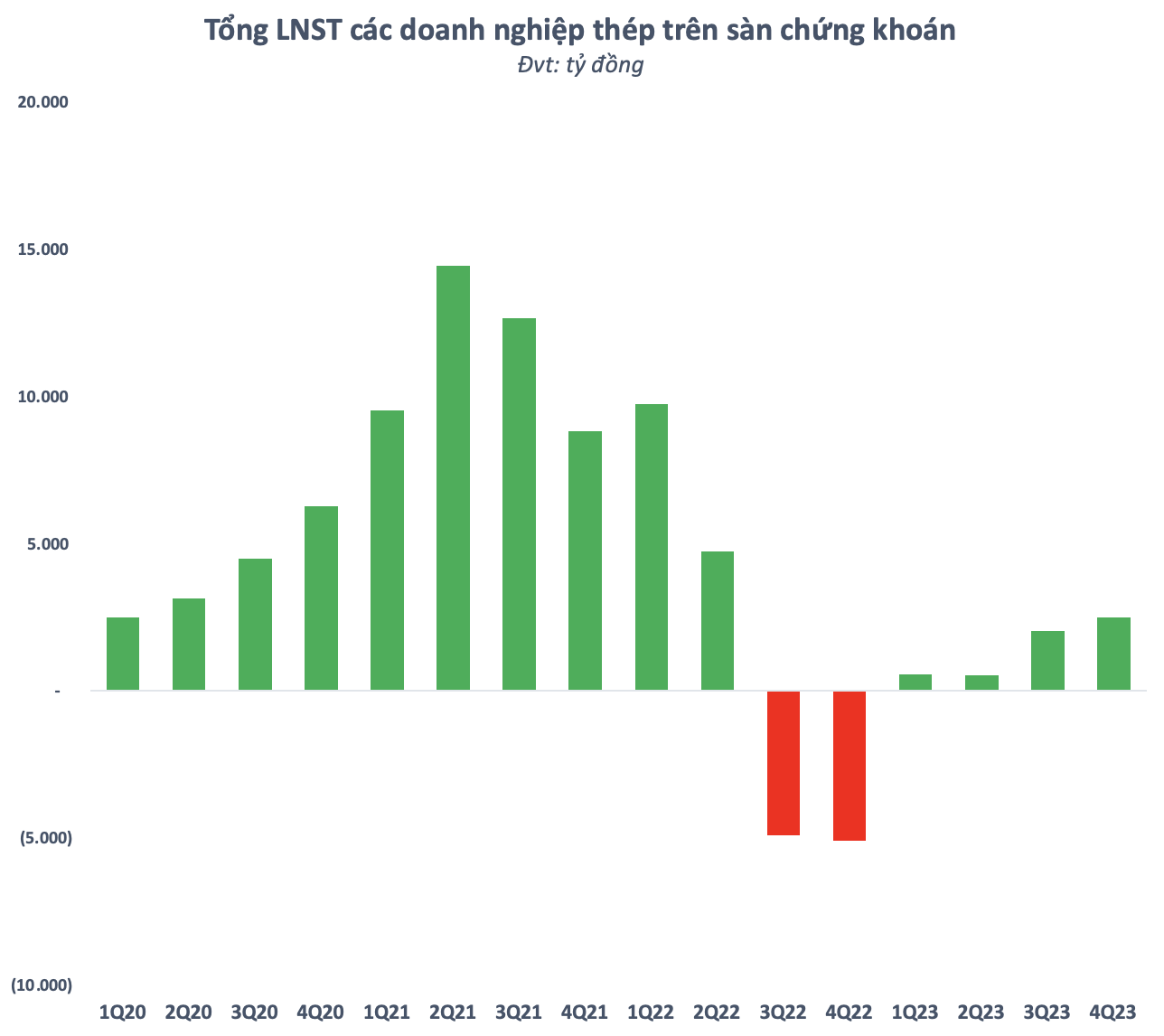

After a difficult period, the steel industry is seeing optimistic signs recently. The total profit of steel companies listed on the stock exchange has grown for the second consecutive quarter compared to the previous quarter. According to estimates in the fourth quarter of 2023, the total profit of the steel industry reached about 2,500 billion dong, an increase of 22% compared to the previous quarter and much more positive than the loss of over 5,000 billion in the same period in 2022. This is also the highest level in the past 6 quarters.

