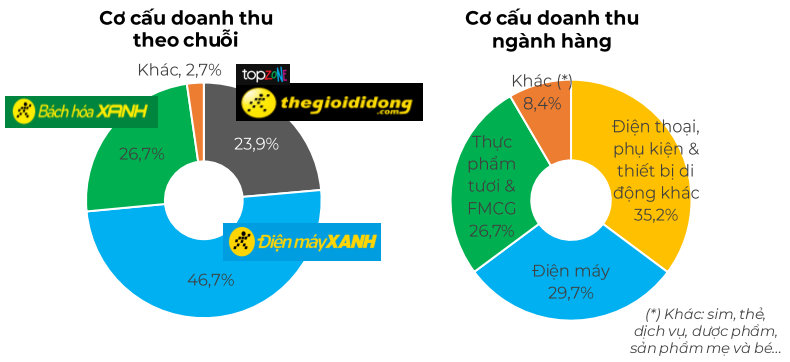

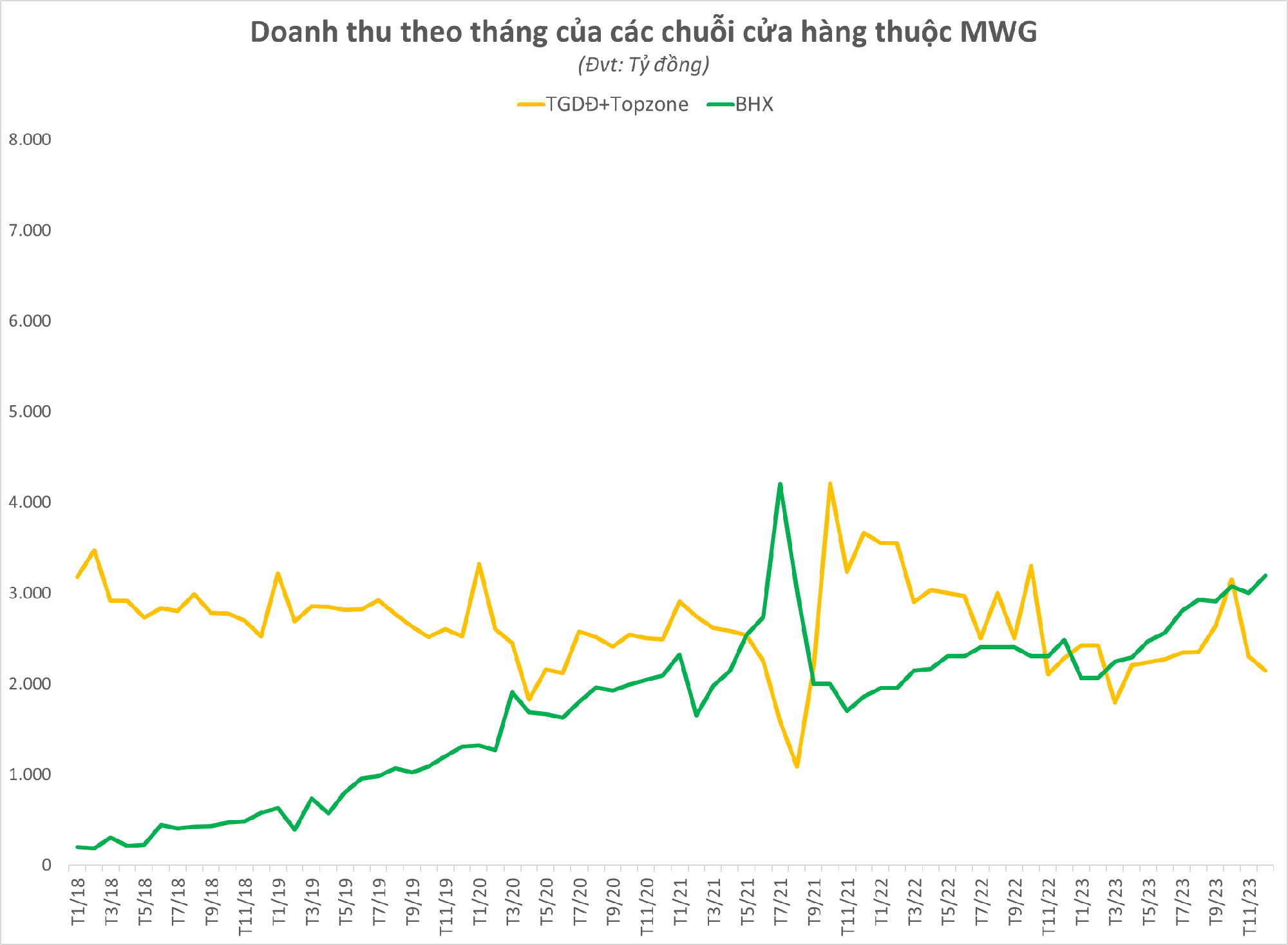

The bright spot comes from the Bách Hóa Xanh chain of stores, with the December revenue returning to growth after a slight slowdown in the previous month. MWG’s supermarket chain recorded VND 3,189 billion in revenue, bringing the full-year revenue to VND 31,581 billion, accounting for nearly 27% of the company’s total revenue and a growth of 17% compared to the previous year.

In contrast, the revenue of the Thế Giới Di động and Topzone retail chains continued to decline by 7% in the last month of the year, reaching VND 2,144 billion, marking the second consecutive month of decline compared to the previous month. Overall in 2023, MWG’s electronics and mobile phone retail chain contributed nearly 24% to the total revenue structure, equivalent to VND 28,269 billion, a decrease of more than 18% compared to the previous year.

Comparing the revenue of the two MWG store chains in December, the revenue of the Bách Hóa Xanh supermarket chain is 1.5 times higher than the revenue of the Thế Giới Di Động and Topzone chains. This is the highest ratio in the history of MWG’s operations (except for July and August 2021 due to the impact of COVID) and the 9th month in 2023 that the revenue from meat, fish, and vegetables… surpasses the revenue from phone and computer sales.

