On January 31st, the VN-Index continued to fluctuate around 1,174 points, slightly down compared to the previous session. The stock market has been moving sideways for weeks, causing frustration for investors. Not to mention the periods of volatility, many investors, especially newcomers (F0), have suffered heavy losses.

Ms. Diep Minh (residing in Binh Thanh district, Ho Chi Minh City), an investor who has been participating in the stock market for over 3 years, still holds real estate and banking stocks purchased when the VN-Index was at 1,500 points. Currently, the VN-Index is hovering around 1,170 points, and her stocks are still at least 50% in the red.

“Selling would be regretful, but averaging down is uncertain as stocks may not increase in value due to the unimpressive business prospects of the companies. I have been day trading for 3 years and always end up with losses, so I’m considering investing in open-end funds with annual returns ranging from 15% to 30%” – Ms. Minh expressed her concerns.

Many new investors suffer losses during periods of sharp decline in the VN-Index

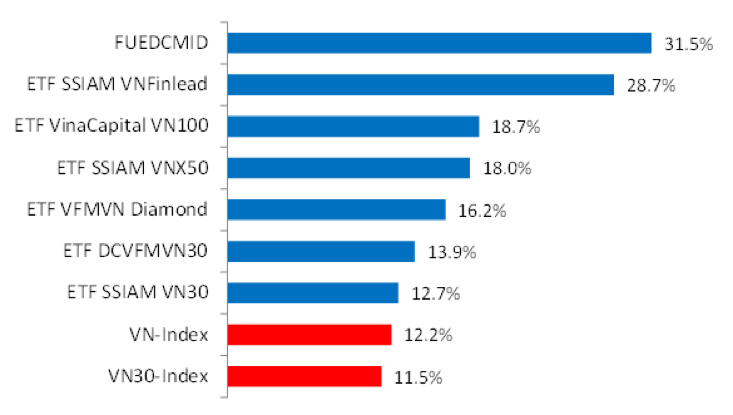

Regarding open-end funds, VinaCapital Fund Management Joint Stock Company has announced that 5 managed open-end funds have achieved outstanding performance compared to the benchmark index in the past 1 and 3 years. In 2023, returns on these funds ranged from 11.2% to 30.9%, depending on each specific fund.

In response to investors’ questions about whether to day trade stocks with a high risk of loss or invest in open-end funds, Mr. Vo Kim Phung, Deputy Head of Analysis at BETA Securities Company, analyzed that stock investing and day trading require investors to have expertise in financial statement analysis, company valuation, meetings with company executives, market understanding, experience, and time to make wise buying and selling decisions. However, in reality, there are not many individuals who can do so.

“Many people prefer to manage their own money for self-investment, but stock investing is always considered a high-risk investment channel, even very high as the potential loss can reach 50-70%, or even higher if investors utilize high leverage during market downturns” – Mr. Phung said.

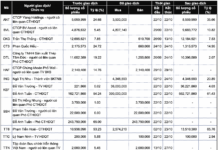

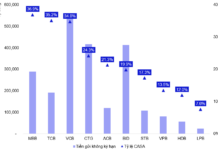

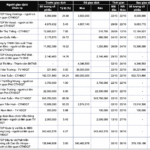

Performance of funds versus the VN-Index in 2023

According to experts, for non-professional investors, investing in open-end funds is safer and more profitable. An open-end fund is a type of investment fund contributed by many investors with the same investment goal, professionally managed by a fund management company.

- Understanding the fund: fund managers, operation modes, investment portfolios, costs, and risks.

- Examining the fund’s track record: historical returns, return rates, and risks.

- Determining one’s investment goals: expected returns, investment period, risk appetite, and available capital.

- Choosing the right type of fund for one’s investment goals.

- Checking transaction fees: purchase fees, redemption fees, and management fees.