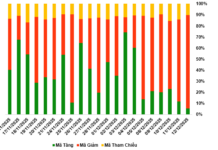

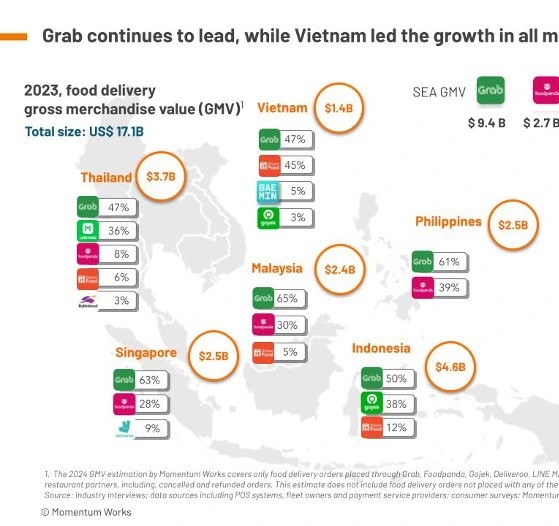

The Food Delivery market in Vietnam grew by 27% in 2023, reaching $1.4 billion, according to a report by Momentum Works. Baemin’s market share decreased from 12% to 5%.

Meanwhile, Grab’s market share in Vietnam increased from 45% to 47%, and Shopee’s increased from 41% to 45%. Gojek, which had a modest 2% market share, also saw an increase to 3%.

Baemin officially exited the Vietnamese market on December 8, 2023, ending its 4-year battle in this market.

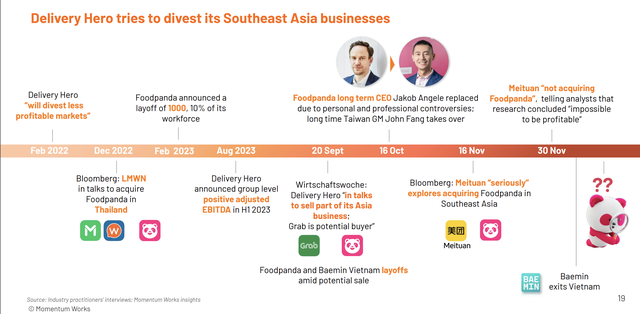

This was an inevitable outcome as the parent company, Delivery Hero, expressed its intention to divest from the “low-profit” market since the beginning of 2022.

Delivery Hero acquired Woowa Brothers, the owner of Baemin, at the end of 2019 for $4 billion. This was considered one of the largest global deals in the food delivery app market.

By the end of 2022, the food delivery app Line Man Wongnai was reportedly in talks to acquire Foodpanda – another food delivery brand owned by Delivery Hero – in Thailand. The outcome of the negotiations is unclear, but in February 2023, Foodpanda announced the dismissal of 1,000 employees.

Instead of acquiring Foodpanda, Line Man later acquired the POS startup FoodStory and acquired a large stake in the payment company Rabbit Line Pay. In 2023, Line Man followed Grab in the Food Delivery sector in Thailand, increasing its market share from 24% to 36%, mainly reclaiming market share from Foodpanda.

In August 2023, Delivery Hero’s parent company announced positive adjusted EBITDA. The unit continued to explore the sale of a portion of its business to Grab in September 2023.

While the negotiations continued without results, food delivery brands Foodpanda and Baemin continued to dismiss employees in the context of the evaluated potential of the Food Delivery market.

In November 2023, Meituan expressed interest in acquiring Foodpanda in Southeast Asia, according to Bloomberg. However, by the end of November 2023, Meituan had abandoned this desire, citing its difficulty in being profitable. Meanwhile, Baemin confirmed the end of its operations in the Vietnamese market. The fate of Foodpanda is still uncertain.

In 2023, while Baemin officially exited the Vietnamese market, Foodpanda – with 3 unsuccessful sale attempts – saw a decrease in market share in most markets. In Thailand, Foodpanda’s market share decreased from 16% in 2022 to 8% in 2023. Other markets such as Malaysia decreased from 38% to 30%, Singapore decreased from 31% to 28%, and the Philippines decreased from 40% to 39%.

While many key players in the Food Delivery market aim for sustainable profitability, Delivery Hero, according to Momentum Works, is eager for divestment, and it is very likely that further consolidation will occur in this market.