Illustrative image

Crude oil prices continue to decline

Oil prices fell 2% and had a weekly decrease after the US employment figures reduced the possibility of interest rate cuts in the world’s largest economy, which could reduce crude oil demand.

At the close of trading on February 2, Brent crude oil fell $1.37, or 1.7%, to $77.33 per barrel, and West Texas Intermediate crude oil fell $1.54, or 2%, to $72.28 per barrel. Both types of oil fell by 7% for the week.

In addition, slow growth in China and the easing of tensions in the Middle East also contributed to the decline in oil prices.

Concerns about the recovery of the Chinese economy persist, as the International Monetary Fund (IMF) predicts that the country’s economic growth will slow to 4.6% in 2024 and further decline to about 3.5% by 2028.

The Organization of the Petroleum Exporting Countries (OPEC) and its leading allies, known as OPEC+, have maintained their production policy. In March 2024, the group will decide whether to extend the voluntary output cuts applied in the first quarter of 2024. OPEC+ announced a reduction of 2.2 million barrels per day (bpd) in the first quarter of 2024 as stated in November 2023.

Natural gas prices in the US rise from 9-month low

US natural gas prices increased by 1% as colder weather forecasts and higher heating demand in the later part of this month boosted prices.

The March 2024 natural gas futures on the New York Mercantile Exchange rose 2.9 US cents, or 1.4%, to $2.079 per mmBTU. In the previous session, natural gas prices touched their lowest level since April 13, 2023. For the week, natural gas prices fell by 23%, after rising 8% in the previous week and declining 24% in the preceding 2 weeks.

Gold prices decline

Gold prices fell as the US dollar and US Treasury bond yields increased after a strong non-farm payroll report. This raises uncertainties about the possibility of the US Federal Reserve starting rate cuts earlier than expected.

Spot gold on the London Bullion Market Association (LBMA) fell 0.8% to $2,038.59 per ounce, but had a weekly increase of nearly 1% and maintained an important level above $2,000 per ounce since the beginning of the year. April 2024 gold futures on the New York Mercantile Exchange dropped 0.8% to $2,053.7 per ounce.

The US dollar index rose 0.9%, making gold bars more expensive for foreign buyers. At the same time, the 10-year US Treasury bond yield also increased.

Copper prices continue to decline

Copper prices fell as the US dollar index rose to its highest level in 7 weeks after strong US employment data, adding downward pressure due to global industrial instability and concerns about demand in China.

London copper delivery after 3 months fell 0.8% to $8,466.5 per tonne after touching its lowest level since January 24, 2024 ($8,454 per tonne). Copper prices fell 0.9% for the week as the US Federal Reserve pushed back the idea of early rate cuts no sooner than the beginning of March 2024, overshadowing prospects for tight supply.

The US dollar strengthened after data showed that US employers created more jobs than expected in January 2024. The US dollar rose strongly, making the silver metal more expensive for customers using other currencies.

Iron ore hits lowest level in 2 weeks, steel declines

Iron ore prices on the Dalian Commodity Exchange fell to their lowest level in 2 weeks and had a weekly decrease due to concerns about the recovery of the real estate sector in the leading consumer country – China.

Iron ore futures for May 2024 on the Dalian Commodity Exchange fell 2.23% to 941 CNY ($131.07) per tonne – the lowest level since January 19, 2024. Iron ore prices fell more than 5% for the week.

Meanwhile, iron ore prices for March 2024 on the Singapore Exchange fell 3.24% to $126.75 per tonne – the lowest level since January 18, 2024. Iron ore prices fell over 6% for the week.

Steel prices decline on the Shanghai exchange

On the Shanghai exchange, rebar prices fell 1.19%, hot-rolled coil prices fell 0.95%, cold-rolled coil prices fell 1.78%, and stainless steel prices fell 0.91%.

Rubber prices in Japan decline

Rubber prices in Japan fell for the second consecutive session before the upcoming Lunar New Year holiday, due to weakening production and employment data in the US putting pressure on the market.

July 2024 rubber futures on the Osaka exchange (OSE) fell by 0.9 JPY, or 0.32%, to 282.7 JPY ($1.93) per kg.

For the week, rubber prices fell 1.4% – the first week of decline since December 11, 2023. Meanwhile, May 2024 rubber futures on the Shanghai exchange fell 115 CNY to 13,290 CNY (1,850.82 USD) per tonne. March 2024 rubber futures on the Singapore exchange fell 0.79% to 151 US cents per kg.

Coffee prices decline

Robusta coffee futures for March 2024 on the London exchange fell 1.5% to $3,237 per tonne. Coffee prices fell 1% for the week. Meanwhile, Arabica coffee futures for March 2024 on the ICE exchange fell 12% to $1.9195 per lb.

