In its latest announcement, Ho Chi Minh City Infrastructure Investment Joint Stock Company (CII) has released the minutes of the extraordinary general meeting held on January 31, 2024.

Accordingly, the number of shareholders present at the time of the meeting was 253 delegates, owning and representing 154.3 million shares, accounting for 48.47% of the total outstanding shares of 318.3 million units. Based on the company’s charter, an extraordinary general meeting cannot be held due to falling below the 50% threshold as prescribed.

CII said it will announce the time of the second meeting in the near future.

Prior to this, in an open letter to encourage shareholders to attend the extraordinary general meeting, CII stated that directly attending or authorizing attendance will receive gratitude gifts in the form of money transferred depending on the number of owned shares.

Organizing committee members who CII publicly announced their contact numbers will contact shareholders to obtain confirmation and transfer information. The money will be transferred to shareholders’ accounts within 24 hours after the organizing committee receives confirmation messages/emails of attendance or authorization. Confirmation messages/emails must be sent before 8:00 AM on January 31, 2024.

However, the meeting results cannot proceed as planned.

In fact, this is not the first time CII has used the strategy of giving money gifts to encourage shareholders to attend meetings. In 2023, the company used this strategy twice to encourage shareholders to attend the annual general meeting and the extraordinary general meeting.

Returning to the extraordinary meeting on January 31, 2024, in the meeting materials, CII expects to pass three main content with shareholders. The first is the adjustment of the purpose of issuance and capital use plan in the public offering package G1 previously approved by the general meeting in Resolution 48 on May 24, 2023.

The second is the adjustment of some contents of the G2 convertible bond issuance plan, which was also approved by the general meeting in Resolution 48 on May 24, 2023. Previously, CII planned to issue 15.9 million bonds with a total issued value at par value of VND 1,592 billion.

The third is the content related to the conversion bond series CIII42013, CII plans not to cancel the suspension of converting CII42013 bonds into shares in the 7th phase (expected on May 2, 2024) and the 8th phase (expected on November 4, 2024) according to the issuance plan in Resolution 44 on June 2, 2020.

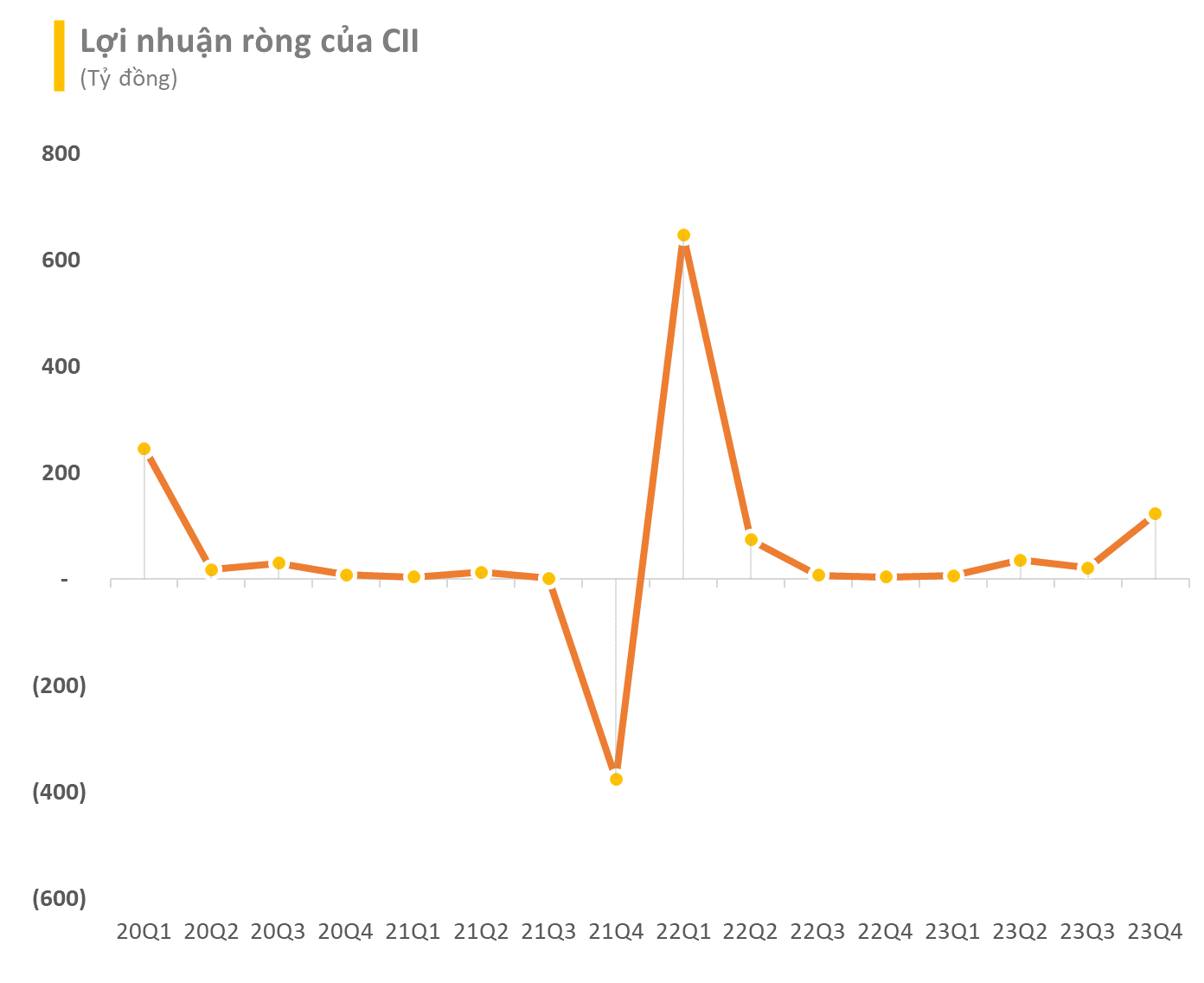

About business situation, CII recorded Q4/2023 revenue of VND 733 billion, a decrease of 61% compared to the same period. The company achieved a net profit of VND 123 billion, while having a net loss of VND 32 billion in the same period. In the whole year 2023, CII’s net revenue reached VND 3,056 billion, with net profit after tax decreased by 55% to VND 381 billion, of which net profit attributable to the parent company reached VND 187 billion.