Specifically, DXS’s net revenue in 2023 only reached nearly 2 trillion dong, a 52% decrease compared to the previous year. The reason is due to a sharp decrease in revenue from real estate services such as brokerage, which was only about 648 billion dong, while it was over 2.3 trillion dong the previous year.

|

Net revenue of DXS in 2023

Source: DXS

|

Not only net revenue, but also a decrease in deposit interest income has caused DXS’s financial revenue to decrease by 13% to nearly 48 billion dong. On the other hand, the Company incurred a loss from associated companies and joint ventures of over 107 billion dong, while there was no such item in 2022.

As a result, DXS had a net loss of over 168 billion dong in 2023, marking the first year of reporting a loss since 2018.

The situation in the fourth quarter of 2023 was also similar, with net revenue decreasing by nearly 478 billion dong and an additional loss of 91 billion dong from associated companies and joint ventures. After deducting all expenses, DXS had a net loss of nearly 114 billion dong.

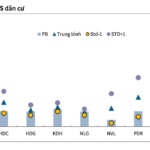

Unit: billion dong. Source: VietstockFinance

|

On the balance sheet, DXS’s total assets as of December 31, 2023 were nearly 15.5 trillion dong, a 7% decrease compared to the beginning of the year. The two largest items were accounts receivable and inventory, which decreased by 6% and 2% respectively, to about 10 trillion dong and over 4.1 trillion dong. Cash holdings decreased by 54%, to 304 billion dong.

Total liabilities decreased by 12%, to over 7.3 trillion dong. Among them, total borrowings decreased by 7%, to over 2.1 trillion dong. Bond liabilities accounted for only over 2% of total borrowings, at 51.5 billion dong. The largest item in the liabilities to be paid was the amount collected from investors, which decreased by over 14% to over 3 trillion dong.

Notably, the number of DXS employees as of December 31, 2023 was only 2,275, a decrease of nearly 32% compared to the beginning of the year.