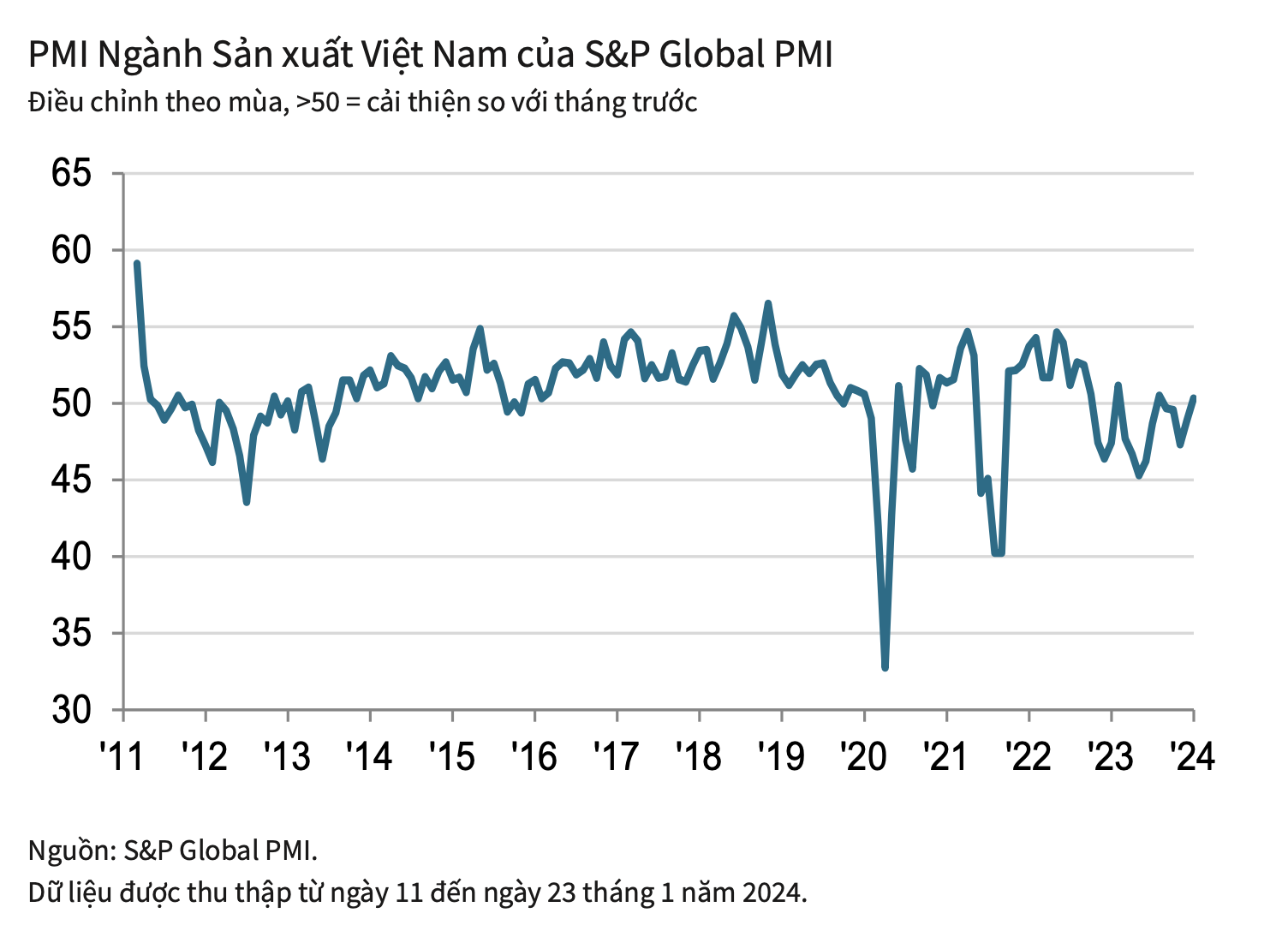

The Vietnam Manufacturing Purchasing Managers’ IndexTM (PMI®) by S&P Global has returned above the 50 point threshold in the first month of the year, increasing to 50.3 points compared to 48.9 points in December. The index result indicates an improvement in the health of the manufacturing sector after 5 months, although the improvement this time is small.

The report states that overall business conditions have improved due to new orders and production levels returning. Domestic and export market demand recovery are the factors that have helped increase the volume of new orders and new export orders for the first time in 3 months.

As a result, companies have ended the four-month period of decline in production. The increase is small but significant since September 2022 and is concentrated in intermediary goods manufacturers.

