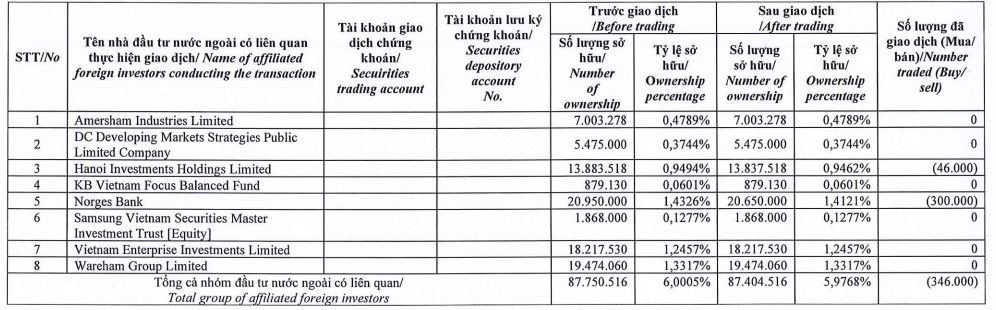

In the latest announcement, Dragon Capital Fund reported selling 346,000 shares of MWG, a subsidiary of Mobile World Investment Corporation. Specifically, Hanoi Investments Holdings Limited sold 46,000 shares, and Norges Bank sold 300,000 units.

The transactions were executed on January 29. After completion, Dragon Capital’s ownership in MWG decreased from 87.75 million shares (6%) to 87.4 million units (5.97%).

Recorded on January 29 session, the market had 764,000 MWG shares traded with a total value of over 34 billion, and an average price of 44,751 VND/share. Meanwhile, at the end of the same session, MWG’s closing price reached 44,600 VND/share. It is estimated that the fund group earned about 1.5 billion VND through these transactions.

Prior to November 1, 2023 session, the Dragon Capital fund group reported owning 105.2 million shares. Therefore, in the past 3 months, this foreign fund group has net sold 17.8 million MWG shares.

In terms of MWG stock performance, over the past three months, the price has shown significant growth, increasing by nearly 23%.

Regarding MWG’s business plan for 2024, the company has announced a revenue target of 125 trillion VND, and a post-tax profit of 2.4 trillion VND, a 5% increase and 14-fold increase compared to the same period last year, respectively. After a comprehensive restructuring starting from Q4/2023, MWG believes that the company still has potential to strengthen revenue and improve profitability targets. For underperforming store chains, MWG may reduce the number of points of sale if they prove to be ineffective. Moreover, the company will focus on enhancing service quality by increasing employee productivity, diversifying merchandise, and implementing promotional programs.

MWG also expects to continue growing its online sales and estimates the contribution of online sales to the company’s revenue for each business segment, ranging from 5% to 30%, depending on the characteristics of each product category.

Prior to 2023, MWG achieved a net revenue of 118.28 trillion VND and a net profit of 168 billion VND, a decrease of 11% and 96% respectively; the lowest profit level in many years for this business.