According to the financial report for the fourth quarter of 2023, recently released, Century Real Estate Corporation (Cen Land, code: CRE, HoSE exchange) recorded a net revenue of VND 330.5 billion, doubling the same period last year. After deducting the cost of goods sold, gross profit reached VND 52 billion, an improvement over the gross loss of VND 55.6 billion in the same period last year.

Financial revenue plummeted from over VND 36 billion to just under VND 14 billion in the fourth quarter of 2023. Meanwhile, interest costs decreased by 1.8 times to just over VND 19 billion.

After deducting various expenses, plus a loss of VND 3 billion from other activities, Cen Land reported a net profit of over VND 1.2 billion, an increase of 104% compared to the loss of over VND 62 billion in the fourth quarter of 2022.

For the full year 2023, Cen Land achieved a net revenue of VND 932 billion, a decline of 73% compared to the previous year. Financial revenue also decreased by 41% to just VND 66 billion. Despite significant cost-cutting efforts, CRE still reported a steep decline of 78% in net profit, reaching only VND 2.5 billion.

By the end of 2023, Cen Land’s total assets decreased by over VND 500 billion to VND 7,108 billion. Short-term receivables accounted for 57% of total assets, equivalent to VND 4,102 billion. Inventory increased by 31% to VND 556 billion, of which real estate inventory accounted for VND 543 billion.

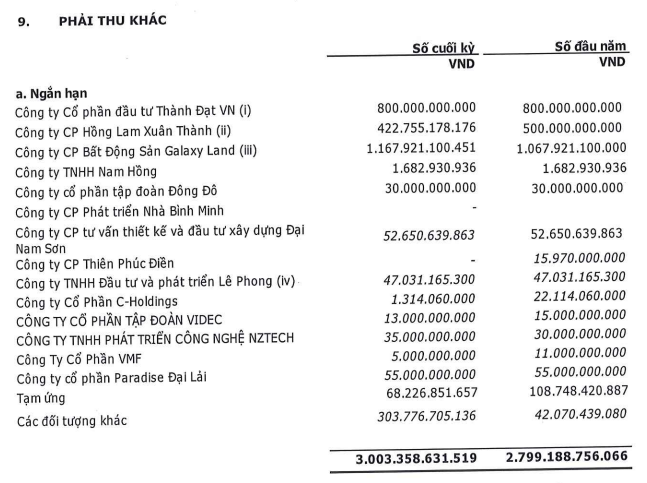

In terms of receivables, Cen Land owed the most to Galaxy Land Real Estate Joint Stock Company with VND 1,167 billion, followed by Thanh Dat VN Investment Joint Stock Company with VND 800 billion, Hong Lam Xuan Thanh Joint Stock Company with VND 423 billion, and Trustlink Investment and Services Joint Stock Company with VND 352 billion. Other companies owed smaller amounts, ranging from tens of billions of dong to each company.

List of receivables with a value of over VND 4,100 billion from CRE at the end of 2023.

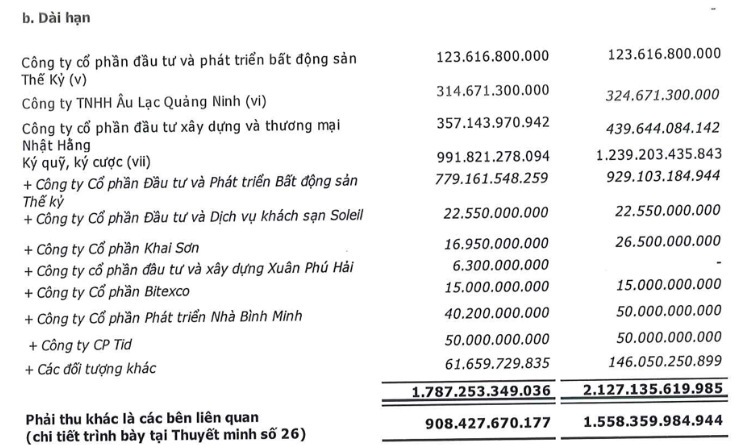

In addition, Cen Land had nearly VND 992 billion in committed deposits, investments from a series of companies such as Century Real Estate Investment and Development Joint Stock Company, Soleii Hotel Investment and Services Joint Stock Company, Bitexco Joint Stock Company… According to the explanation, these are mainly deposit amounts to guarantee the implementation of contracts with investors, in order to fulfill the role of a general distributor for real estate products formed from these projects.

On the other side of the balance sheet, Cen Land recorded a liability of VND 1,489 billion (down 25% from the beginning of the year). Specifically, short-term financial debt decreased significantly by 22% to VND 785 billion (with subordinated debt accounting for VND 450 billion), while long-term debt also decreased to just over VND 1.3 billion.

Poor business performance made it difficult for CRE to repay principal and bond interest. Specifically, at the end of 2023, Cen Land received consent from bondholders to extend the CRE202001 bond worth VND 450 billion. Accordingly, CRE changed the bond term from 3 years to 4 years and 1 month; the revised due date is January 31, 2025. The interest rate starting from January 1, 2024, is 12% per year.

It is known that this is the only bond issuance currently in circulation by Cen Land. On January 2, Cen Land fully paid the principal of over VND 96.45 billion of the CRE202001 bond. However, the company only paid nearly VND 502 million out of the total interest due of VND 25.9 billion.

The company stated that it is negotiating with bondholders regarding a new payment term for the interest due on the VND 450 billion bond. The proposed payment plan includes a maximum extension period of 3 months from January 2, 2024.