Hanoi Beer – Alcohol – Beverage Corporation (Habeco) has just announced its financial report for the fourth quarter of 2023.

In this quarter, the net revenue reached 2,246 billion VND, slightly decreased compared to the third quarter of 2023 and decreased by 9% compared to the same period last year.

Observation shows that the fourth quarter is usually the quarter with the highest revenue in the year for beer and alcohol businesses, and Habeco’s revenue is decreasing over time. The revenue in the fourth quarter of 2023 is only 60% compared to the same period 7 years ago, which is the fourth quarter of 2016.

The decreasing revenue led to a 7.2% decrease in pre-tax profit to 89.2 billion VND, but post-tax profit increased by 24% to 64 billion VND thanks to a reduction in corporate income tax expenses.

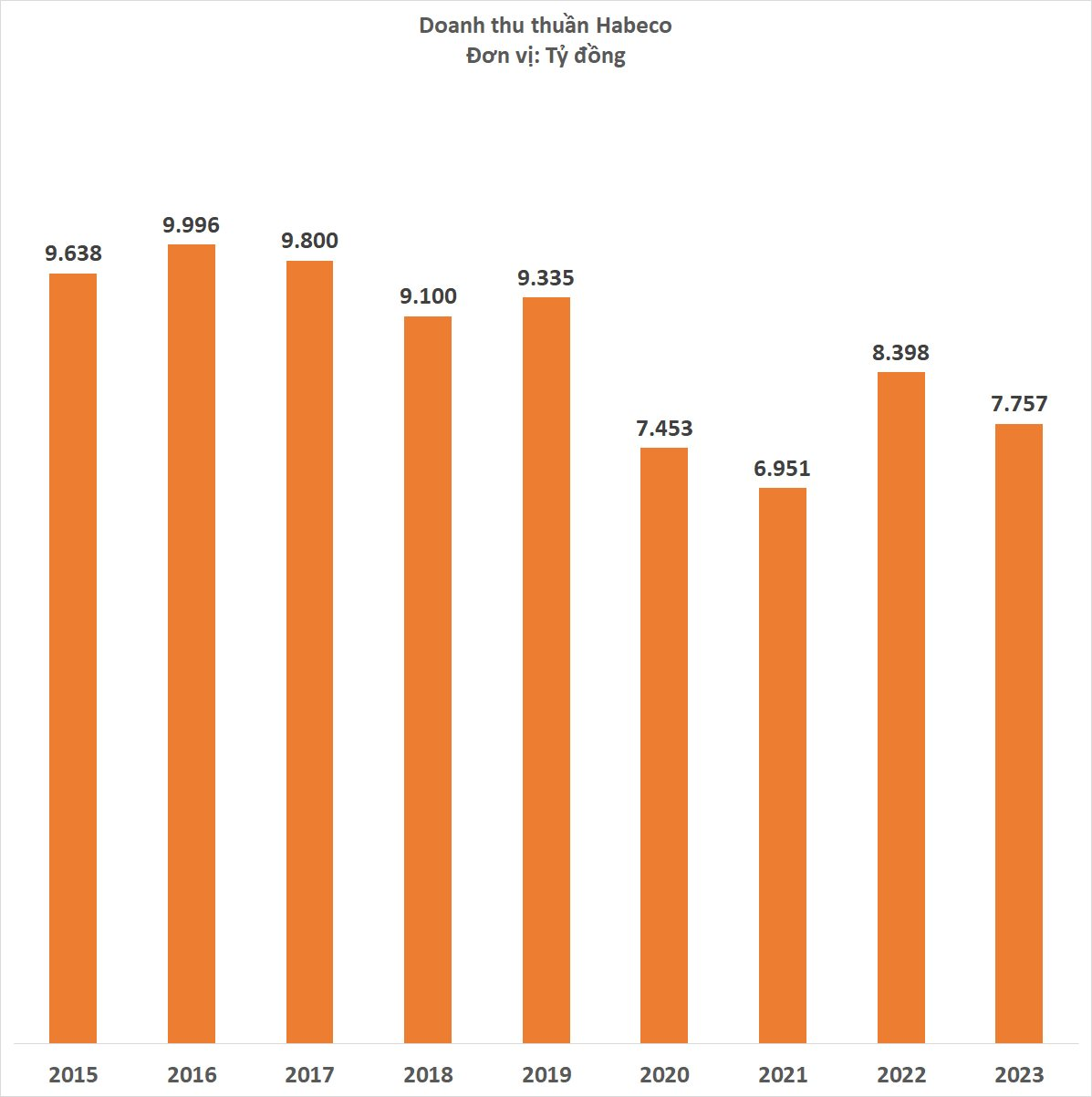

Accumulated for the whole year, Habeco achieved a net revenue of 7,757 billion VND and a post-tax profit of 355 billion VND, decreased by 7.7% and 30% compared to 2022. The revenue for the past year at Habeco is just slightly higher than in 2020.

Habeco stated that the main reason for the decrease in revenue this year is the increasingly fierce competition in the beer market and the declining consumer trend in the context of economic and social fluctuations. In addition, the increased control of alcohol concentration in the last months of 2023 also affected the company’s revenue.

Last year, Habeco significantly reduced expenses for advertising, promotions, support, down to only 579 billion VND compared to the level of 700 billion VND in 2022. This is the most costly expense of Habeco, accounting for 48% in the sales cost structure in 2022 and previously 54% in 2022.