Banking stocks have seen a withdrawal of funds in recent sessions. This group is facing the risk of continued correction as the strong recovery momentum has taken place. However, BSC Securities continues to maintain an optimistic recommendation when looking at the prospects of the banking sector in 2024, with profit growth becoming more optimistic.

In particular, in the assessment of the prospects for 2024, BSC expects overall industry profit growth to rebound, driven primarily by the expansion of NIM. However, the speed of this recovery will depend on the development of credit demand and asset quality. Nevertheless, BSC believes that the industry’s valuation has already reflected the uncertainties mentioned above.

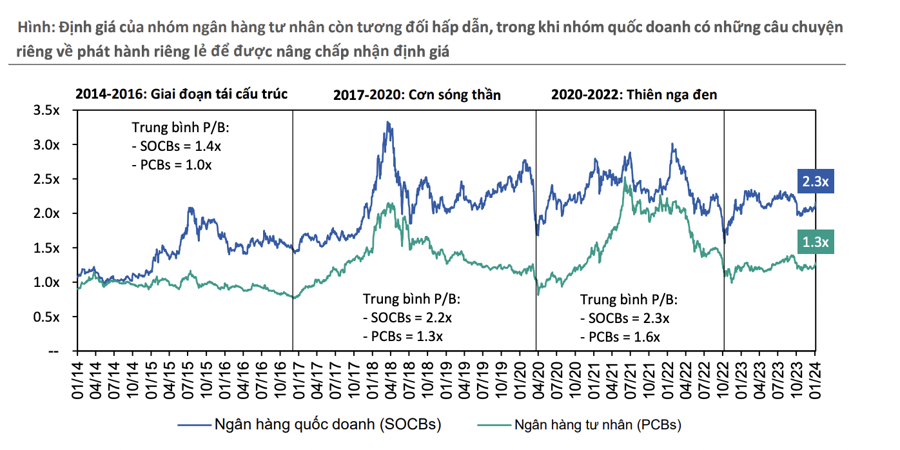

The discounted valuation compared to previous cycles continues to provide a buffer for investors.

Banking stocks in BSC’s watchlist have recorded an average price increase of about 27% in 2023, compared to the 15% performance of the VN-Index, partly due to the heavily discounted valuation. At the beginning of 2024, state-owned banking stocks are generally showing superior price performance compared to the sector.

BSC believes that the current valuation of the industry is still suitable for accumulation, especially for private banks, while state-owned banks have a basis for raising acceptance of private placement valuations. The basis comes from reviewing the industry’s valuations in past cycles, without considering the period from 2014-2016, which was a restructuring period for the industry after the real estate crisis, with a series of new regulations being added, such as Circular 36/2014 and Circular 41/2016 of the State Bank of Vietnam (SBV).

BSC also notes that stricter risk governance regulations and improved balance sheet health are the main differences in the current cycle compared to the past. The amended Credit Institutions Law, aimed at minimizing systemic risks, has also been recently passed.

Based on these factors, BSC continues to maintain an optimistic recommendation for the banking sector in 2024 based on the following key points: a low interest rate environment and economic recovery prospects will help improve credit growth and NIM due to the reset of funding costs, enhanced handling of bad debts in 2023 will create room for recognizing profits from debt recovery in 2024, thereby improving the prospects for profit growth in 2024, supported by valuations still in an appropriate range for accumulation.

In more detailed forecasts, BSC expects credit growth in 2024 to reach about 14% in the base scenario. The impetus will come from areas related to exports, public investment, and real estate business.

With pressure on the formation of bad debts (NPL ratio coupled with debt erasure during the period) remaining high in the short term, BSC maintains a cautious view on the sector’s asset quality in 2024. In the base scenario, banks are expected to maintain a stable NPL ratio in 2024 compared to 2023 after having erased debts significantly in the past year.

BSC believes there will be differentiation in the level of NIM recovery for the industry in 2024. Banks that were most affected in 2023 when funding costs increased sharply at the beginning of the year are expected to have the most significant recovery (TCB, VPB), while banks with stable CASA advantages (MBB) or have a retail lending portfolio (ACB, STB, VIB, CTG, BID) are expected to maintain stable NIM and show slight improvement.

One unexpected factor for the forecast will come from the speed of credit demand recovery, especially positive developments in the real estate market, thereby helping banks to improve lending rates. An early indicator for the return of credit demand could come from the point when banks simultaneously increase deposit rates, showing increased pressure on fundraising to support lending.