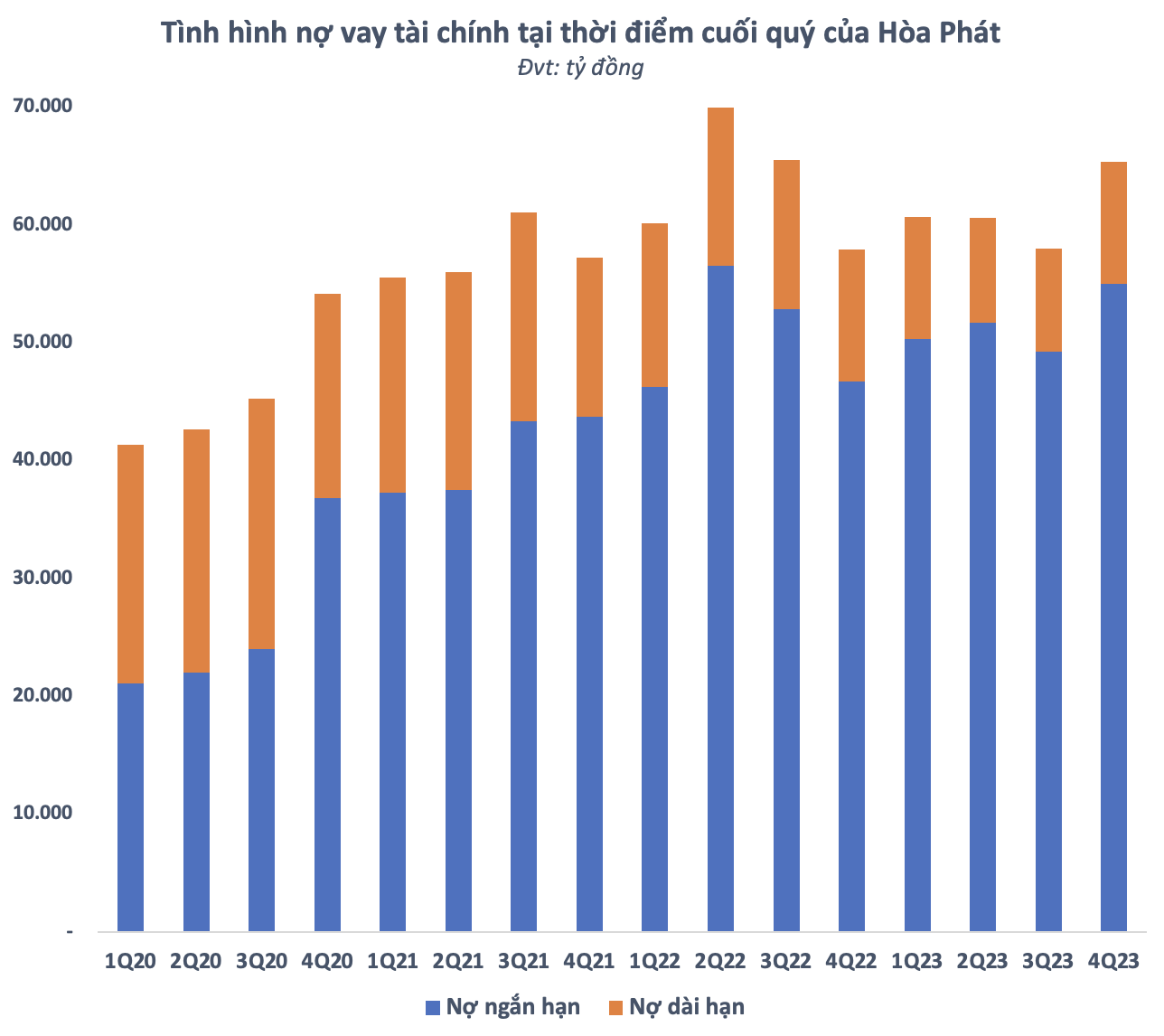

According to the consolidated financial report of the fourth quarter of 2023, Hoa Phat Group Joint Stock Company (HPG code) has a financial debt balance of nearly 65.4 trillion VND as of December 31, 2023, accounting for nearly 35% of total assets. This number increased by nearly 7.4 trillion compared to the end of the previous quarter and is the highest level in 5 quarters. With the current debt, Hoa Phat is one of the most heavily indebted companies on the stock market.

