VGC Corporation (ticker: VGC, exchange: HoSE) has just released its consolidated financial report for the fourth quarter of 2023, with net revenue of VND 3,020 billion, a decrease of 8% compared to the same period last year. Gross profit also decreased by 21% to VND 565 billion.

During the period, revenue from financial activities decreased by 75% to nearly VND 6 billion. The company also recorded a loss of VND 16.2 billion from joint ventures and associates.

Along with the high maintenance costs (with management costs increasing by 44%), Viglacera incurred a net loss of VND 11 billion from its business operations (compared to a net profit of VND 233 billion in the same period last year).

After tax deductions, VGC recorded a net loss of VND 48 billion (compared to a net profit of VND 222 billion in the same period last year). This is the first quarterly loss since the company announced its information.

According to the explanation, Viglacera’s profit decreased sharply due to difficulties in the glass segment, with reduced selling prices and lower sales volume leading to a decrease in revenue. In addition, the company allocated VND 100 billion to the Science and Technology Development Fund as approved by the General Meeting of Shareholders.

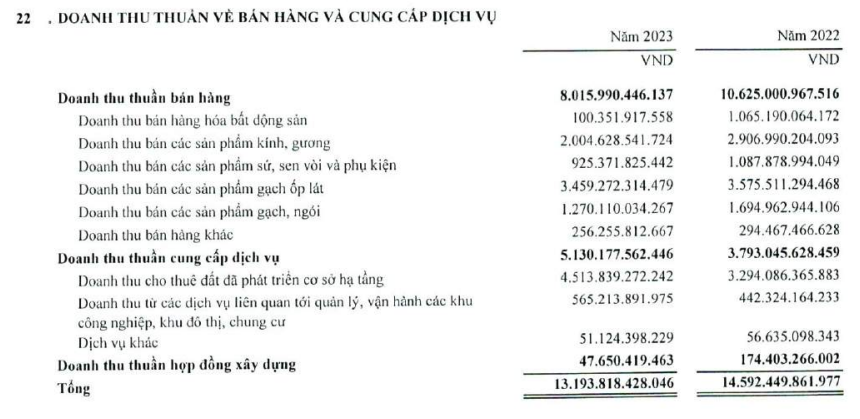

For the whole year of 2023, Viglacera reported a net revenue of VND 13,194 billion, a decrease of 10% compared to 2022. Most revenue segments experienced a decline: real estate segment (a 90% decrease, reaching VND 100 billion), glass segment (a 31% decrease, reaching VND 2,004 billion), ceramics, faucets, and accessories segment (a 15% decrease, reaching VND 925 billion), and roofing tiles segment (a 25% decrease, reaching VND 1,270 billion). Only the tile segment decreased by only 3%, reaching VND 3,459 billion.

Source: VGC

The company’s pre-tax and after-tax profits reached VND 1,602 billion and VND 1,162 billion, decreasing by 30% and 39% respectively. In 2023, VGC set a target of VND 13,468 billion in revenue and VND 1,216 billion in pre-tax profits. Thus, the company has achieved 98% of the revenue target and exceeded the profit plan by 32%.

As of December 31, 2023, Viglacera’s total assets reached VND 24,099 billion, an increase of 5% compared to the beginning of the year. VGC has a fairly large amount of money with VND 2,467 billion; in which cash and cash equivalents reached VND 1,841 billion, a decrease of 9%; investments held until maturity reached VND 626 billion, an increase of 4.8%.

Inventory increased by 12% to VND 4,739 billion, of which the largest proportion is finished glass, ceramics, faucets, etc. with VND 2,603 billion. The inventory of unfinished real estate projects is VND 1,537 billion.

The cost of unfinished basic construction reached VND 6,229 billion, an increase of 8%. The projects with the highest costs are the Thuan Thanh Industrial Park Phase 1 (VND 1,665 billion), Yen My Industrial Park (VND 967 billion), Van Hai Premium Ecological Tourism Area (VND 760 billion), and Phu Ha Industrial Park Phase 1 (VND 847 billion)…

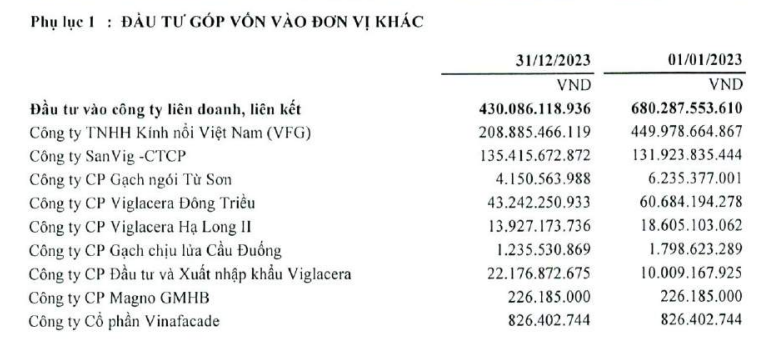

Last year, Viglacera reduced the value of its contributions to joint ventures and associates by 37%, with a total of only VND 430 billion. Among them, the value of investment in Viglacera Dong Trieu and Viglacera Ha Long II decreased significantly…

Source: VGC

In terms of capital, total liabilities reached VND 14,575 billion, an increase of 5% compared to the beginning of the year. Among them, financial loans reached VND 5,134 billion, an increase of 42%, with short-term debts exceeding VND 2,897 billion. The unfulfilled revenue reached VND 2,670 billion, a decrease of 3%.

At the beginning of January, the Large Enterprises Tax Department (General Department of Taxation) issued a decision to impose administrative penalties on Viglacera Corporation for tax violations.

Accordingly, Viglacera was fined more than VND 1.4 billion, equivalent to 20% of the amount of tax understatements leading to the shortage of tax payable from 2018 to 2022.

The tax authority also requested Viglacera to pay an additional amount of nearly VND 7.2 billion, which is the corporate income tax still owed to the state budget during these years. In addition, Viglacera must pay nearly VND 2.5 billion for late tax payment.

Therefore, the total amount to be recovered, administrative penalties, and late tax payment that Viglacera must pay to the state budget is more than VND 11 billion.

The tax authority also decided to reduce the VAT deduction amount transferred to subsequent periods after the tax calculation for December 2022, with the amount being over VND 877 billion.