VN-Index experienced fluctuations in the last trading session of January with a decrease of more than 15.34 points (1.3%) to 1,164 points – marking the sharpest decline in the past 2 months, since the end of November 2023. The market liquidity also increased sharply with trading volume exceeding 1.1 billion shares, and the trading value on HOSE exchange reached nearly 21,900 billion VND. Foreign trading continued to be a positive point with a sudden net buying of 1,269 billion VND across the market.

On HOSE, foreign investors made a net buying of approximately 121 billion VND.

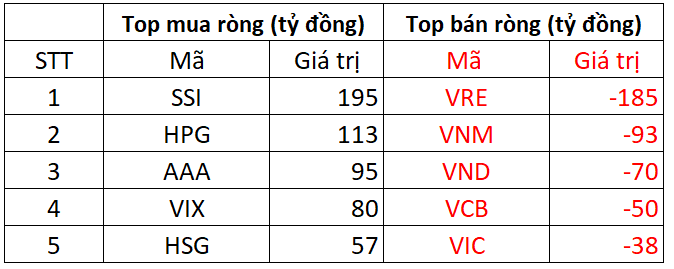

On the buying side, the net buying focus was on SSI shares with a value of 195 billion VND. Following that, HPG and AAA were also net bought with respective values of 113 billion VND and 95 billion VND. In addition, VIX and HSG also ranked on the net buying list on HoSE with 80 billion VND and 57 billion VND, respectively.

On the other hand, VRE was under the most selling pressure from foreign investors with a value of 185 billion VND, followed by VNM and VND, which were the next two stocks sold for 70 billion VND and 50 billion VND each.

On HNX, foreign investors made a net selling of 1.2 billion VND

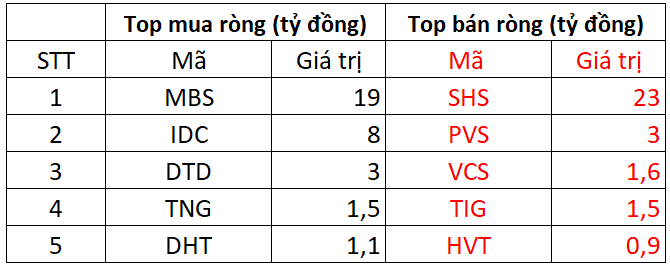

On the buying side, MBS was the most net bought with a value of 19 billion VND. In addition, IDC ranked on the net buying list on HNX with 8 billion VND. Moreover, foreign investors also made net buying on DTD, TNG, and DHT with not too large values.

On the other hand, SHS was the stock under the most selling pressure from foreign investors with a value of 23 billion VND; followed by PVS, which was sold for about 3 billion VND.

On UPCOM, foreign investors made a sudden net buying of more than 1.150 billion VND

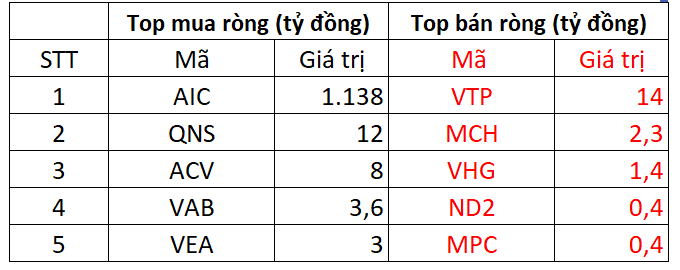

In the buying session, AIC shares of the Air-insurance Corporation were suddenly bought by foreign investors with nearly 75 million units (accounting for 3/4 of the circulating volume). All of these shares came from the foreign investors’ buying transactions; the corresponding net buying value reached 1,138 billion VND.

Previously, the company was approved by the Ministry of Finance to transfer shares to DB Insurance Co., Ltd and Artexport Handicraft Import-Export Joint Stock Company, early in January. According to the contract signed at the extraordinary general shareholders’ meeting held in February 2023, the group of the 20 shareholders of the Air-insurance Corporation will transfer 75 million shares (equivalent to 75% of the charter capital) to DB Insurance Co., Ltd of South Korea.

VTP today was heavily sold by foreign investors with about 14 billion VND; besides, they also sold at MCH, VHG, ND2,…