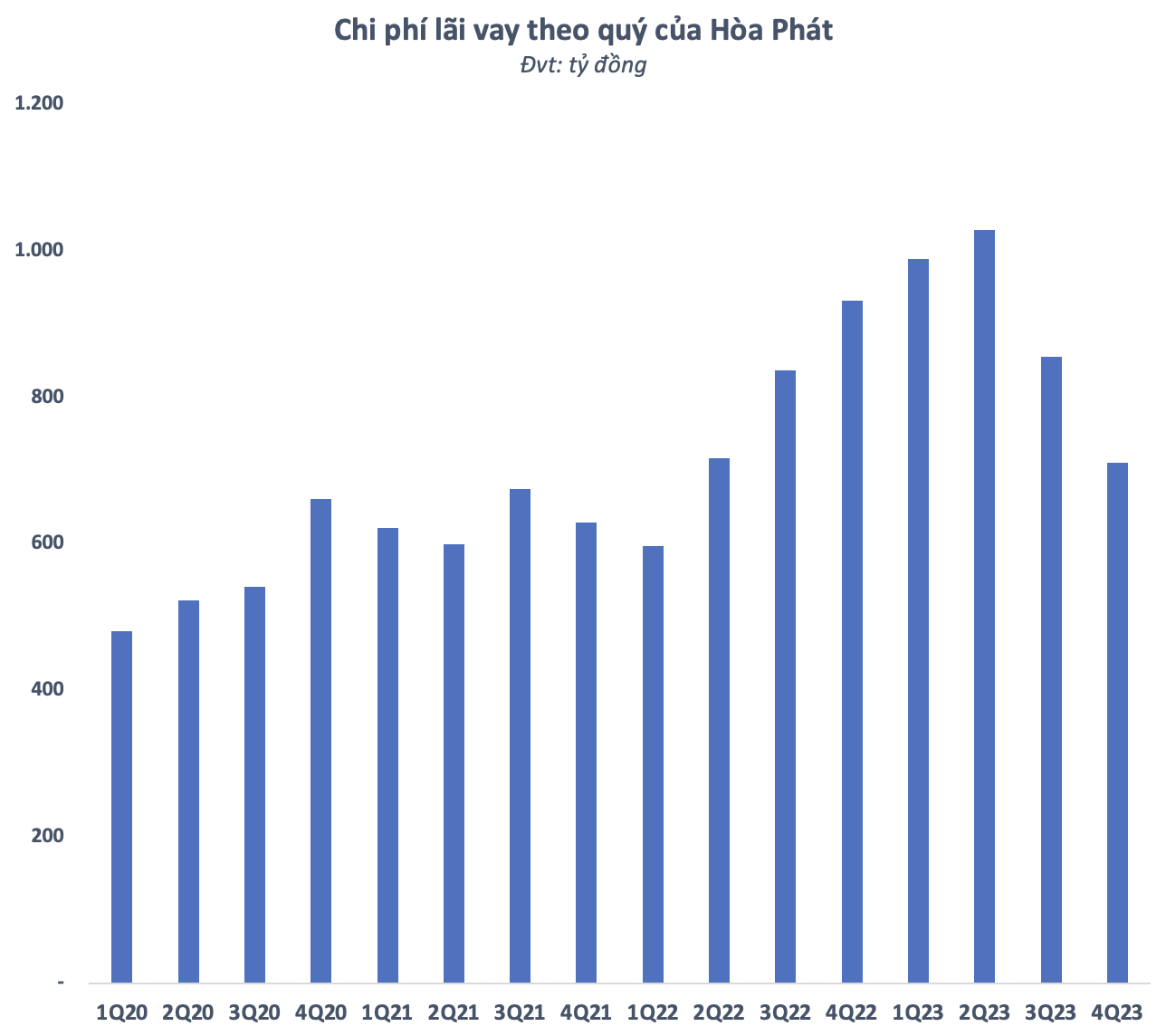

The huge debt burden has caused Hoa Phat to bear a very large interest expense of hundreds of billions, even trillions, per quarter. In the fourth quarter of 2023, the group of Mr. Tran Dinh Long incurred an interest expense of 711 billion VND, a decrease of 145 billion compared to the previous quarter and 222 billion lower than the same period in 2022. This is the lowest interest expense in 7 quarters of Hoa Phat. Despite the increase in debt, the interest expense has decreased, most likely due to the lower interest rate environment in the fourth quarter of 2023.

Overall in 2023, Hoa Phat’s interest expense reached nearly 3.6 trillion VND, still increasing by more than 16% compared to 2022 and the highest level ever. Although it decreased continuously in the last 2 quarters, the high interest expense in the first half of the year has pushed the interest expense for the whole year 2023 to a record high. Estimated average daily in 2023, Hoa Phat has to bear nearly 10 billion VND of interest expense every day.