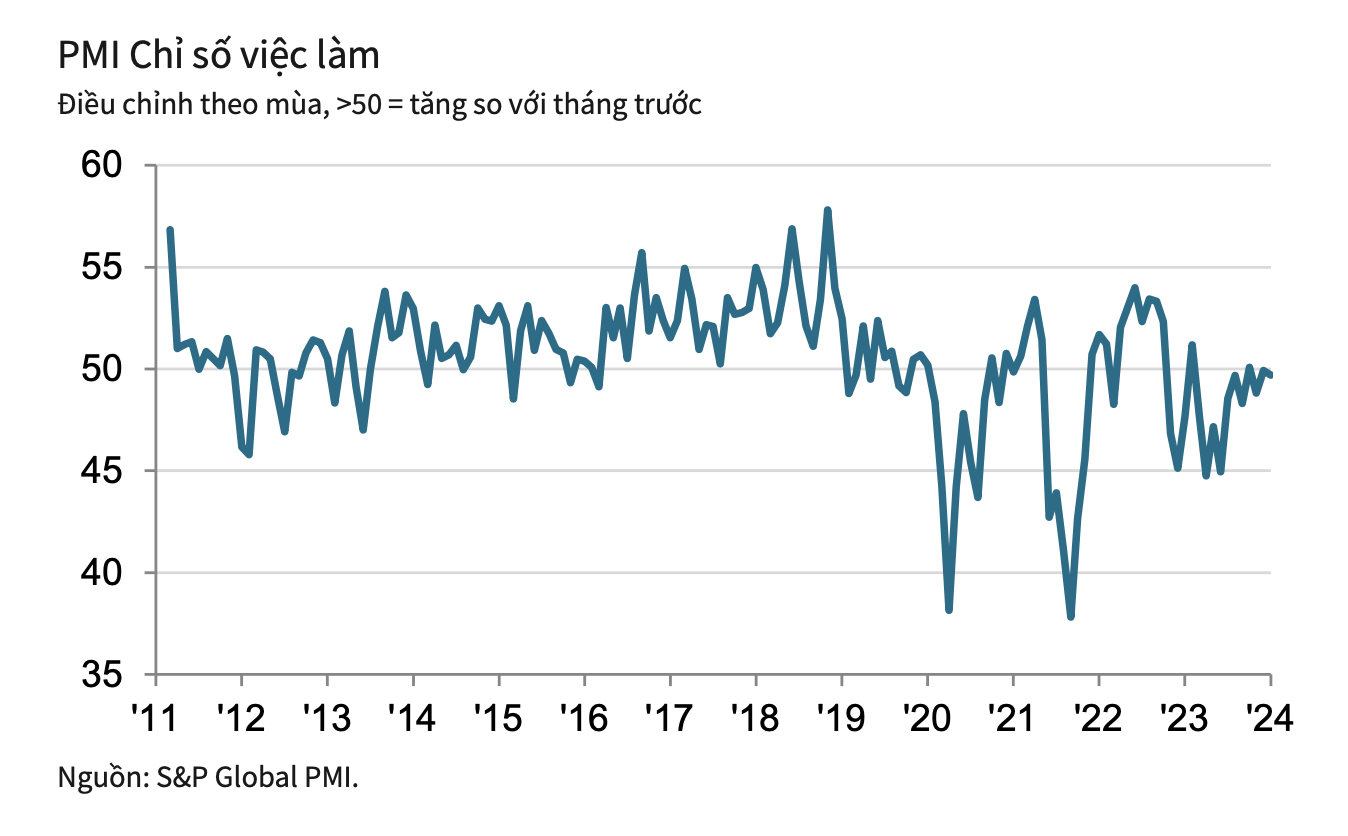

Furthermore, according to S&P Global, with the slight increase in both production and new orders, companies have maintained stable employment and purchasing activities in the first month of 2024. The stable status of operations in the context of increased new orders has led to consecutive month-on-month increases in workforce size.

Source: S&P Global

In addition, finished goods inventory after production decreased in January 2024. Inventory of purchased goods also decreased while production demand increased but purchasing activities remained unchanged. The decrease in pre-production inventory was the largest since June last year.

S&P Global assesses that delayed transportation and logistics issues have prolonged delivery times for suppliers in January, leading to a decline in salesperson efficiency for the first time in over a year. However, the prolonged delivery time is only slight.

The transportation issues impacting delivery have also resulted in increased transportation and input costs in the beginning of the year, leading to significant price increases. Companies also reported increased fuel and road costs.

Despite the continued increase in input costs, Vietnamese manufacturers have reduced selling prices in an attempt to stimulate demand, ending the 5-month price surge.

Confidence in future production has reached a low point in the past 7 months due to concerns about economic conditions. However, S&P Glocal notes that manufacturers in general remain optimistic, hoping for improved demand and customer numbers as well as new product launches.

Source: S&P Global

Andrew Harker, Associate Director of Economics at S&P Global Market Intelligence, commented on Vietnam’s manufacturing sector in the first month of 2024:

“This is a promising start to 2024 for Vietnam’s manufacturing sector as new orders and production have shown positive improvements. However, the corresponding increases are small and not enough to persuade companies to hire more employees or increase purchasing activities. Backlogs continued to increase as industry capacity remained unchanged.”

According to the expert, there are reports of issues with transportation and delivery in January, leading to delays and increased costs. However, companies have lowered selling prices, indicating relatively weak demand.