Real Estate Services Corporation – Land Xanh (DXS, HoSE stock code) has announced its consolidated financial report for the fourth quarter of 2023, showing a bleak business situation.

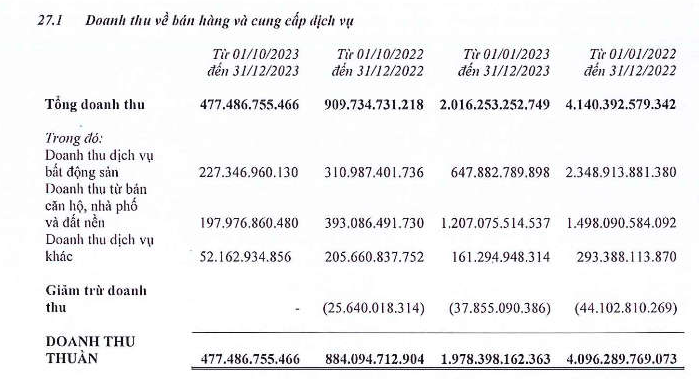

In particular, net revenue in the fourth quarter decreased by half to VND 477 billion. The largest contribution came from real estate service revenue at VND 227 billion, with the remainder from revenue from apartment sales, land plots, and other services. After subtracting the cost price, gross profit remained at over VND 184 billion.

Source: DXS

A positive aspect is that various costs have been drastically reduced, such as sales and business management costs, which have decreased 2.7 times, and interest costs, which have decreased 1.6 times.

However, in this period DXS had to bear an additional loss of VND 91 billion from its joint venture partner, leading to a negative net profit of VND 83 billion from business activities. After deducting all costs, DXS had a net loss of VND 124.5 billion in the fourth quarter of 2023, a slight improvement compared to a loss of VND 142 billion in the same period.

Overall in 2023, Land Xanh Services achieved a revenue of VND 1,978 billion, a 52% decrease compared to the previous year. The reason comes from a sharp decline in real estate service revenue, such as brokerage, which amounted to nearly VND 648 billion, while it was over VND 2,300 billion the previous year. Additionally, due to high cost prices, the gross profit plummeted by 70% to just under VND 700 billion.

Due to a loss of over VND 107 billion in its joint venture company, the net profit from business activities in 2023 was negative at VND 87 billion. As a result, DXS had a net loss of VND 160 billion in 2023, compared to a profit of over VND 500 billion in 2022. This is the first year DXS has reported a loss since 2018.

In terms of the balance sheet, DXS’s total assets as of December 31, 2023 were VND 15,457 billion, a 7% decrease compared to the beginning of the year. Short-term receivables reached VND 9,979 billion, a 6% decrease, accounting for 64% of total assets. Among these, allocation deposits and betting for distribution contracts and marketing for projects such as Gem Sky World, Tien Hai City, Quang Riverside Land, Ngoc Duong Urban Area… accounted for VND 4,530 billion.

Cash and deposits held decreased by 54% to VND 304 billion. Inventory decreased insignificantly to VND 4,119 billion. Among these, land use fees, construction costs, and development costs for projects such as Regal Lengend, La Maison, Quang Riverside Land… accounted for VND 3,580 billion.

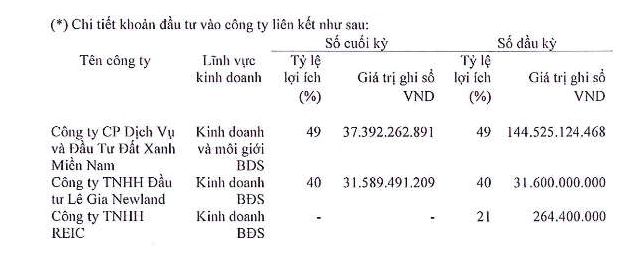

Last year, investments in joint venture companies decreased sharply from VND 176 billion to VND 69 billion, mainly due to the absence of investments in REIC Company and a decrease in capital contributions to Southern Land Company to VND 37 billion.

Source: DXS

In terms of capital structure, total liabilities to be paid amounted to VND 7,354 billion, a 12% decrease compared to the beginning of the year. Among these, total borrowings decreased by 7% to over VND 2,100 billion, including over VND 50 billion in bond debt, the remaining VND 855 billion short-term bank loans, and over VND 1,200 billion long-term bank loans.

The largest item in liabilities to be paid is cash collected on behalf of investors, which decreased by over 14% to over VND 3,052 billion.

Of note, the number of DXS employees as of December 31, 2023 was only 2,275, a decrease of nearly 32% compared to the beginning of the year, when it was 3,340 employees. This is the total number of personnel at DXS parent company, 13 direct subsidiaries, and 43 indirect subsidiaries.