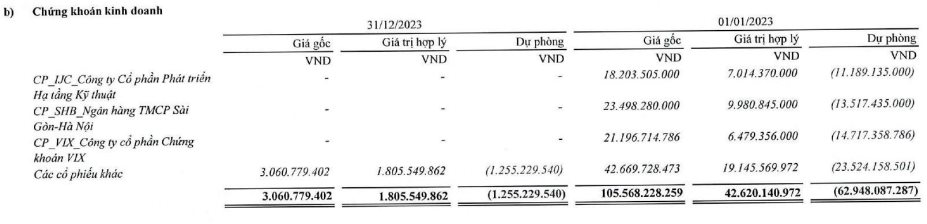

Steel Tiến Lên (stock code: TLH) is one of the companies in the market known for bringing investment capital. However, according to the Q4/2023 financial statements, the company’s securities investment portfolio has decreased significantly from 105.5 billion at the beginning of the year to over 3 billion VND.

Specifically, Steel Tiến Lên has cut losses on stocks such as NVL, VIX, SHB, and many other stocks. In the Q3/2023 financial statements, the company’s securities investment portfolio had an original cost of 88 billion VND, while the fair value was recorded at 74.7 billion VND. Therefore, the total value of the company’s sold portfolio is about 71 billion VND and is almost “cut loss”.

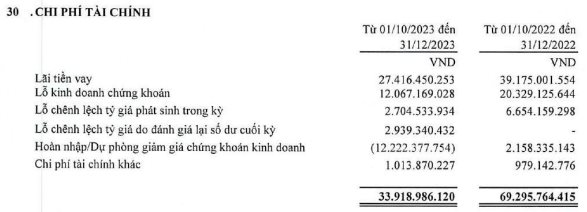

In Q4/2023, the company recorded a net loss of over 9 billion VND from securities business. This figure was over 20 billion VND in the same period. With the move to sell the above portfolio, Steel Tiến Lên has put an end to a long time of selling steel to compensate for “stock speculation”.

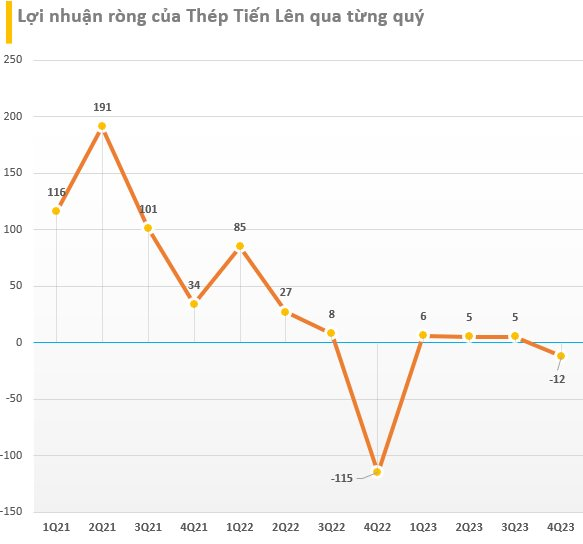

In terms of business results, in Q4/2023, Steel Tiến Lên achieved net revenue of 2,168 billion VND, an increase of over 30% compared to the same period last year. With no longer doing business at cost, the company’s gross profit was 33 billion VND, while it recorded a gross loss of 51 billion VND in the same period.

During the period, Steel Tiến Lên’s core business thrived as the steel industry showed signs of turning around and consumer demand increased. Financial expenses decreased sharply by 51% compared to the same period, down to 34 billion VND, mainly due to the reversal of provisions for financial investments. Meanwhile, sales and business management costs increased slightly by 11 billion VND and 13 billion VND, respectively.

As a result, Steel Tiến Lên recorded a post-tax loss of over 12 billion VND, while it lost 114 billion VND in the same period. Thus, after 3 consecutive profitable quarters, this company returned to loss in the last quarter of 2023.

Accumulatively in 2023, Steel Tiến Lên recorded revenue of 6,157 billion VND, an increase of 16% compared to the same period, net profit reached 4 billion VND, a decrease of up to 47% compared to the realization level in 2022 and only completed 4% of the profit plan for the year.

The company stated that the steel consumption market faced many difficulties, with production and selling prices declining while the prices of raw materials increased. In addition, losing money because of securities investments is also the main reason for the sharp decline in the company’s profit.

On the balance sheet, Steel Tiến Lên’s total assets as of December 31 decreased slightly compared to the beginning of the year, to 3,562 billion VND. Among them, the main asset is inventories with 2,413 billion VND, accounting for 68% of total assets; short-term receivables were recorded at 820 billion VND.

Regarding capital sources, the company’s financial borrowings decreased by 6.6% at the beginning of the year, down to 1,450 billion VND, with the majority being short-term borrowings.

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-150x150.jpg)

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-100x70.jpg)