The Vietnamese stock market ended January 2024 with a surprising drop of more than 15 points. Banking stocks were heavily sold, with SHB being the center of attention, trading more than 127 million units, equivalent to 3.5% of the total circulating shares. Among them, the matched volume reached 124.7 million units, a record since the bank’s listing in 2009. The corresponding trading value was 1,510 billion VND.

With the newly established record, SHB became the 7th stock on the Vietnamese stock market with a matched volume of over 100 million units per session, following ROS, FLC, NVL, DIG, HPX. In the past, sessions with “massive” matched volumes of over 100 million units did not occur frequently. FLC is the only stock that has done this more than once, with all trading sessions taking place in the volatile year of 2022.

With a very strong selling force, SHB nearly touched the floor price before ending the session with a 5.69% decrease to 11,600 VND/share. Market capitalization also “evaporated” more than 2,500 billion VND, leaving only about 42,000 billion VND. However, this number is still about 7% higher than the beginning of 2024.

SHB listed its shares on the HNX exchange on September 20, 2009, as the 3rd bank to be listed on the stock market, following Sacombank (July 12, 2006) and ACB (November 21, 2006). On October 11, 2021, the bank officially transferred its listing to HoSE. SHB used to be the most valuable stock on the HNX exchange with market capitalization reaching 70,000 billion VND, but this number is now only about 2/3.

In terms of business performance in Q4 2023, SHB recorded pre-tax profit of 735 billion VND, after-tax profit of 579 billion VND, an increase of 15.4% compared to the same period. Accumulated throughout the year, the bank’s pre-tax profit reached 9,244 billion VND, a decrease of 4.6%, and after-tax profit was 7,470 billion VND, failing to meet the plan set by the Shareholders’ General Meeting (over 10,600 billion VND). The profit decrease was mainly due to a more than 40% increase in provisioning expense, reaching over 7,411 billion VND for the year.

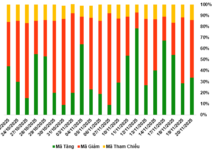

As of the end of 2023, SHB’s total assets stood at 630,400 billion VND, an increase of 14.4% compared to the beginning of the year. Among them, customer loans recorded a balance of 438,500 billion VND, an increase of 13.7%. The bank’s bad debt balance was 12,483 billion VND, a 15% increase compared to the beginning of the year but a decrease compared to the result of 13,484 billion VND at the end of Q3. The bad debt ratio was 2.85%, equivalent to the beginning of the year.