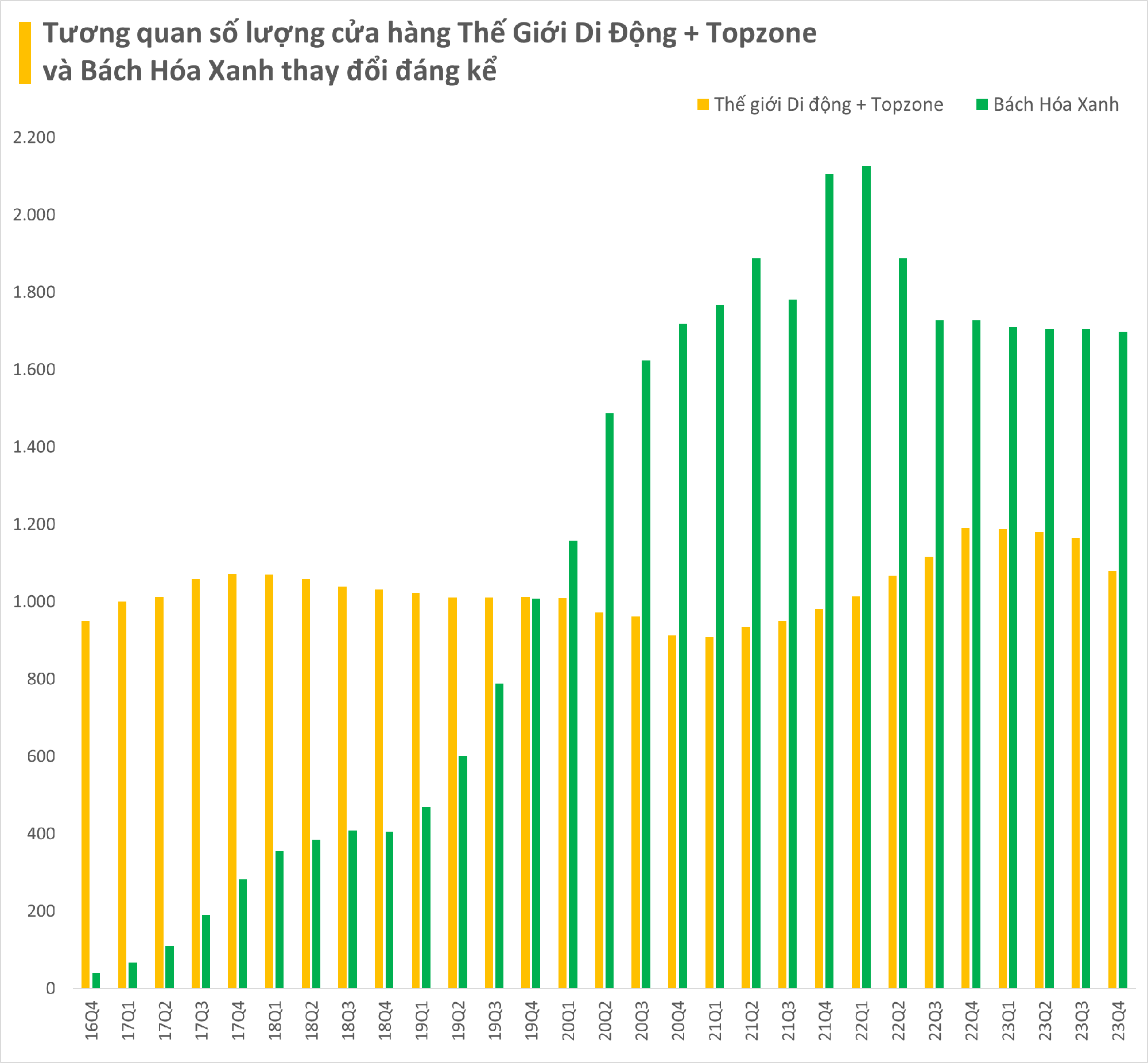

The contrast in business results is further reflected in the sharp increase in the number of Bách Hóa Xanh stores in contrast to the slowdown of the Thế Giới Di Động chain. As of December 31, 2023, Bách Hóa Xanh had 1,698 stores, while Thế Giới Di Động and Topzone had 1,078 stores. These numbers at the end of 2017 were 283 and 1,072 stores, respectively. Therefore, after 6 years, Bách Hóa Xanh is expanding and now has a size 1.6 times larger than Thế Giới Di Động and Topzone.

Bách Hóa Xanh is known as a new direction for MWG as the ICT and electronics sectors become saturated. After 8 years in the retail food market, in December 2023, with an average revenue of VND 1.8 billion per store, MWG officially announced that Bách Hóa Xanh has achieved its breakeven target after all costs, based on current operation and on the core business (excluding (i) one-time costs accounted for in the fourth quarter and (ii) part of the depreciation costs related to the decrease in store area due to restructuring which will gradually decrease over time. Bách Hóa Xanh is confident that it will make up for this part to have net profit for the whole year 2024).

This was previously revealed by MWG Chairman of the Board of Directors, Nguyen Duc Tai, at the latest Shareholders’ Meeting. Mr. Tai is confident that Bách Hóa Xanh will achieve breakeven with improving revenue and gross profit growth.

