VPBank: VPBank achieved a consolidated pre-tax profit of VND 2,708 billion in Q4/2023, an impressive increase of 96% compared to the same period in 2022. VPBank is one of the banks with the highest growth rate in the last quarter of 2023.

For the whole year of 2023, the bank’s pre-tax profit reached VND 10,987 billion, a decrease of 48% compared to 2022. Accordingly, VPBank did not meet the approved business plan set by the Annual General Meeting of Shareholders.

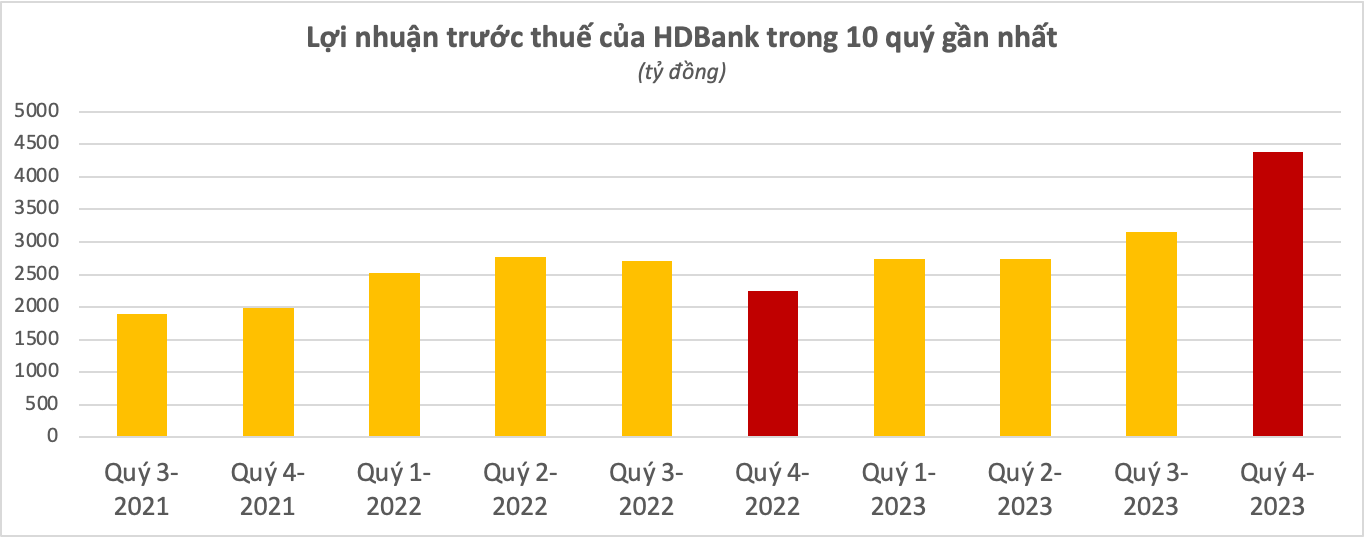

HDBank: HDBank also achieved remarkable growth with a pre-tax profit of VND 4,385 billion in Q4/2023, an increase of 95% compared to the same period last year. The bank’s full-year pre-tax profit in 2023 reached VND 13,017 billion, a 27% growth and ranked 7th in terms of profit among all banks.