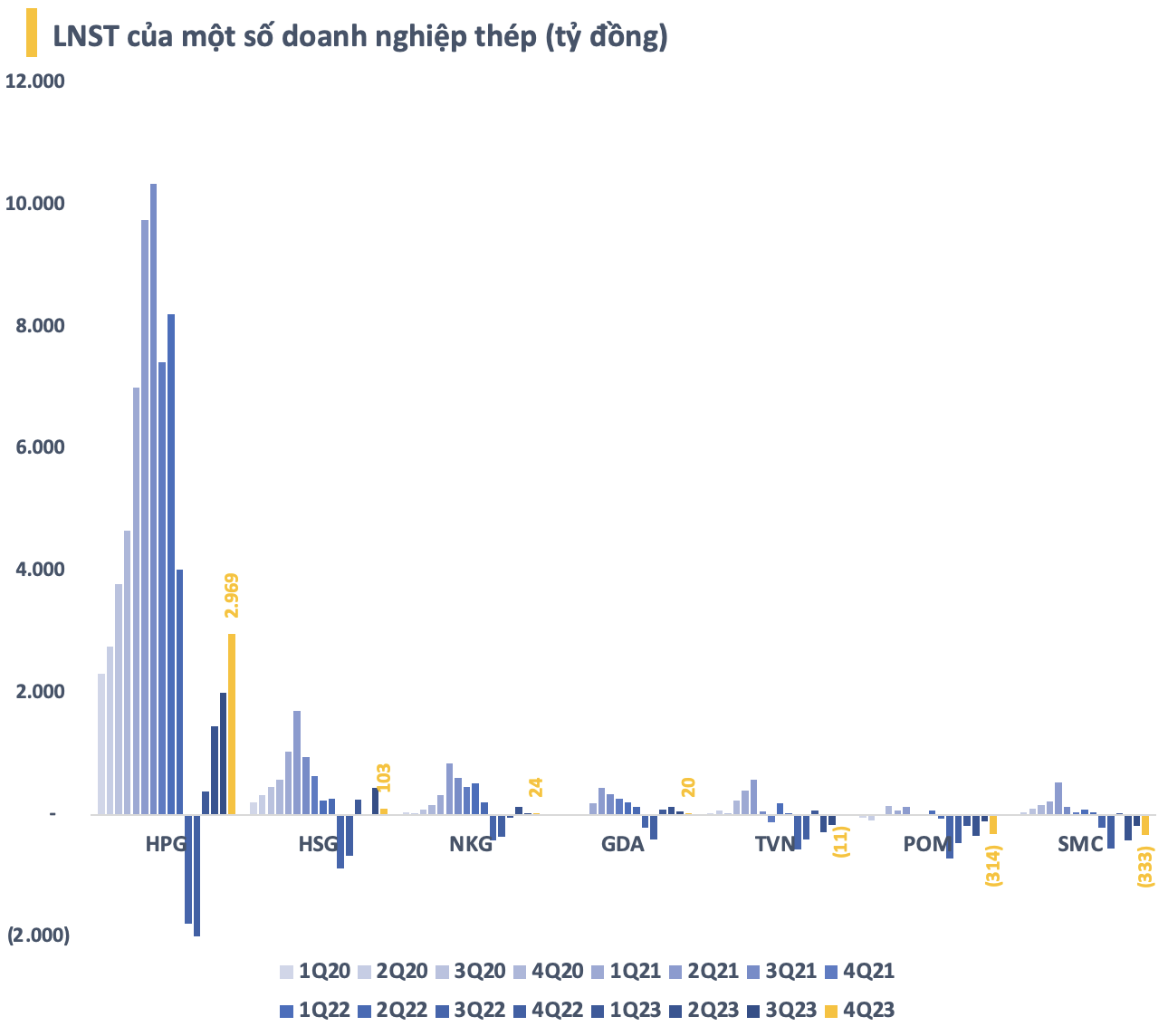

Compared to the same period in 2022, most steel companies have recorded a strong recovery in profits, especially Hoa Phat (HPG) with a net profit of nearly 5,000 billion. Many other companies have also made hundreds of billions of profit recovery compared to the fourth quarter of 2022, such as Hoa Sen (HSG), Nam Kim (NKG), VNSteel (TVN), Ton Dong A (GDA),…

However, compared to the third quarter of 2023, most steel companies have slowed down their recovery. Hoa Sen recorded a sharp decline in profits in the fourth quarter of 2023 (the first quarter of the 2023-2024 financial year) compared to the previous quarter. Pomina (POM) and SMC even reported heavy losses, both over 300 billion dong. VNSteel reduced its losses significantly but has not been able to return to positive profits.

