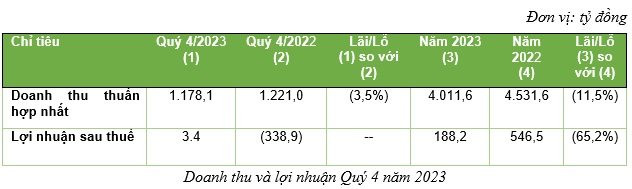

According to the Q4/2023 financial report released by Bamboo Capital (BCG), the company recorded a net revenue of 1,178.1 billion VND, a decrease of 3.5% compared to the same period in 2022. The profit after tax in the quarter only amounted to 3.4 billion VND, however, this is a significant improvement compared to the Q4 of the previous year.

The total net revenue for the whole year of 2023 by Bamboo Capital reached 4,011.6 billion VND, equivalent to 57.9% completion of the revenue plan presented at the 2023 Shareholders’ Meeting. The accumulated profit after tax for the whole year of 2023 reached 188.2 billion VND, completing 28.9% of the plan. In the context of the past year, the macroeconomic market still faced many difficulties and fluctuations, these positive results were thanks to the solid defensive strategy of Bamboo Capital. In 2023, the company made continuous efforts to streamline the organization, tightly control costs to improve operational efficiency. Financial expenses, selling expenses, and business management expenses in 2023 decreased by 72 billion VND compared to 2022.

Regarding the revenue structure of Bamboo Capital in 2023, it mainly came from the core business areas: construction – infrastructure (1,349 billion VND – 33.6%), renewable energy (1,121 billion VND – 27.9%), real estate (944 billion VND – 23.5%), and financial services (358 billion VND – 8.9%).

Notably, among the financial services group, AAA Insurance Corporation made remarkable progress in 2023. AAA Insurance started to become profitable after the restructuring process since its merger into the Group, and at the same time expanded its business network with over 50 branches nationwide. The revenue of AAA Insurance reached 116% of the business plan, with a growth rate of 123%. In 2024, AAA Insurance has set a revenue target exceeding 1,000 billion VND and aims to improve business efficiency compared to the previous year. The company also strives to enter the Top 10 non-life insurance companies with the best market performance in the near future.

Despite the real estate market has not fully recovered and still faces many difficulties, the real estate segment of BCG Land still generated profits and contributed positively to the revenue thanks to the handover of products in the projects of Malibu Hoi An and Hoian d’Or.

Successful debt restructuring, achieving a safe leverage ratio

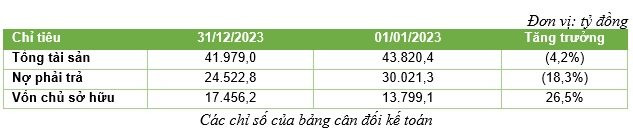

As of Q4/2023, the total assets of Bambooo Capital reached 41,979.0 billion VND, a slight decrease of 4.2% compared to the beginning of 2023. The total outstanding debt reduced by more than 5,498 billion VND as the Group proactively settled the loan amounts to reduce interest costs and ensure financial safety for the company.

Previously, BCG Energy (a subsidiary of Bamboo Capital’s renewable energy sector) proactively repurchased the entire 2,500 billion VND bond lots before maturity. At the same time, Bamboo Capital Group also actively recovered investments and cooperated to settle other payable amounts. Bamboo Capital Group has been resolute in debt restructuring to minimize risks in a macroeconomic period still facing many difficulties and fluctuations.

As of December 31, 2023, Bamboo Capital’s equity reached 17,456.2 billion VND, equivalent to a 26.5% increase compared to the beginning of 2023 as BCG Energy’s subsidiary completed the capital increase to 7,300 billion VND in Q4/2023. This continued to reduce BCG’s leverage ratio to a safe level.

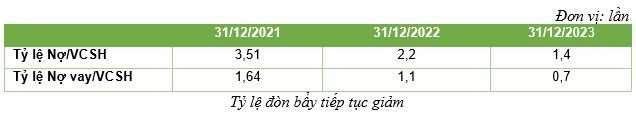

With the increased capital and proactive debt reduction, the total debt-to-equity ratio of Bamboo Capital has decreased from 2.2 times at the end of 2022 to 1.4 times at the end of this year. The debt-to-equity ratio has officially decreased below 1. This is a favorable ratio for the Group specialized in investing in capital-intensive sectors such as real estate, renewable energy, and infrastructure.

During a period of macroeconomic fluctuations, Bamboo Capital suspended external investment activities and focused on core business areas. Bamboo Capital’s cash flow continues to improve. Specifically, the net cash flow from operating activities changed from -3,609 billion VND in Q4/2022 to -152 billion VND in Q4/2023; the net cash flow from investment activities also significantly improved from -4,031 billion VND to 608 billion VND. The total net cash flow in the period changed from -415 billion VND to 127 billion VND in Q4 of this year.