Sugar prices rise

Raw sugar futures for March 2024 on the ICE exchange rose 0.33 US cent, or 1.4%, to 23.89 US cents per lb. Sugar prices rose 0.5% for the week. Meanwhile, white sugar futures for March 2024 on the London exchange rose 1.3% to 660.7 USD per tonne.

Soybean, corn, and wheat prices decline

Soybean prices in the US fell 1% and corn prices also declined as the US dollar strengthened after the monthly US employment report exceeded expectations, reducing expectations that the US Federal Reserve will cut interest rates in the short term.

On the Chicago exchange, March 2024 soybean futures fell by 13 US cents to $11.9-1/4 per bushel. In the session on January 30, soybean prices touched $11.87-3/4 per bushel – the lowest level since November 2021. March 2024 corn futures fell by 3-3/4 US cents to $4.43-1/2 per bushel, and March 2024 wheat futures fell by 1/2 US cent to $6.01 per bushel.

Palm oil prices decline

Palm oil prices in Malaysia fell for the fourth consecutive session and had the biggest weekly decline in 9 months, as India, the top buyer, tried to cut vegetable oil imports. Along with that, the weakening prices of other vegetable oils and the sharp rise of the ringgit also put pressure on the market.

April 2024 palm oil futures on the Bursa Malaysia fell 36 ringgit, or 0.95%, to 3,762 ringgit ($797.88) per tonne – the lowest level since January 11, 2024. Palm oil prices fell 6.35% for the week.

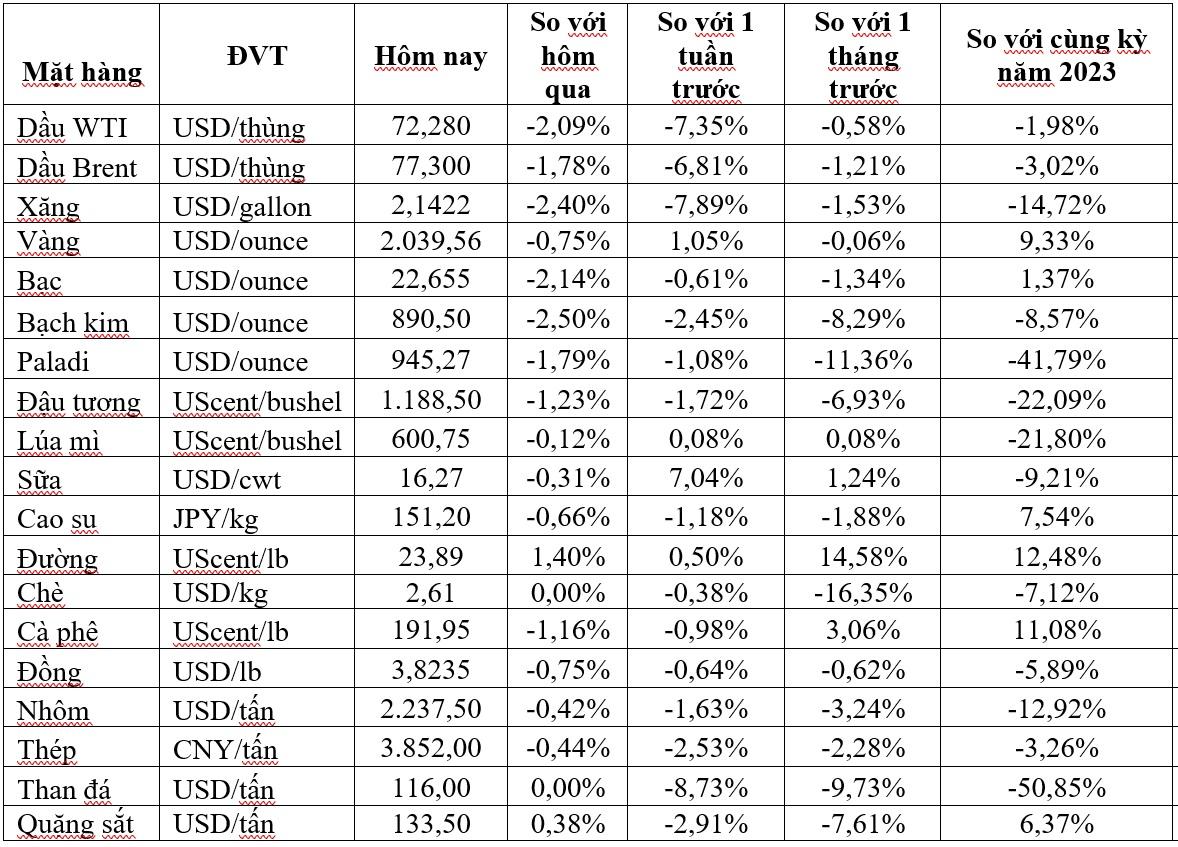

Key commodity prices on the morning of February 3