In that context, Hoa Phat stands out when this leading steel company’s net profit in the fourth quarter of 2023 reached nearly 3,000 billion dong, an increase of 48% compared to the previous quarter and the highest level in the past 6 quarters. Therefore, it is not unreasonable to say that Hoa Phat accounted for the entire steel industry’s profits in the fourth quarter of 2023.

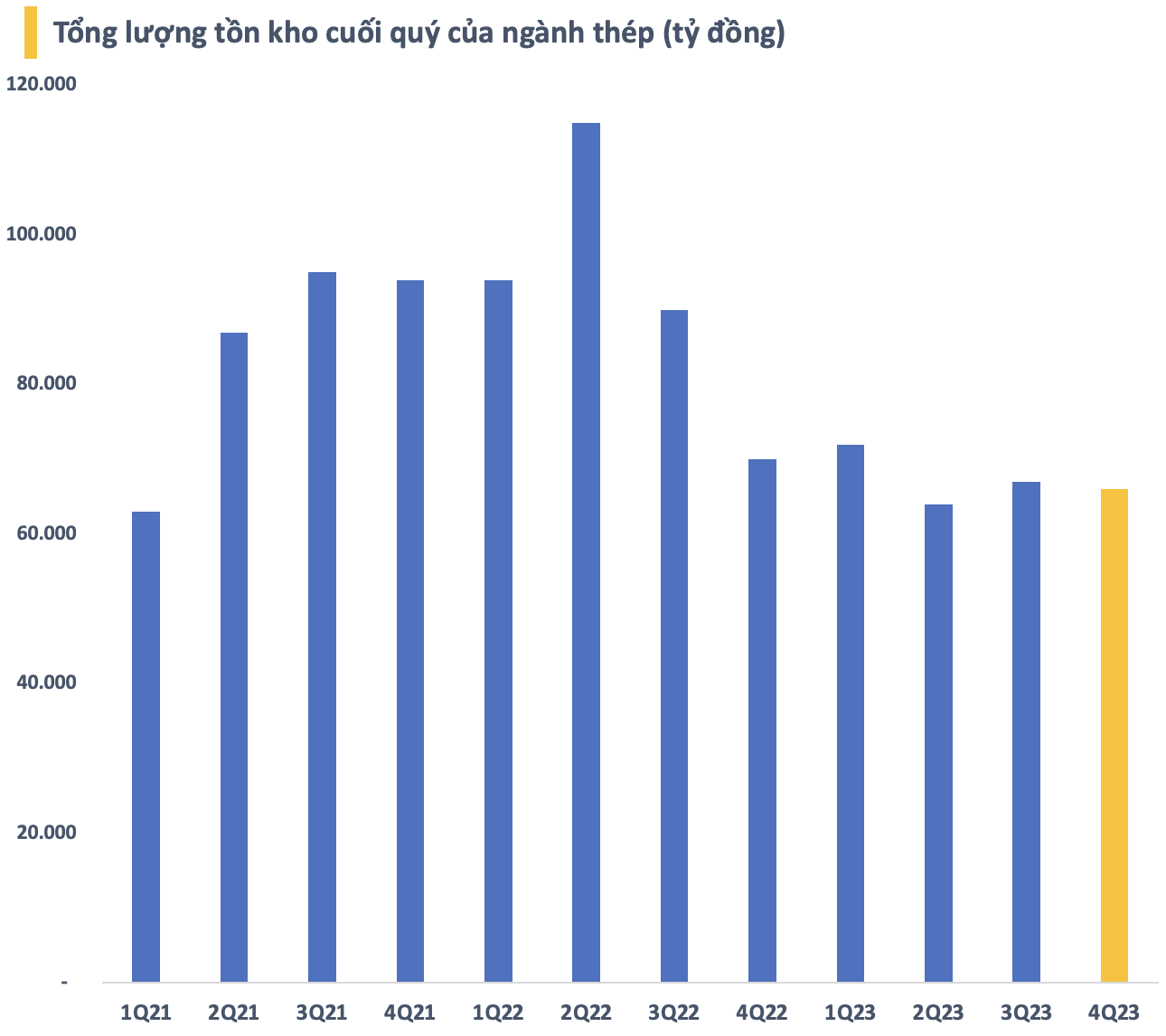

