Using the credit growth policy has helped the State Bank of Vietnam achieve certain goals in monetary policy, contributing to macroeconomic stability. Photo: N.K |

The Credit Institutions (Amendment) Act was passed by the National Assembly on January 18, 2024, with a approval rate of 91.28%. It includes many provisions to prevent cross-ownership, manipulation, and control of credit institutions (CIs) – an issue that has been prominent lately and is even more alarming after the incident relating to Sai Gon Commercial Joint Stock Bank (SCB).

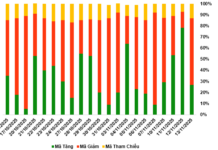

Specifically, Article 63 on the ownership ratio regulates the reduction in the ownership ratio, with the aim of increasing the number of shareholders, enhancing public participation, and diversifying the ownership structure of CIs. Accordingly, an individual shareholder must not own more than 5% of the charter capital of a CI; an institutional shareholder must not own more than 10% of the charter capital of a CI. At the same time, a shareholder and persons related to that shareholder must not own more than 15% of the charter capital of the CI. Large shareholders in one CI and persons related to that shareholder must not own shares from 5% of the charter capital of another CI.

In addition, the law supplements provisions on information supply and public disclosure in Article 49: shareholders owning from 1% of the charter capital or more of a CI must provide information and CIs must publicly disclose information about these shareholders to ensure transparency.

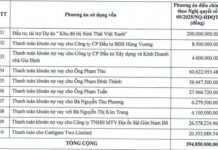

To limit the concentration of credit to a customer and large groups of customers, and prevent “backdoor lending”, the law adjusts the limit on credit granted to a customer and related persons with specific timeframes in Article 136. Accordingly, the total credit granted to a customer, a customer and related persons of that customer, by a commercial bank, a cooperative bank, a foreign bank branch, a people’s credit fund, a microfinance institution must not exceed the following ratios: From the effective date of this law (July 1, 2024) to before January 1, 2026 is 14% of the CI’s equity for a customer; 23% of the CI’s equity for a customer and related persons of that customer. In 2026, these ratios are 13% and 21%; in 2027, 12% and 19%; in 2028, 11% and 17%; from 2029 onwards, 10% and 15%.

Along with that, the law expands the scope of those who are not allowed to hold positions or hold positions simultaneously. Article 43 stipulates that independent members of the board of directors of CIs must not simultaneously hold one of the following positions: (1) The executive of that CI; (2) The manager, executive of another CI, manager of more than two other enterprises; (3) Member of the supervisory board of another CI, other enterprise.

Correspondingly, Article 41 on the standards and requirements for managers, executives stipulates that independent members must not directly or indirectly own 1% or more of the charter capital or voting shares of that CI, instead of 5% as previously drafted. This is to ensure the independence of independent members and limit cases of manipulation and control when adjusting the provision on not holding positions for independent members.

Previously, during discussions in the National Assembly, delegates were concerned that the above tools do not address the core issue of cross-ownership, domination, and manipulation of CIs. In other words, “taking the visible to control the invisible” in this way is not highly effective.

According to delegate Vo Manh Son (Thanh Hoa), the goal of enhancing the safety of the banking system is necessary but reducing the maximum ownership ratio is not a suitable solution at this time. “The maximum ownership ratios of 5%, 15%, and 20% in Vietnam are relatively low compared to many countries in the world. However, the concentration of credit to related groups still occurs regularly, increasing the risks to the system. Therefore, the provisions on the maximum ownership ratio have not really had the desired effect, as shareholders who do not fall into the definition of related persons according to the law still have close connections with each other to easily agree on concentrated credit”, Son said.

Similarly, delegate Doan Thi Le An (Cao Bang) believes that adjusting the ownership ratio does not have much significance in limiting cross-ownership but only controls it on paper. “Controlling the ratio is not as important as monitoring the enforcement of regulations, not to mention the creation of barriers to prevent foreign capital from flowing into the domestic banking system…”

According to An, the recent violations have shown that the true ownership ratio of these entities is much higher than the regulation through affiliated companies, associate companies, or individuals in name. “Amending the law to suit reality is very necessary, but controlling the ownership ratio at banks is not enough to prevent a recurrence of similar incidents as at SCB. Because cross-ownership or manipulation of banks is inherently very complex, if we look at the paperwork, many shareholders have lower ownership ratios than allowed, but they still have dominant control.”

In fact, the concern of the National Assembly delegates is justified. The Standing Committee of the National Assembly also recognizes that to ensure the effectiveness of law enforcement, in addition to specific provisions in the law, the Government needs to direct the strengthening of inspection and supervision work, close coordination between agencies. It includes strengthening the exchange and coordination of management among ministries and sectors to timely detect intentional acts of “bypassing” regulations on stock ownership or related persons, or determining the relationships between major shareholders of CIs and “backdoor” enterprises. At the same time, it directs the completion of the national database on the population, the information system of the enterprise registration database to make information on individuals, enterprises related to banking activities transparent. The Standing Committee of the National Assembly also affirmed that it will direct the relevant agencies to continue improving and enhancing regulations to prevent risks and approach international practices.

An Nhiên