Illustrative image

The Bank for Investment and Development of Vietnam (BIDV) recently announced its financial report for the fourth quarter of 2023 with total assets reaching over VND 2.3 quadrillion by the end of 2023, an increase of 8.5% compared to the beginning of the year. With this asset scale, BIDV continues to lead the banking industry in terms of total assets, far ahead of other giants in the industry such as VietinBank (VND 2,033 trillion), Agribank (VND 2 trillion), and Vietcombank (VND 1,839 trillion).

In 2023, BIDV’s outstanding loans to customers increased by 16.8% – much higher than the industry’s overall growth rate (13.71%) and reached a record level in the bank’s history of VND 1,778 trillion. Customer deposits also increased by 15.7%, reaching over VND 1,704 trillion with non-term deposit ratio at 20.2%.

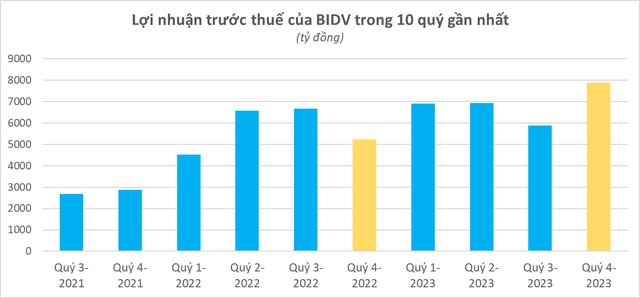

By the end of 2023, BIDV’s consolidated pre-tax profit reached nearly VND 27,650 billion, an increase of 20.6% compared to 2022. This is the first time BIDV’s profit has exceeded USD 1 billion and is the second highest profit in the banking industry, second only to Vietcombank (VND 41,244 billion).

In 2023, BIDV’s main source of revenue was net interest income of over VND 56,135 billion, an increase of only 0.3% compared to 2022 despite credit outstanding expanding by 16.66%. This indicates a significant decrease in the profit generating ability of the credit portfolio in the context of the bank continuously pushing forward programs to reduce lending interest rates and support customers.

Meanwhile, most of BIDV’s non-interest income sources all saw impressive growth. Specifically, net income from service activities increased by 16.3% to VND 6,572 billion; net income from foreign exchange trading more than doubled, reaching over VND 4,707 billion; in particular, net income from securities investment reached nearly VND 2,872 billion, 11 times higher than 2022; securities trading turned from a loss of nearly VND 32 billion in 2022 to a profit of over VND 305 billion.

Overall, BIDV’s operating income in 2023 reached nearly VND 73,025 billion, an increase of 5.1% compared to the previous year. With these results, BIDV has the highest net revenue among the banking system. On average, this bank earns more than VND 200 billion in net revenue per day.

In terms of asset quality, BIDV’s on-balance sheet bad debts at the end of 2023 stood at VND 22,229 billion, an increase of 22.9% compared to the beginning of the year. As a result, the bad debt ratio on total outstanding loans increased from 1.19% to 1.25%; the coverage ratio for bad debts decreased from 210% to 182%.