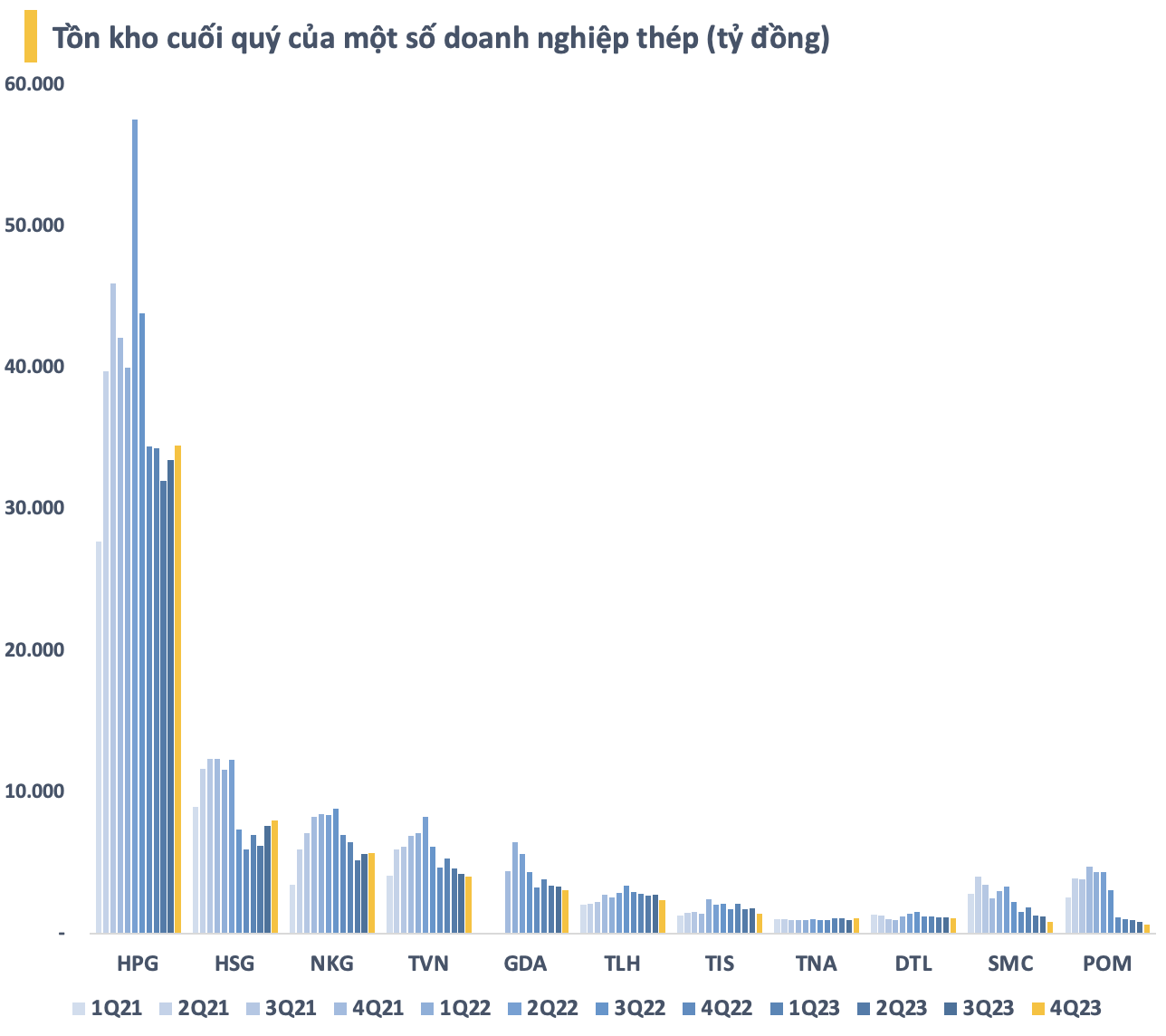

Low inventory

The slow recovery rate is seen in the context where many steel companies are still cautious in maintaining low inventories despite the somewhat positive price trend compared to the previous quarter. According to statistics, the total value of steel industry inventories by the end of 2023 was about 66,000 billion dong (including provisions for price reductions), slightly lower than the previous quarter.