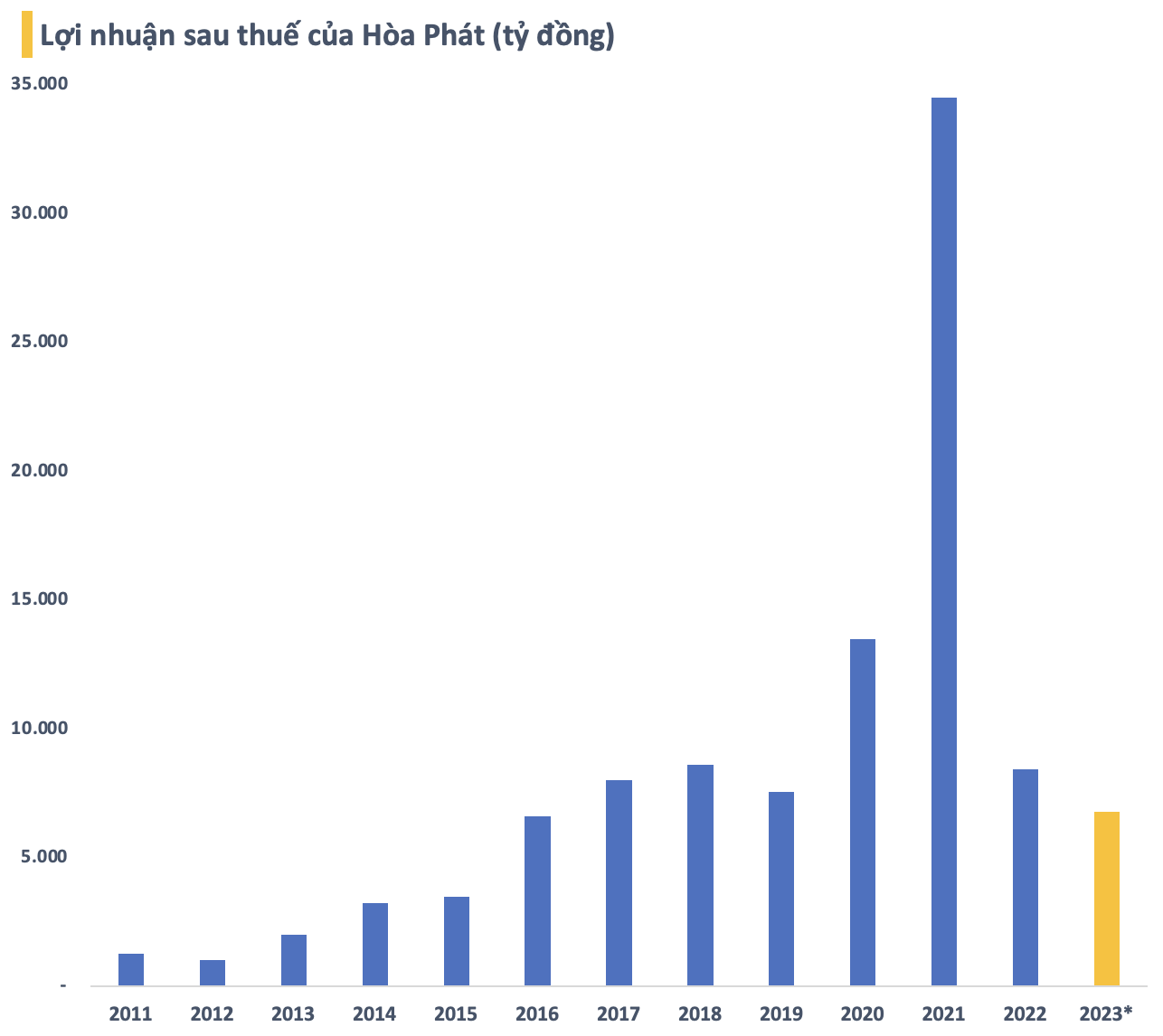

The large interest expense significantly erodes Hoa Phat’s profit. In 2023, Hoa Phat recorded consecutive quarterly profit recovery higher than the previous quarter, but the accumulated net profit for the whole year still decreased by more than 19% compared to the previous year, reaching 6.8 trillion VND. This number is only 1/5 of the record level achieved in 2021.

