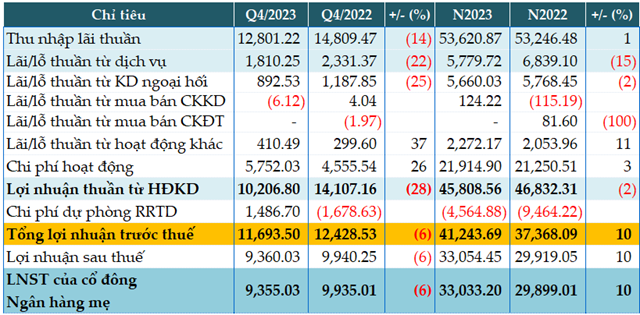

Specifically for the fourth quarter, most of Vietcombank’s business activities declined compared to the same period last year. The main source of income decreased by 14% with net interest income of only 12,801 billion VND.

All non-credit sources of income declined, such as service income (-22%), forex trading income (-25%), and securities trading activities reported losses while they were profitable in the same period.

In addition, operating expenses in the quarter increased by 26% to 5,752 billion VND. Although the Bank recovered nearly 1,487 billion VND of credit risk provisions in this quarter while it allocated nearly 1,679 billion VND in the same period last year, pre-tax profit still decreased by 6% to only 11,693 billion VND.

In the whole year of 2023, net interest income remained at 53,620 billion VND while all non-interest income sources decreased.

The only highlight came from other operating income, which increased by 11% to 2,272 billion VND thanks to an extraordinary income of 1,649 billion VND from interest rate swaps.

Thanks to a 52% decrease in credit risk provisions, to only 4,564 billion VND, Vietcombank reported a pre-tax profit growth of 10% compared to the previous year, reaching 41,243 billion VND.

Therefore, the “big brother” in the banking system only achieved 96% of the set target of 43,000 billion VND pre-tax profit for the whole year of 2023.

|

Business results for the fourth quarter and the whole year of 2023 of VCB. Unit: Billion VND

Source: VietstockFinance

|

As of the end of 2023, the Bank’s total assets increased slightly by 1% compared to the beginning of the year to nearly 1.84 quadrillion VND. In which, cash in vault decreased by 20% (to 14,504 billion VND), deposits at the State Bank decreased by 37% (to 57,104 billion VND), and loans to customers increased by 11% (to 1.27 quadrillion VND).

In terms of capital sources, Government and State Bank debts decreased by 97% (to only 1,679 billion VND), debts to other credit institutions increased by 90% (to 19,875 billion VND), and customer deposits increased by 12% (to nearly 1.4 quadrillion VND).

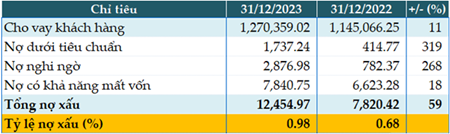

The quality of Vietcombank’s loans is also not optimistic as bad debts increased by 59% compared to the beginning of the year to 12,454 billion VND as of December 31, 2023. Among them, substandard and doubtful debts increased significantly. As a result, the ratio of bad debts to total loans increased from 0.68% at the beginning of the year to 0.98%.

|

Loan quality of VCB as of December 31, 2023. Unit: Billion VND

Source: VietstockFinance

|