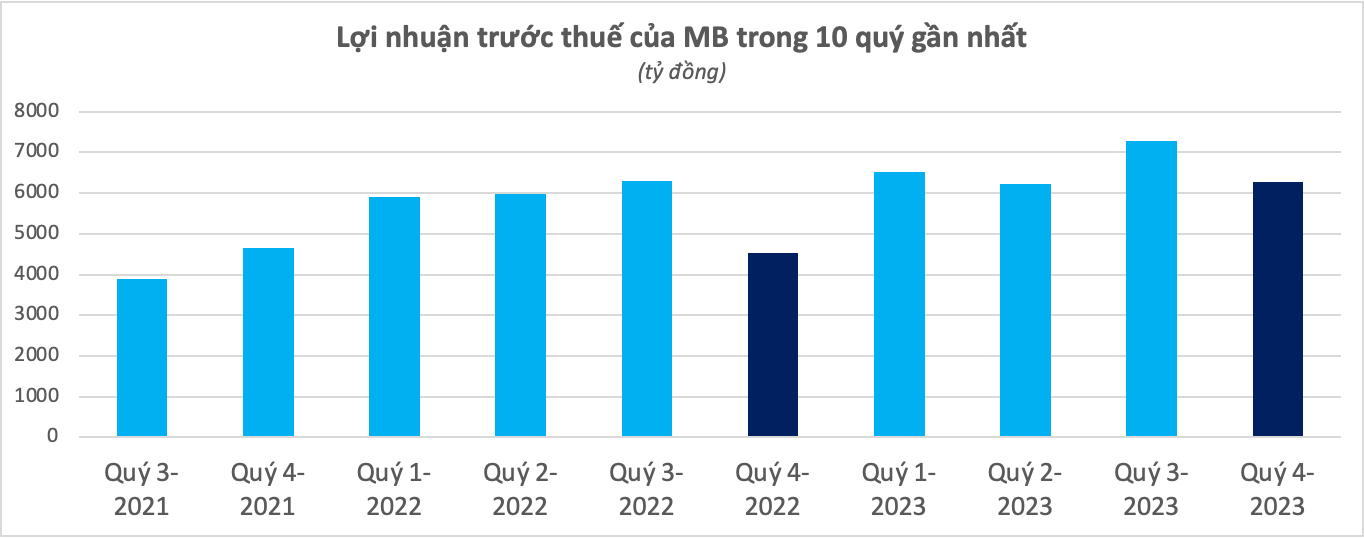

MB: In Q4/2023, MB achieved a pre-tax profit of VND 6,287 billion, a growth of 38.6% compared to Q4/2022. The bank’s full-year pre-tax profit in 2023 reached VND 26,306 billion, a 15.7% increase compared to 2022. The main growth driver came from core activities with a net interest income growth of 7.4% to VND 38,683 billion. The cost-to-income ratio (CIR) improved from 32.5% to 31.5%. The provision for bad debts decreased by 24.4% to VND 6,087 billion.

As of December 31, 2023, MB’s total assets reached VND 944,954 billion, an increase of 29.7% compared to the end of 2022. Loans to customers increased by 32.7% during the year. Customer deposits increased by 27.9% to VND 567,533 billion. The non-term deposit ratio (CASA) reached 40.2%, the highest in the industry.

