Buy and sell caution has quickly brought the market back to a state of differentiation and gradually lowered altitudes. After about 90 minutes of opening, VN-Index was pushed back closer to the reference mark as the number of stocks on the electronic board was becoming more balanced. Increased selling pressure has caused VN-Index to gradually shift into a slight oscillation state.

The banking stock group has become the main factor putting pressure on the market. Large stocks in the industry such as VPB, BID, CTG, MBB, TPB… are the most negative impacting stocks on the VN-Index. Meanwhile, the securities group increases slightly and real estate stocks become bright spots.

Specifically, PDR stock had a moment of ceiling touch while NVL and DIG increased significantly, leading the market in terms of liquidity. Other stocks such as CII, DXG, LCG, NLG… all simultaneously turned green.

Bluechip stock group affecting the market in today’s session (2/2).

According to statistics, the top 5 stocks with the highest trading value on HoSE are NVL, PDR, SSI, DIG, VIX.

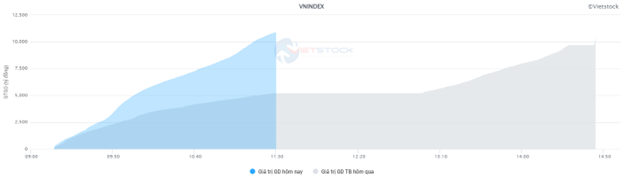

It is worth noting that even though there are only a few trading sessions left before the Tet holiday, the money flow is still maintained at the 20,000 billion VND mark. Specifically, there were more than 914 million shares transferred, equivalent to a trading value of 20,028 billion VND. The total trading value of the whole market reached 22,750 billion VND.

At the end of the trading session, VN-Index decreased by 0.47 points to 1,172.5 points, HNX-Index decreased by 0.01 points to 230.56 points, Upcom increased by 0.36 points to 88.37 points.

While the domestic money is being poured in, foreign investors are “withdrawing money for Tet”. Today, foreign investors net sold 208 billion VND on HoSE exchange. The top 5 stocks with the strongest net selling were VNM, PC1, VPB, GEX, VHM.