Thus, steel companies have maintained inventory values around 65,000-70,000 billion dong for 5 consecutive quarters, much lower than the previous period. In particular, this figure has decreased by about 50,000 billion compared to the peak period in mid-2022.

Hoa Phat, Hoa Sen, and Nam Kim continue to increase their inventories, although the increase is not significant. Hoa Phat, the “oldest brother,” had the highest inventory increase in the fourth quarter of 2023, but the value has not reached billions of dong. On the contrary, most of the following top companies have seen a significant decrease in inventories compared to the previous quarter.

VNSteel, Ton Dong A, Pomina, SMC, Thép Tiến Lên (TLH), Tisco (TIS) all have inventories that have decreased by hundreds of billions. SMC is the company with the sharpest decline in inventory value, with a value of over 400 billion (~22%) compared to the previous quarter. This is the first time this company has reduced inventory value to below one billion dong in many years.

Strong recovery in demand and expected prices

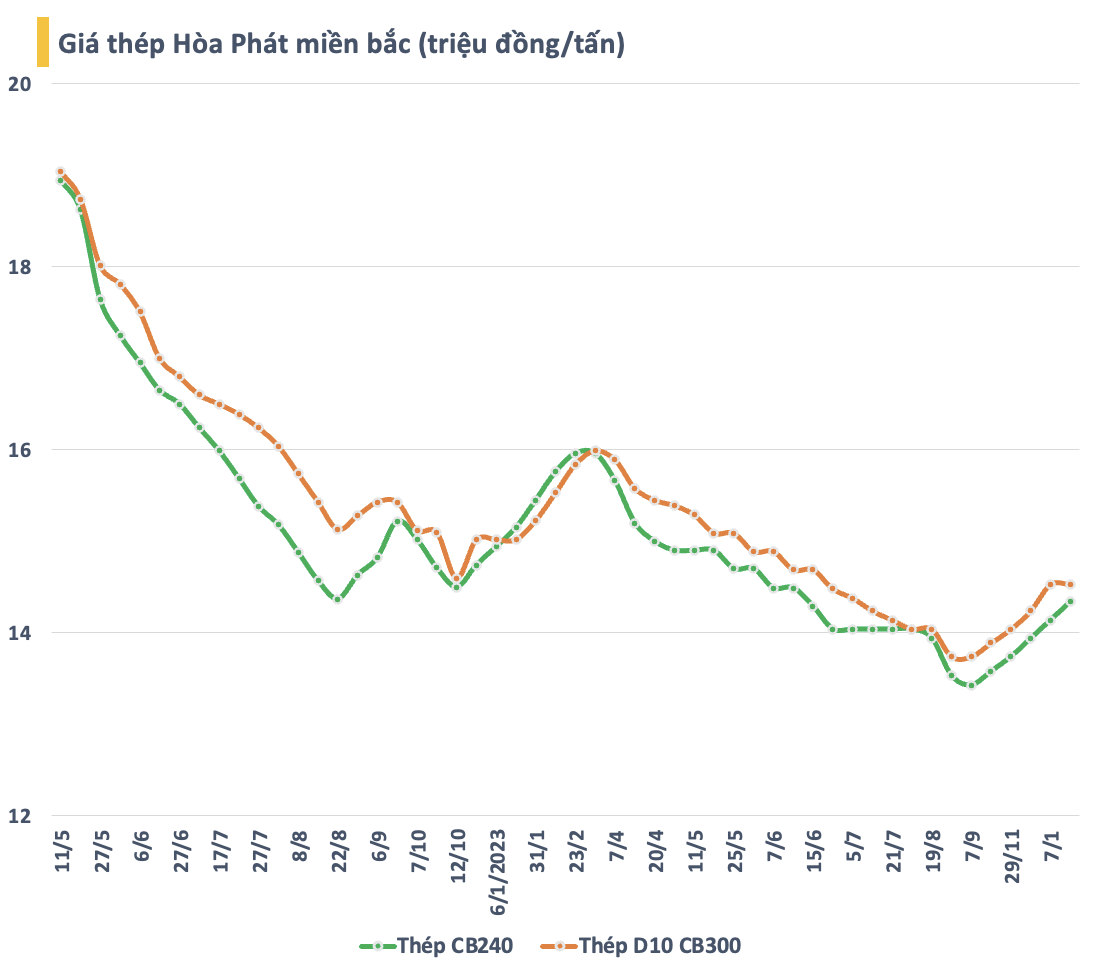

Steel companies maintain low inventories while steel prices have shown signs of turning around at the end of last year. In the Chinese market, rebar prices at one point increased by about 10% and nearly touched 4,000 CNY/ton by the end of last year. Although it has declined recently, the overall steel price level is still relatively higher than last year. In the domestic market, construction steel prices also show signs of recovery after hitting bottom in September.