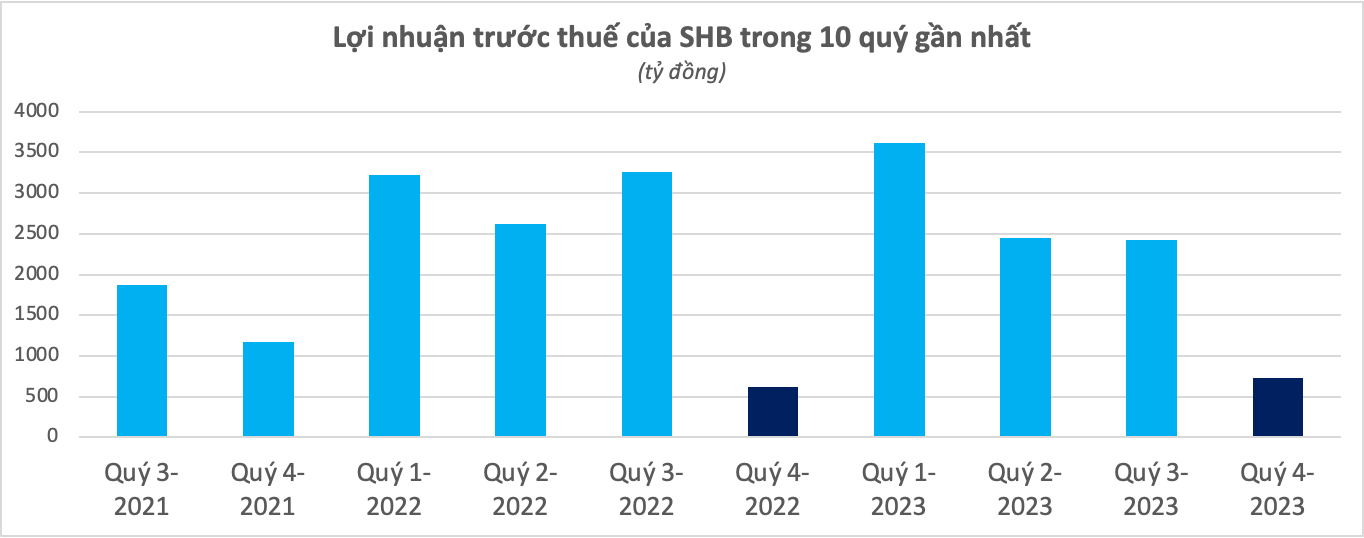

SHB: SHB achieved a pre-tax profit of VND 735 billion in Q4/2023, a 12.3% increase compared to the same period. The bank’s full-year pre-tax profit in 2023 reached VND 9,244 billion, a 4.6% decrease compared to 2022.

As of December 31, 2023, SHB’s total assets were VND 630,425 billion, a 14.4% increase compared to the end of 2022. Loans to customers increased by 13.7% to VND 438,464 billion. Customer deposits increased by 23.7% to VND 447,503 billion.

OCB: OCB recorded a pre-tax profit of VND 5,227 billion, a 19.1% increase compared to 2022. As of December 31, 2023, OCB’s total assets reached VND 239,454 billion, a 23.4% increase compared to 2022. The total market mobilization 1 reached VND 168,112 billion, a 22.4% increase compared to the same period. Market debt 1 increased by 20.5% compared to 2022 to reach VND 148,005 billion, achieving 100% of the annual plan.

Kienlongbank: KienlongBank’s pre-tax profit in Q4/2023 reached VND 79.5 billion, bringing the total profit in 2023 to VND 719 billion, achieving 102% of the plan approved by the Shareholders’ General Meeting in April.

NamABank: NamABank achieved a pre-tax profit of over VND 3,300 billion in 2023, a 50% increase compared to 2022. The business segments have shown positive growth, with a net interest income of over VND 6,600 billion (an increase of more than 30%), net income from service activities of nearly VND 600 billion (an increase of 116%), and net income from other activities of over VND 330 billion (an increase of 10.1%)…

As of December 31, 2023, NamABank’s total assets reached over VND 210,000 billion, an 18% increase compared to the beginning of the year, ranking among the top 20 banks with the largest total assets in the system.

Capital mobilization reached nearly VND 165,000 billion, an increase of nearly 20% compared to the beginning of the year, and outstanding loans reached nearly VND 142,000 billion, an 18% increase compared to the beginning of the year.

VietABank: The consolidated pre-tax profit in Q4/2023 reached VND 336 billion, a 12.8% increase compared to Q4/2022. After deducting corporate income tax, the bank’s net profit reached nearly VND 275 billion, a 14.4% increase.

The full-year pre-tax profit in 2023 of VietABank reached over VND 928 billion, a decrease of 16.2% compared to 2022 and only achieved 73% of the plan. The main reason was the sharp increase in provisions for bad debts, which narrowed the profit despite positive results from key revenue sources.

As of the end of 2023, VietABank’s total assets reached VND 112,207 billion, a 6.7% increase compared to the beginning of the year. Loans to customers reached over VND 69,000 billion, a 10.4% increase compared to the beginning of the year, below the average of the economy (13.7% growth). Customer deposits reached nearly VND 86,700 billion, a 23.5% increase compared to the beginning of the year.

