In 2023, despite facing numerous difficulties and challenges, the Vietnamese economy experienced positive growth. The Vietnamese stock market also recovered and became more stable after addressing violations on the market. The quality of listed companies has also improved. Moving into 2024, the economy is projected to continue growing but will still face certain challenges.

During the Talk Show Phố Tài Chính on VTV8, Mr. Dominic Scriven, Chairman of Dragon Capital Vietnam, emphasized the need for the stock market to continue implementing various solutions to attract strong investment capital. This includes increasing transparency, improving the quality of listed companies, and promoting the upgrading of the stock market.

Financial Journalist Mui Khanh Ly: With nearly three decades of presence and support for the Vietnamese stock market, how do you evaluate its current development?

Mr. Dominic Scriven, Chairman of Dragon Capital Vietnam

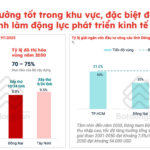

Currently, the capital market accounts for about 70% of the GDP, which includes the government bond market, corporate bond market, and stock market. The stock market alone represents approximately 50% of the GDP, reaching a peak of about 78% of the GDP. According to my knowledge, the Ministry of Finance’s target is to reach 120% of the GDP by 2030. Therefore, overall, the market is developing, but there is still a lot of potential for growth in the next 10 years.

2023 was a year full of difficulties and challenges for the world and Vietnam. However, the Vietnamese stock market has gradually become more stable after addressing violations in 2022. How do you evaluate this?

We must remember that the most important value in the stock market is not financial factors but trust, experience, and confidence from investors, businesses, including state agencies. Trust is extremely important. In the past 10 years, Vietnam’s stock market has developed rapidly in terms of volume and market capitalization. Ten years ago, the market capitalization was about 35 billion USD, and now it has exceeded 250 billion USD, increasing eight times in 10 years. However, the management structure, regulations, risk management, and quality have not developed at the same pace. Despite the difficulties faced in the past two years, including ourselves, I think we should remain calm and have a long-term vision, accepting necessary adjustments to make the market safer, more efficient, and of higher quality.

Has the quality of listed companies improved?

I would say that there are many types of companies in Vietnam. We have over 1,500 companies listed in all three exchanges. If we focus on the top 70 companies, they account for about 70-80% of the total market capitalization, which is similar to other markets. Therefore, when it comes to the quality of companies, I would have to mention these 70-80 top companies. We are quite satisfied with these companies. Currently, the market has approximately 50 companies with a market capitalization of over 1 billion USD. The second aspect is the quality of management and sustainable business models, which have received more attention. The third aspect is the business development, which depends on the respective industries. As we know, in 2023 and probably in 2024, the role of the finance sector in the stock market is significant, while the role of other sectors depends on specific industries, such as real estate or consumer goods, which still face difficulties.

In your opinion, what does the Vietnamese stock market need to do to attract large-scale investment funds from around the world?

Foreign investors have generally had positive evaluations of Vietnam, including stability in finance, politics, development trends, and population, which includes the attractiveness of the stock market. However, there are still challenges preventing Vietnam from fully attracting foreign investment reflecting its potential. It is difficult to quantify, but a World Bank study suggested that Vietnam could attract about 50 billion USD if certain conditions are met. Another issue is the ability to absorb and allow the outflow of funds. Vietnam places emphasis on stability.

However, from the perspective of a fund management company, we find that there are still challenges for investing in listed companies in Vietnam. The ownership limit is frequently mentioned, but that is only part of the problem. The main issue is the scale of the companies and their stock liquidity. There are also issues related to the market structure. For example, foreign investors have to transfer money first before trading, or some companies have websites that do not provide information in foreign languages. I think if Vietnam wants to attract those 50 billion USD or even more in the future, it needs to gradually address these issues.

As the year 2023 came to an end, the global economy began to recover, and the FED temporarily paused interest rate hikes. However, risks still exist. In your opinion, how will the global market continue to face difficulties in 2024, and where will the positive aspects and opportunities lie?

I think Vietnam has its own strengths over the past 2-3 years, but it is difficult to avoid external influences. In 2023, we saw from the GDP model that the first quarter was relatively low, the second quarter was better, the third quarter was even better, and the fourth quarter was more positive. This trend is likely to continue into 2024.

The general situation of the world is difficult to predict, but it seems to be a soft landing. However, how soft the landing will be is still a question. We still need to monitor monthly figures from the US, Europe, and Japan. Generally, we see the recovery happening globally, especially in Vietnam, which will continue in the upcoming quarters. It will lead to the recovery of listed companies in terms of revenue and profit, but we should also pay attention to risk management in all aspects.

Dragon Capital has been accompanying and contributing significantly to the development of the Vietnamese stock market over the past decades. In 2024, what solutions will you implement to further stimulate the development of the Vietnamese stock market?

Indeed, it has been 30 years, but there is still much to do. Currently, we are paying attention to the following tasks: First, support individual Vietnamese investors to enhance their investment awareness, knowledge, and effective risk management for participation in the Vietnamese stock market. The second issue is focused on promoting the diversified development of institutional investors in Vietnam, including the development of open-end funds, closed-end funds, and pension funds. The third aspect is assisting listed companies in improving their quality in terms of content, management, risk, and communication with investors. Finally, we will support foreign investors in gaining a deeper understanding of the Vietnamese market.