In a recent report, MBS Securities assesses that global steel supply and demand is forecasted to recover in 2024, specifically steel supply is expected to decrease by 1% compared to the same period in the context of China cut production, and Turkey has not recovered. Meanwhile, world demand according to WSA’s latest forecast will increase by 1.9% with the main driver coming from construction demand in the EU and India, which is also expected to have a positive impact on global steel prices in 2024.

Domestically, the anticipated supply shortage is expected to improve from 2024, which will have a positive impact on domestic construction steel consumption. Furthermore, the Government has issued several measures to support the real estate market. MBS expects positive factors from global steel prices and the real estate market to recover from mid-2024, boosting domestic steel prices. Therefore, the construction steel price is expected to recover to 15 million dong/ton, an increase of 8% in 2024.

MBS also believes that the recovery in demand from the EU is a major positive factor, making the export steel market a bright spot. Steel export volume is expected to reach 10.5 million tons (an increase of 25%) in 2023 and 11.2 million tons (an increase of 7%) in 2024. In addition, the export price of HRC is expected to reach 800 USD/ton (+8%) in 2024.

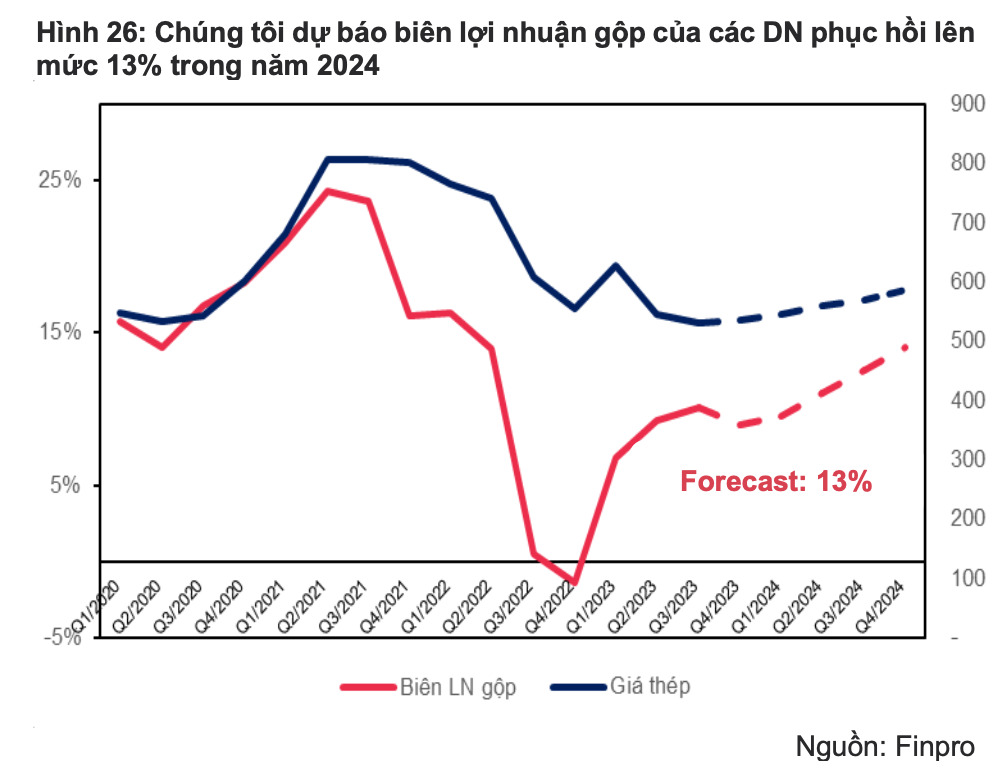

According to MBS’s forecast, the gross profit margin of steel companies will improve from an average of 8% in 2023 to 13% in 2024. Steel prices are expected to recover by about 8%, and raw material prices to decrease slightly by 6%, providing the basis for the gross profit margin of companies in the industry to recover to double digits in the coming year.

