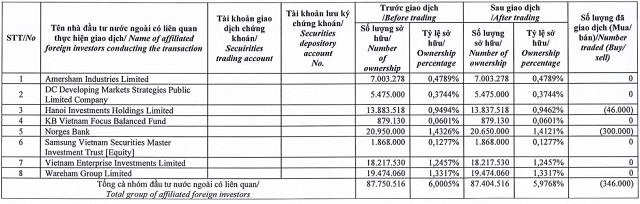

The Dragon Capital group has reduced its ownership ratio to below the 6% threshold.

Specifically, 2 out of 8 member funds of the Dragon Capital group, including Norges Bank and Hanoi Investments Holdings Limited, sold 300,000 shares and 46,000 shares of MWG respectively in the session on 29/01, thereby reducing the ownership ratio in MWG to 1.41% and 0.95%.

Overall, the Dragon Capital group sold 346,000 shares of MWG, reducing its ownership to 87.4 million shares, equivalent to 5.98% ownership. Based on the closing price of MWG shares in the session on 29/01 at VND 44,600/share, it is estimated that this fund group has earned about VND 15.4 billion.

|

Dragon Capital fund trading of MWG shares on 29/01/2024

Source: MWG

|

The event of reducing the ownership ratio to below 6% happened not long after this fund group left the 7% ownership milestone. Specifically, on 01/11/2023, the Dragon Capital group net sold over 4.1 million shares of MWG, with 4 out of 9 member funds making sales and only 1 fund buying. After that transaction, the ownership of this foreign fund group in MWG decreased from over 105.2 million shares to over 101 million shares, equivalent to 6.91% capital ratio.

It is worth noting that the session on 01/11 also marked the successful bottoming out of MWG share prices after a continuous decline. Since that session until now, the MWG share price has recovered nearly 26%, reaching VND 47,400/share after the session on 02/02/2023.

| MWG shares on the path to recovery after a sharp decline from mid-September 2023 |

Expectations for recovery in 2024

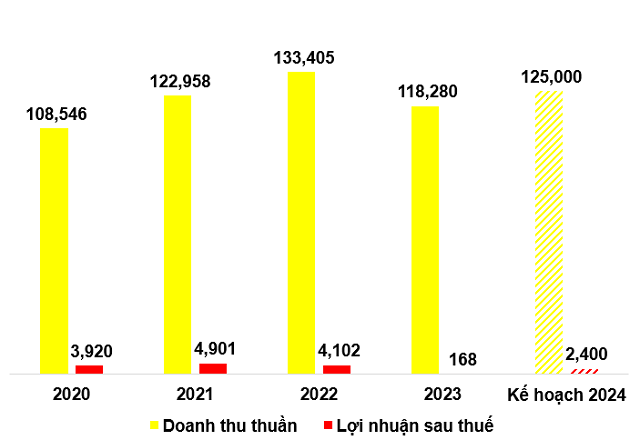

In terms of business performance, in the context of the ICT industry facing many difficulties, MWG is not immune to negative impacts. At the end of 2023, this retail giant only made a net profit of VND 168 billion, a decrease of 96% compared to the previous year and marking the lowest level since listing.

MWG only made a net profit of nearly VND 168 billion in 2023, the lowest since listing

Recently, on 31/01, the Board of Directors of MWG approved the business plan for 2024 to submit to the Annual General Meeting of Shareholders. The plan is believed to be optimistic about the recovery with net revenue of VND 125 trillion and after-tax profit of VND 2.4 trillion, up 6% and 14 times compared to the actual figures in 2023, respectively.

In which, the Thế giới Di động chain (including Topzone) and Điện máy Xanh are expected to still be the main pillars, contributing about 65% of revenue and bringing in the main profits. Meanwhile, Bách hóa Xanh contributes about 30% of revenue, with double-digit growth, increasing market share, and starting to generate profits from 2024.

The three chains of An Khang Pharmacy, AvaKids, and EraBlue also target double-digit revenue growth and increased market share. An Khang and AvaKids are expected to achieve breakeven before 31/12/2024.

|

MWG shows ambitions for recovery in 2024

Unit: Billion dong

Source: VietstockFinance

|

Huy Khải