Exactly one year ago, on February 3, 2023, amidst countless difficulties faced by No Va Investment Corporation (Novaland – code NVL), Mr. Bui Thanh Nhon (born in 1958) officially returned as the Chairman of the Board of Directors to steer the company through the storms.

Sharing his decision at that time, Mr. Bui Thanh Nhon emphasized: “I am returning to the position of Chairman of the Board of Directors and legal representative of Novaland because as business people, we must accept and face challenges. Once we overcome one obstacle, another challenge will come”.

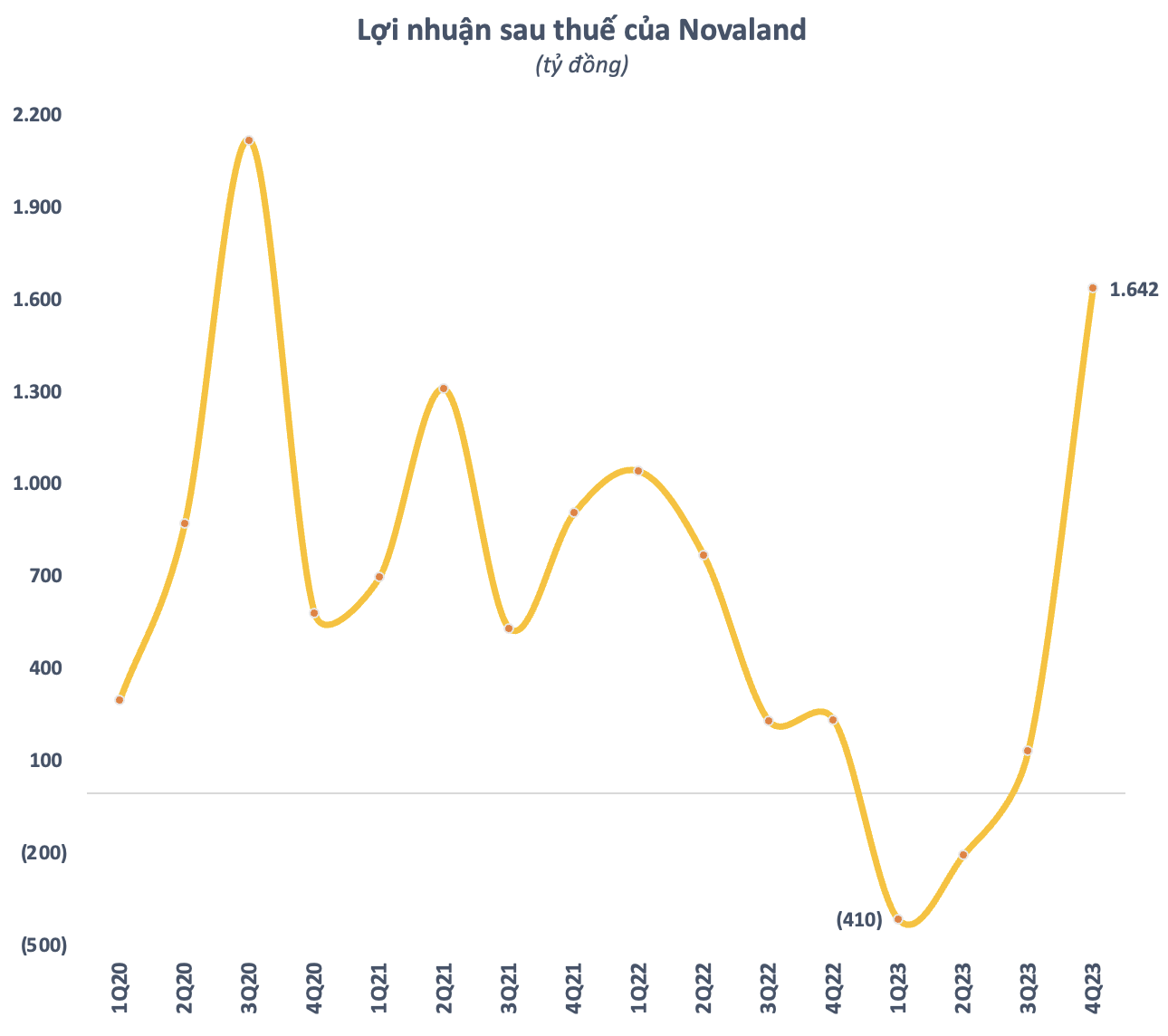

After one year, the overall business situation of Novaland has shown positive changes. From a record loss of VND 400 billion in the first quarter of 2023, Novaland’s profitability has gradually recovered. In the fourth quarter of 2023, Novaland reported a profit of VND 1,642 billion, 7 times higher than the same period in 2022 and the highest level in 3 years. This figure surprised many investors as the real estate market has not shown much improvement.

However, it is important to note that the quality of Novaland’s profitability is still a question mark as the majority of profits come from abnormal financial activities and other profits. Meanwhile, both revenue and gross profit decreased by 37% and 44% respectively compared to the same period in 2022.

Overall in 2023, Novaland’s after-tax profit amounted to nearly VND 685 billion, only 1/3 of the profit in 2022. In addition, the net cash flow from the core business operations of this real estate enterprise is a heavy negative VND 3,182 billion. This means that although Novaland has made a profit, it has not actually received money from its core business operations.

A positive point is that the financial pressure on Novaland has eased somewhat after a year of restructuring. The company’s financial debt has decreased by nearly VND 7,000 billion compared to the end of 2022, reaching VND 57,700 billion. Out of this, bond debt has decreased by VND 5,900 billion in one year, to nearly VND 38,300 billion.

Shares of related shareholders to Mr. Bui Thanh Nhon gradually diminish

In the effort to support the restructuring of Novaland’s debt, shareholders related to Mr. Bui Thanh Nhon have had to accept losing a large amount of shares through active sales and liquidation.

According to the latest management report, as of January 31, 2024, the group of shareholders related to Mr. Bui Thanh Nhon holds less than 42% of the shares in Novaland. Among those, NovaGroup and Diamond Properties are still the two largest shareholders, holding 19.6% and 9.24% of the shares in Novaland respectively. Mr. Nhon’s family directly owns about 12.8% of the shares.

Compared to a year ago (before Mr. Bui Thanh Nhon officially returned), the total ownership percentage of the entire group has decreased by about 10%, equivalent to 195 million NVL shares “slipping” from the hands of shareholders related to the Chairman of Novaland. Among them, the two largest shareholders, NovaGroup and Diamond Properties, have also reduced their ownership the most.

In the context of continuing bond pressure and ongoing restructuring activities, the number of shares held by shareholders related to Mr. Bui Thanh Nhon is likely to continue to decrease. Recently, NovaGroup has registered to sell more than 12.4 million NVL shares from January 29 to February 9 through matched transactions or agreements. If successful, this organization will reduce its ownership ratio in Novaland to 18.9%.

A large amount of shares distributed to small investors has made NVL transactions much more dynamic than before. Along with that, NVL shares have experienced strong fluctuations but have a tendency to recover over the past year. Currently, NVL’s stock price is at VND 17,000/share, an increase of nearly 14% compared to a year ago. The corresponding market capitalization is VND 33,150 billion.

In general, after one year of comprehensive restructuring under the leadership of captain Bui Thanh Nhon, the financial and business situation of Novaland has changed quite positively. However, it is still too early to evaluate the success of Mr. Nhon’s comeback as there is still a long way to go with many challenges ahead.