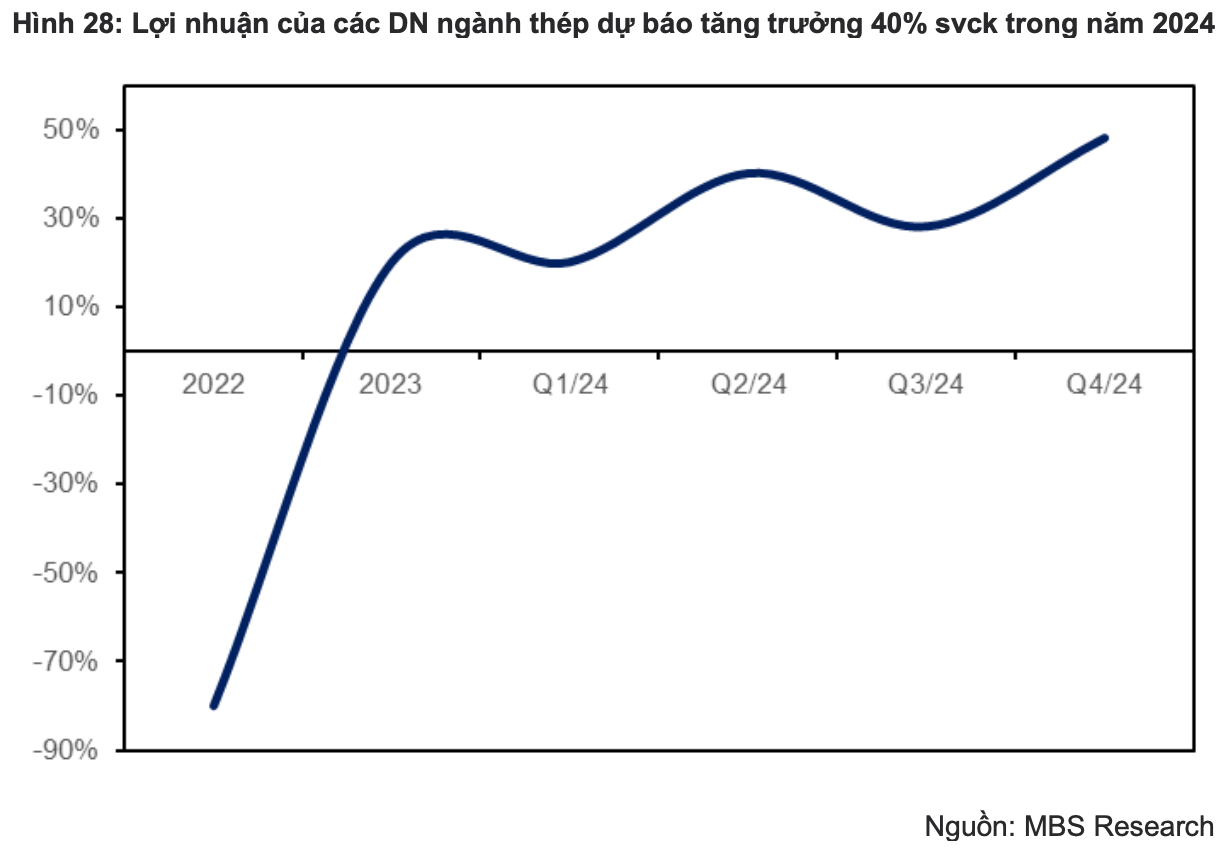

The total profit of steel companies is also projected by MBS to grow by 40% compared to the same period in 2024 due to (1) expected revenue recovery of 25% in the context of growing sales volume and prices; (2) expected gross profit margin to recover to 13% (compared to about 8% in 2023); and (3) financial costs to decrease by 30% due to exchange rate pressure and lower interest expenses.