Since 2012, the banking industry in Vietnam has undergone a significant restructuring process. The number of joint-stock commercial banks decreased from 36 in 2014 to 31. In the current context, the banking industry will continue to face intense competition, not only from other banks but also from the increasing number of financial companies and fintechs entering the market. Thus, a clear strategic direction and customer portfolio are necessary for banks to create their competitive advantage.

During this period, commercial banks can be categorized into two groups: those focusing on retail credit and those emphasizing wholesale credit, or lending to large businesses. Each group leverages its unique advantages in terms of network, capital structure, and governance mechanisms to capture market share in the context of an annual credit growth target of 14%-15%. Due to their flexible strategies, many private banks have grown rapidly and now compete directly with large state-owned banks, which previously dominated the market share. However, in 2023, the macroeconomic context became more complex, forcing banks to reshape their credit growth strategies and optimize their operations to adapt.

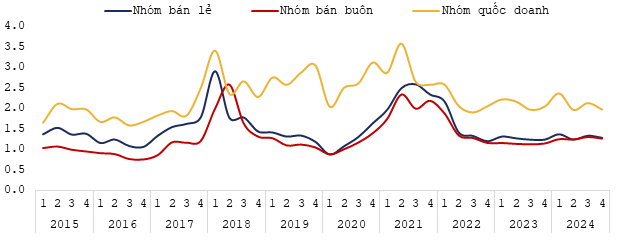

The credit pivot in 2023 altered the landscape of the banking industry. That year, a liquidity shock in the real estate market led to a significant slowdown in consumer credit. Previously, credit outstanding in this sector maintained a higher growth rate compared to other industries in the pre-pandemic phase. However, due to the impact of COVID-19, the growth rate of real estate credit in 2020 and 2021 dropped to 12.06% and 15.7%, respectively. In 2022, real estate credit growth rebounded strongly, reaching 23.91%, but in 2023, it fell to 11.81%. According to the State Bank of Vietnam’s report, as of the end of September 2024, real estate credit had increased by 9.15% compared to the end of 2023. However, consumer real estate credit increased by only 4.62%, indicating a noticeable slowdown.

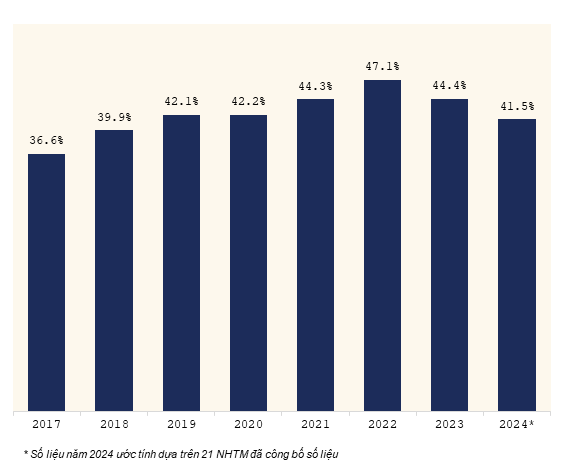

At the same time, there was a significant shift in the credit structure in the real estate lending sector: the proportion of consumer credit outstanding in total real estate credit decreased from 65% to 60%, while credit for real estate businesses increased from 35% to 40%. On the other hand, according to financial reports from commercial banks, personal credit has achieved an average growth rate of 20-25% annually. 2023 marked the first year that personal credit growth was significantly lower than the overall credit growth rate of the banking industry, reaching only about 11.2%. In contrast, corporate credit surged, with an estimated growth rate of nearly 23%, double the range of 10%-14% in 2019-2022, driven by increases from major sectors such as trade, services, and exports. This shift made corporate credit the growth driver, replacing the traditional role of retail credit in the previous phase.

|

Chart 1: Proportion of Personal Loans over the Years

Source: Consolidated

|

This change in consumption patterns has negatively impacted banks with a high proportion of retail loans, such as VPBank, Sacombank, VIB, and ACB. As of the end of 2023, Sacombank and VIB recorded credit growth rates of 10% and 14.8%, respectively, lower than the industry average of 18%. VPBank has also gradually reduced the proportion of personal loans and increased corporate lending. In contrast, banks with a wholesale lending focus, such as MBBank, LPBank, and Techcombank, recorded outstanding credit growth rates ranging from 17% to 30%.