Large bank deposits

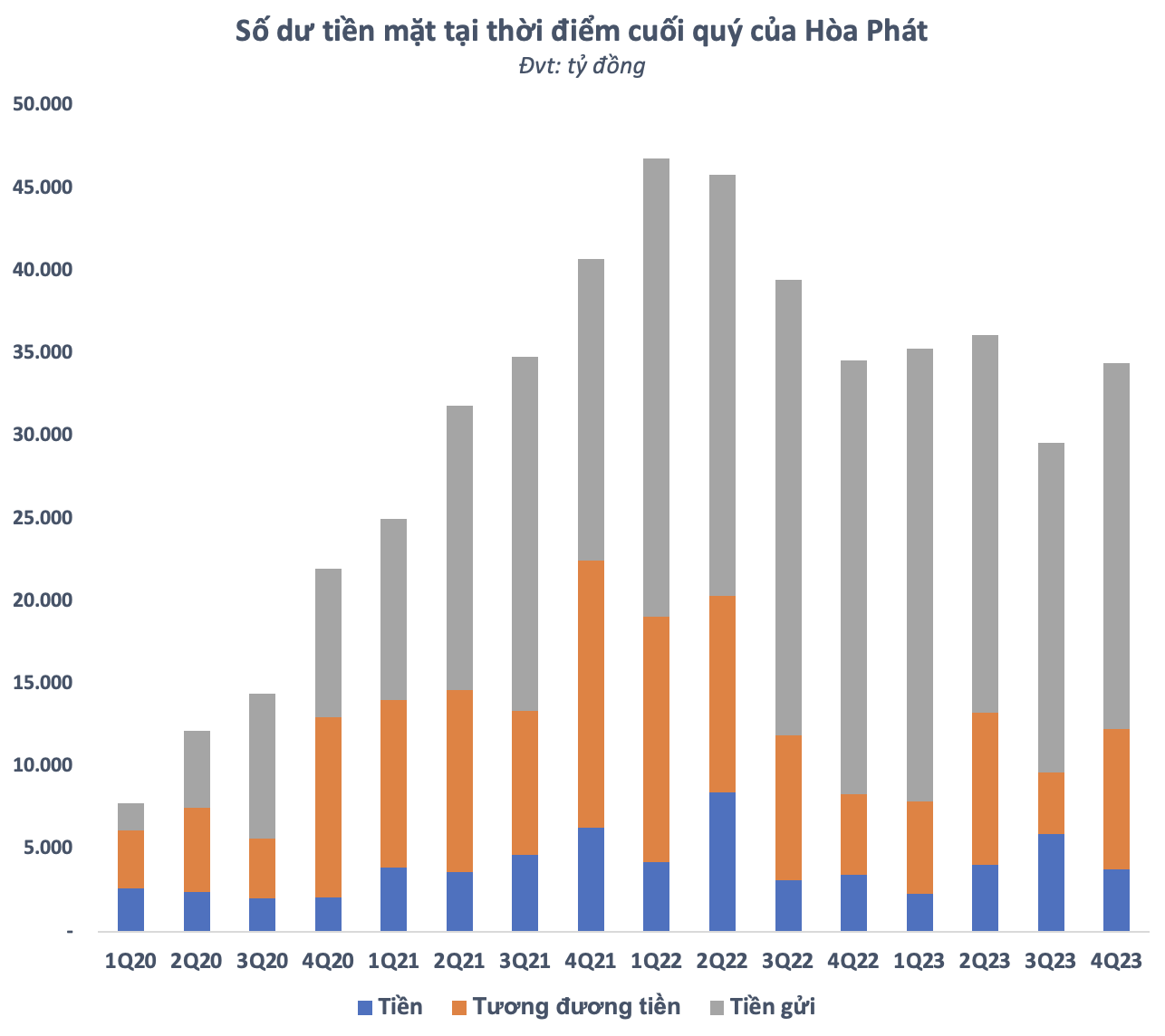

Besides borrowing a lot, Hoa Phat also has a huge amount of deposits deposited at the top “monstrous” level on the stock market. At the end of 2023, the leading steel company had nearly 22.2 trillion VND of bank deposits (short-term), an increase of 2.2 trillion compared to the end of the previous quarter. In addition, Hoa Phat also has nearly 3.8 trillion VND in cash and 8.5 trillion VND equivalent.

