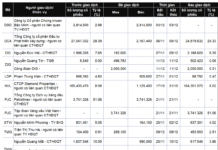

| Financial Results of DAG for the period 2022-2023 |

According to the consolidated financial statements for Q4 2023, DAG recorded net revenue of nearly 31 billion VND, a 94% decrease compared to the same period last year. The gross loss was over 1 billion VND, while the company made a profit of 32 billion VND in the same period last year. It is worth noting that on the separate financial statements, DAG almost had no revenue in Q4.

According to the explanation, the company’s revenue decreased significantly due to the overall economic situation in the country and the difficulties in the real estate project market, causing DAG and its subsidiaries specializing in the distribution of plastic products for the real estate sector to be affected.

In that context, the costs of operating factories, business management, depreciation, interest expenses, and business operation costs of the parent company and its subsidiaries still had to be paid, resulting in a net loss of more than 22 billion VND in Q4.

“The entire Group is struggling to maintain and come up with solutions such as restructuring, reducing staff, expanding the search for partners, distributors, agents to increase, grow, recover production and business, and maintain continuous operations,” DAG added.

From the beginning of 2023, the company’s consolidated revenue amounted to 1,204 billion VND, a 47% decrease compared to the previous year, and a gross loss of 65 billion VND.

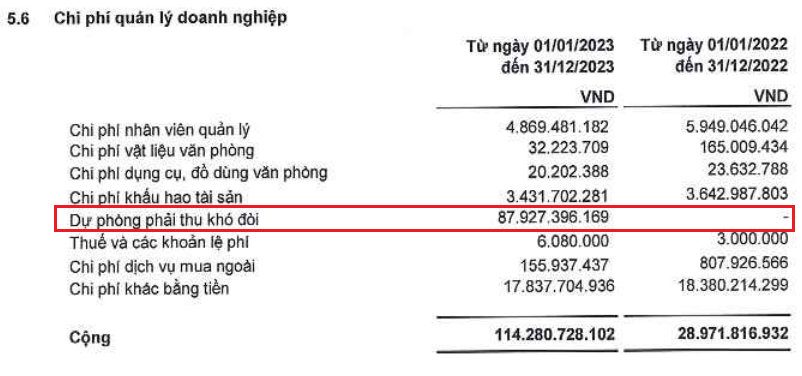

Significantly, business management expenses increased sharply in the year, reaching 114 billion VND, nearly 4 times higher than the previous year. The main reason is that the company set aside 88 billion VND as a provision for difficult-to-collect receivables, which did not occur in the previous year.

Source: Company’s Financial Statements

|

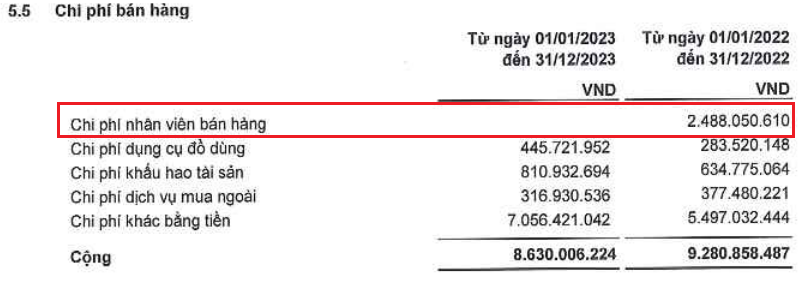

On the other hand, selling expenses amounted to nearly 9 billion VND, a 7% decrease compared to the previous year. Among them, the sales staff costs were completely cut, compared to over 2 billion VND in the previous year. As of the end of 2023, the company’s workforce was significantly reduced to 150 employees, compared to 290 employees at the beginning of the year.

Source: Company’s Financial Statements

|

Lastly, Dong A Plastic JSC incurred a net loss of 257 billion VND in 2023. This is the highest loss in the past 20 years.

| Record Loss for DAG in 2023 |

Increased Debt

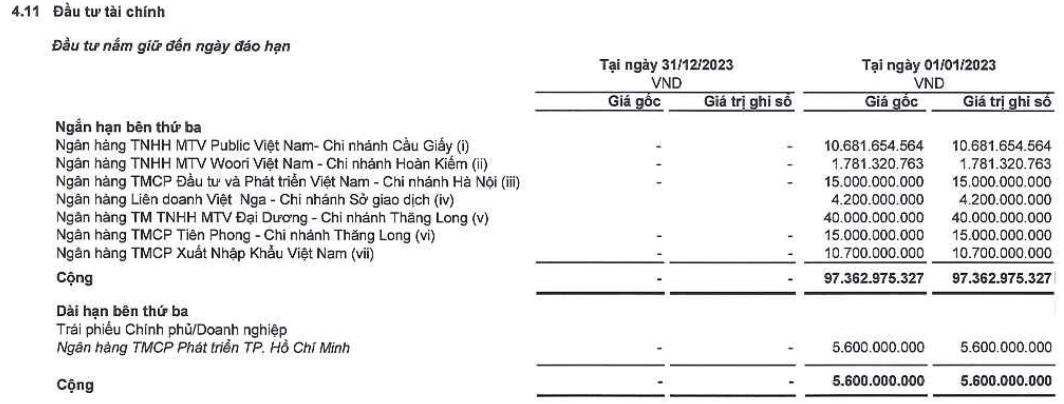

As of the end of 2023, DAG’s total assets amounted to 2,175 billion VND, a slight decrease compared to the beginning of the year. Inventory was recorded at 856 billion VND (including a provision of 34 billion VND), a 12% decrease. Construction work in progress amounted to 39 billion VND, a 34% decrease. The company no longer holds investments due for maturity (short and long-term) such as deposits and bonds, with the recorded value at the beginning of the year being 5.6 billion VND.

Source: Company’s Financial Statements

|

On the balance sheet, liabilities amounted to 1,745 billion VND, a 17% increase compared to the beginning of the year. Among them, short-term borrowings and financial leases amounted to 1,023 billion VND, a 6% increase; while long-term borrowings and financial leases increased by 4% to 256 billion VND.

| Financial Structure of DAG |

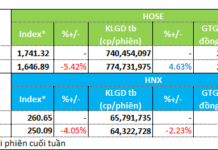

Currently, DAG’s stock is still under control. Previously, on November 2, 2023, the Ho Chi Minh Stock Exchange (HOSE) issued a document regarding the transfer of DAG’s stock from the warning category to the control category, as the listed organization continued to violate regulations on information disclosure in the stock market.

Regarding the measures to address this situation, DAG stated that after correcting the information disclosure work, the company has published and submitted the Q4 2023 financial statements on time on January 31, 2024; at the same time, all departments/units are advised to comply with the regulations on information disclosure in the stock market.