“Since its inception, every month Thế Giới Di Động has had to provide funding for Bách Hóa Xanh, like parents giving money to their children for education. However, since the end of this year, Bách Hóa Xanh will enter a completely different phase when it can earn money, cover expenses, and the corporation will no longer have to subsidize losses,” Mr. Nguyen Duc Tai shared.

In relation to this, the Technology and Investment Corporation Bách Hóa Xanh (Investment BHX) – a subsidiary of MWG and holding all shares of Bách Hóa Xanh Trading Joint Stock Company – has just announced a plan to raise capital through private placement of common shares for potential investors. The expected number of shares to be offered for sale ranges from 5% to a maximum of 10% of the total shares of Investment BHX depending on the actual capital utilization needs at the time of capital raising. The offer price is currently undisclosed.

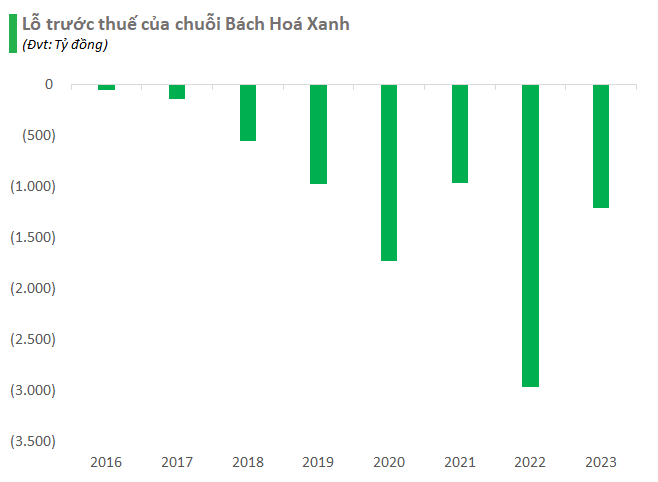

However, there are still many challenges ahead when considering the profit aspect separately, this area is the heaviest burden. Bách Hóa Xanh announced a pre-tax loss of VND 306 billion in the fourth quarter of 2023, equivalent to a daily loss of over VND 3 billion for the supermarket chain.