This reality has compelled banks to adjust their credit strategy orientations. The group of retail banks now has to return to the “playing field” of corporate lending to seize growth opportunities. Conversely, some wholesale banks have started to aggressively enter the retail segment to optimize their loan portfolios as corporate credit demand may cool down due to macroeconomic risks. This clearly indicates a blending of credit strategies among the banking groups.

Strategic differentiation among banks – A challenge for investors

As banks shift towards a mixed model of retail and wholesale lending, the traditional boundaries between the two groups are becoming blurred. Previously, the differentiation was evident through their distinct loan portfolios: VPBank and VIB excelled in consumer credit, Techcombank focused on real estate credit, and state-owned banks mainly lent to large corporations. However, the intersection of credit strategies has made these characteristics increasingly challenging to distinguish.

This change compels investors to adjust their approach to analyzing the banking industry. Assessing the retail and wholesale models should consider the context of personal consumption and corporate production, along with evaluating banks’ strategy execution and its financial impacts through financial indicators. For instance, banks focusing on corporate lending typically have lower net interest margins (NIMs) due to lower interest rates, but they also tend to have lower non-performing loan ratios and more stable return on equity (ROE). This shift will directly impact how investors perceive stock valuations, such as P/B and P/E ratios, for different banking groups.

|

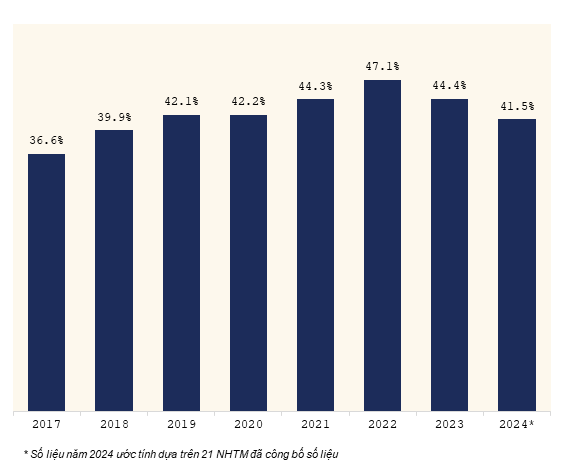

Chart 2: P/B Ratios of Banking Groups over the Years

Source: Consolidated

|

The strong credit growth phase in 2016-2017 provided momentum for higher bank valuations. During the pandemic, retail banks were positively assessed for their ability to maintain credit growth. However, in the past two years (2023-2024), the strategic intersection between banking groups has led to a convergence in their valuations, as described in the chart. As both groups rely on corporate lending as the primary growth driver to maintain overall credit growth, their valuations have started to show a converging trend.

Meanwhile, state-owned banks have maintained higher valuations due to their financial strength and ability to withstand bad debts, a factor of particular interest to the market in the context of 2023. Additionally, the large-cap stocks of state-owned banks have also demonstrated strong attraction for investment flows. This trend continued into 2024, evident from the stock price movements. Specifically, the wholesale banking group achieved a return of 35% in 2024, outperforming the 21% return of the retail banking group, reflecting a shift in investor expectations regarding the potential of these banks.

As banks increasingly intersect in the credit segment, they must seek new niche markets and adopt innovative growth strategies to maintain their edge. However, the pressure to meet annual credit targets may lead some banks to loosen lending criteria or accept lower profit margins to expand their market share. Particularly, smaller banks with fewer advantages in scale, network, and capital compared to larger banks face more significant challenges in accessing high-quality customers. The most significant risk is that they may focus on high-risk or low-profit margin customer segments, leading to a potential increase in non-performing loans in the coming years. Therefore, closely monitoring financial indicators and strategic lending shifts is necessary to identify early signs of weakness among banks in the highly competitive environment.

While the Vietnamese economy still heavily relies on bank credit, the post-2023 credit shift has triggered a wave of strategic changes in the industry. The fierce competitive landscape and the opportunities in the banking sector today compel investors to adjust their approach to stock analysis. As the boundaries between retail and wholesale banks become blurred, a thorough understanding of each bank’s financial structure and growth strategy will be crucial for investors to seize opportunities and effectively manage risks.

Lê Hoài Ân, CFA – Nguyễn Thị Ngọc An, HUB

– 08:00 28/03/2025

What are the banking industry outlook and risks in 2024?

In the context of the Vietnamese economy going through a period of hardship, external and internal challenges, according to the experts’ assessment, banking is still considered an industry with low risk and good prospects. VnEconomy had an interview with Mr. Nguyen Anh Quan, Head of Credit Rating Department for Financial Institutions, FiinRatings …