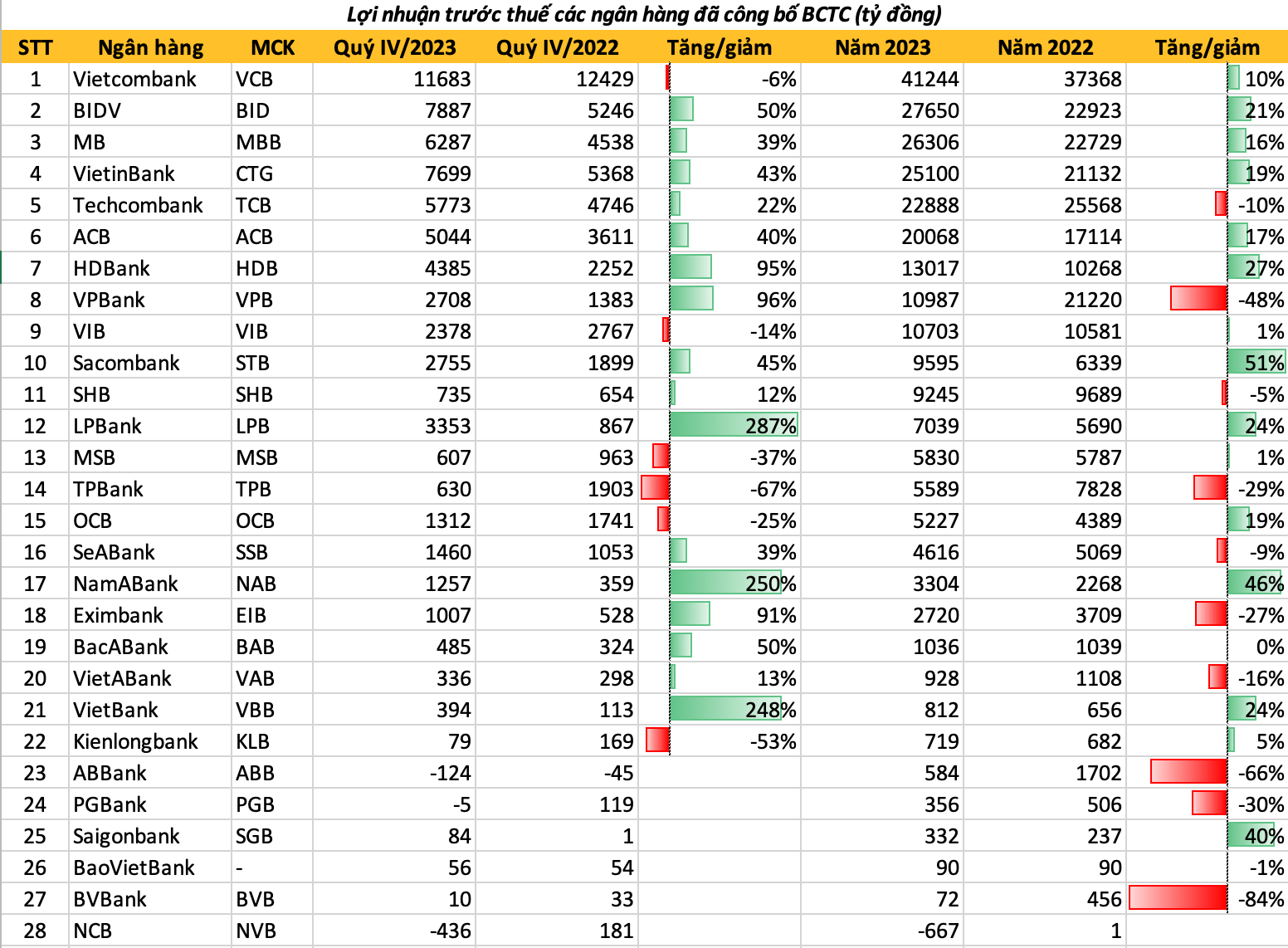

Looking at the profit rankings, the business results of banks in 2023 showed significant differentiation.

Vietcombank continued to lead the industry’s profit rankings with an estimated pre-tax profit of over VND 41,000 billion. The top 5 profits this year included the Big 4 (Vietcombank, BIDV, Agribank, VietinBank) and MB.

Only 7 banks achieved profits over VND 20,000 billion. In addition to the Big 4 group (Vietcombank, BIDV, Agribank, VietinBank), MB (over VND 26,000 billion), Techcombank (nearly VND 22,900 billion), and ACB (VND 20,068 billion) also achieved high profits.

The Q4/2023 profits of banks showed significant differentiation. Currently, Saigonbank (SGB) has the highest growth, with a pre-tax profit of VND 84 billion, 92 times higher than the same period in 2022. Many banks experienced negative growth in Q4/2023, such as VIB, MSB, TPB, and others. Additionally, some banks incurred losses in the fourth quarter of this year.

Most private banks did not meet their approved profit plans in 2023. The main reason was their significant increase in provisions for bad debts, resulting in narrowed profits despite positive results in many business areas.

In the group of private banks, Techcombank and ACB achieved close to their planned profit. However, VPBank, VIB, MSB, TPBank, Eximbank, and others did not meet their plans.