Hoa Binh Construction Corporation (HBC stock code) has recently announced that the Ho Chi Minh City Stock Exchange (HoSE) has warned that the company’s HBC shares may be delisted if it fails to submit the 2023 audited Financial Statements (FS) on time.

According to the announcement, HBC stated that this is just a reminder from HoSE that the company needs to submit the 2023 audited FS on time. “We affirm that HBC will strictly comply with regulations, not allowing the risk of HBC shares being delisted. Currently, the corporation is making efforts to complete the 2023 audited FS ahead of schedule. HBC has implemented measures to overcome the delay in completing the audited FS and is committed to ensuring the deadline for submitting the 2023 audited FS” – stated HBC.

Earlier, on February 2, 2024, HoSE sent a reminder letter to HBC stating that if the listed organization fails to submit the audited FS for 3 consecutive years, it will be delisted. The shares are currently under control for violating the late submission of audited financial reports for 2 consecutive years.

Based on Clause 1 Article 120 of Decree No. 155/2020/ND-CP dated December 31, 2020 of the Government detailing the implementation of certain provisions of the Securities Law dated November 26, 2019: ““Shares of a public company shall be delisted when one of the following cases occurs: i) The listed organization violates the late submission of audited financial reports for 3 consecutive years“.

In a related development, on January 19, 2024, HBC shares were removed from the restricted trading list by HoSE and officially resumed normal trading. The HBC stock price is currently at 8,900 VND/share, up 13% since the beginning of 2024. The market capitalization is equivalent to more than 2,400 billion VND.

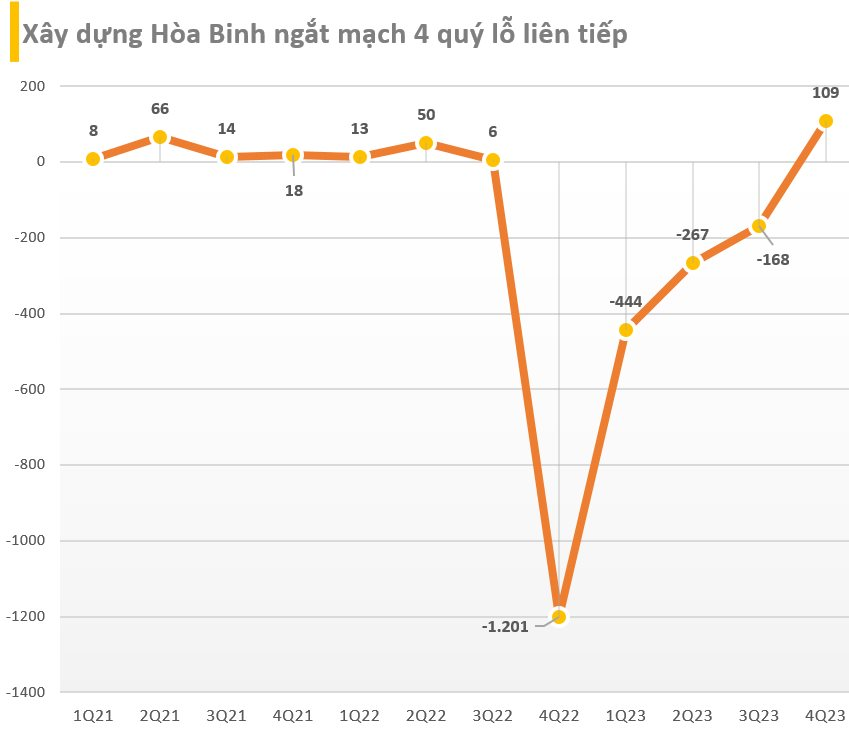

In terms of business results, according to the separate consolidated FS for Q4/2023, HBC recorded revenue of 2,190 billion VND, a 32% decrease compared to the same period last year. Thanks to a significant decrease in cost of goods sold, a strong increase in financial revenue, and the reversal of provisions, the post-tax profit attributable to the parent company’s shareholders reached nearly 103 billion VND, while in the same period last year, there was a loss of more than 1,200 billion VND.

Accumulated throughout 2023, HBC recorded net revenue of 7,546 billion VND, nearly half of 2022. However, the company incurred a loss of 777 billion VND for the whole year, compared to a loss of nearly 2,600 billion VND in the previous year. The accumulated loss as of the end of 2023 reached nearly 2,900 billion VND, with the equity remaining at only 453 billion VND.