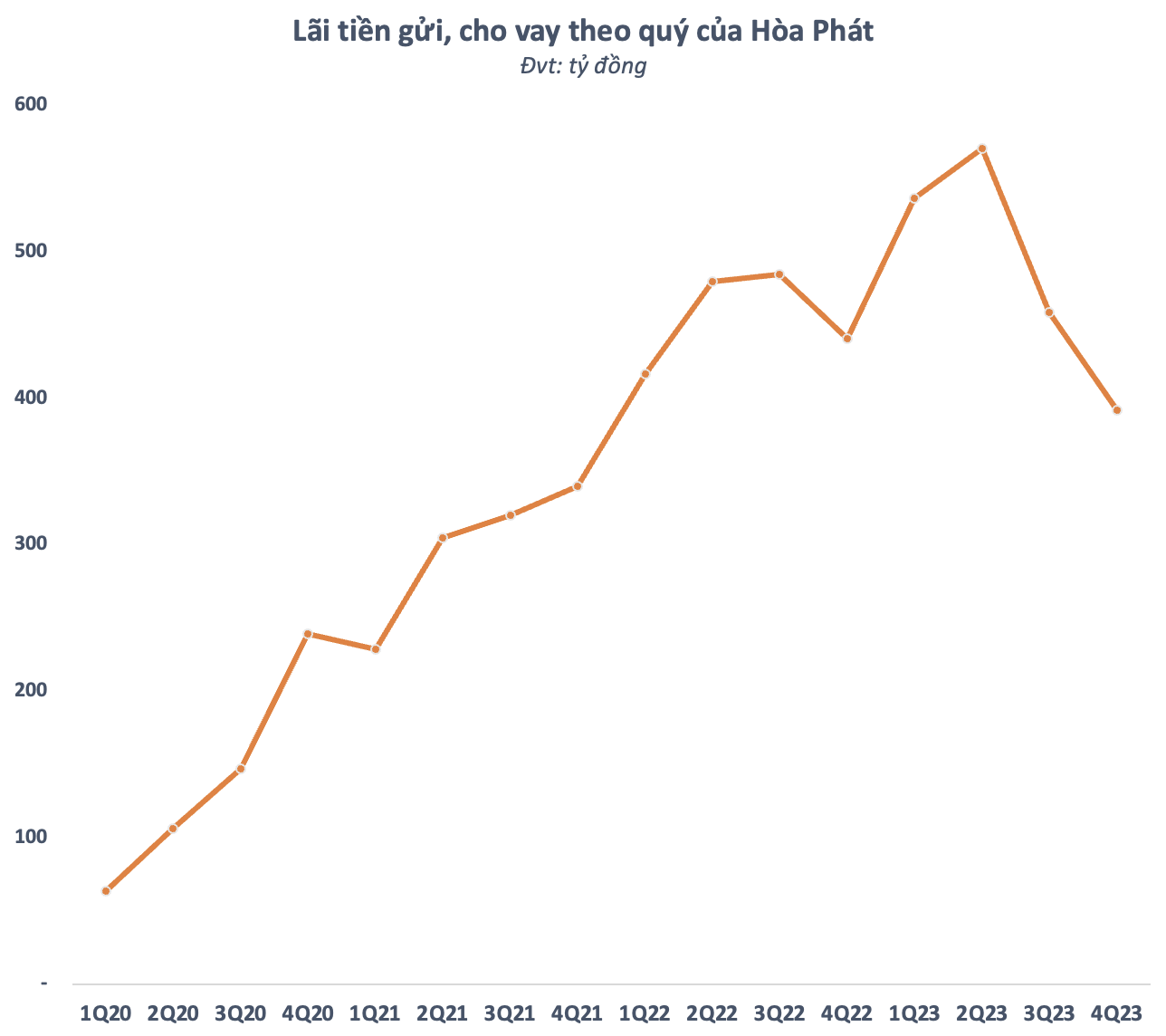

The large amount of deposits helps Hoa Phat “pocket” significant interest income, thereby partially offsetting the interest expense. In the fourth quarter of 2023, the group received 392 billion VND of deposit interest income, a decrease of nearly 15% compared to the previous quarter and 11% lower than the same period in 2022. This is the lowest deposit interest income that Hoa Phat has received in the past 2 years. The main reason is that the deposit interest rate at banks has dropped to a record low.

In general, it is not uncommon for businesses to borrow a lot and have a huge amount of bank deposits. Maintaining a sufficient amount of money to meet payment requirements from partners or investments is necessary for any business. In the case of Hoa Phat, the corporation is focusing on the key project of Dung Quat 2 Interchange with a scale of up to 3 billion USD, so it always needs a large amount of money.

According to the plan, the Dung Quat 2 KLH project will be completed in the first quarter of 2025 with a capacity of 1.5 million tons per year for phase 1. The total design capacity of this project is 5.6 million tons per year, including 4.6 million tons of hot-rolled coiled steel (HRC) and 1 million tons of special steel. Hoa Phat estimates that it will take about 3 years for the operation of Dung Quat 2 to reach maximum capacity, thereby increasing the crude steel capacity to over 14 million tons per year.

According to a recent report from VNDirect, in the first 9 months of 2023, Hoa Phat is estimated to have disbursed 3,300 billion VND to invest in fixed assets for KLH Dung Quat 2. The total accumulated investment capital disbursed until the end of the third quarter of 2023 was 12,700 billion VND. This securities company assessed that the slow disbursement is reasonable as Hoa Phat wants to ensure liquidity and avoid a relatively high interest rate environment in the first half of 2023.

VNDirect expects Hoa Phat to accelerate the construction progress in the 2024-25 period to ensure the increase in HRC production capacity from the current 3 million tons to 6 million tons in the second half of 2025 (50% of the design capacity will be put into operation from phase 1 of KLH Dung Quat 2). After being operated at full capacity, the project will increase Hoa Phat’s growth prospects in the 2025-27 period with an estimated annual growth rate of 30% when adding an additional 6 million tons of HRC to the current capacity.