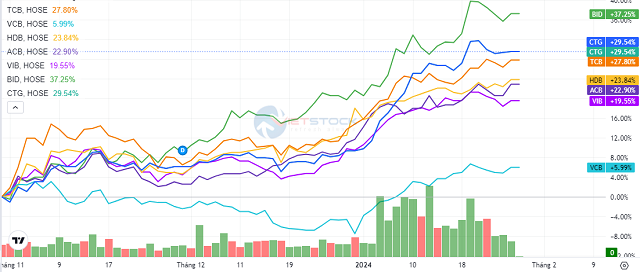

Following a period of consolidation, bank stocks have started to show significant growth since the beginning of the fourth quarter of 2023. Since then, the industry has continued to attract significant attention from investors, as there have been positive signs regarding capital flows. During this period, many stocks such as HDB, MBB, CTG, have exceeded their one-year highs, while other stocks like ACB, BID, VCB, are currently at their highest prices since listing.

Out of the top 10 stocks affecting the VN-Index from November 2023 to January 2024, 6 out of 10 are bank stocks (BID, CTG, TCB, MBB, VCB, ACB).

| Stocks influencing the VN-Index from 01/11/2023-26/01/2024 |

An upward trend has started to form in the short and medium-term for bank stocks. Compared to the beginning of November 2023, when bank stocks started to rally, many stocks have increased by 20% to over 30%.

Among them, BID has attracted a lot of attention with a significant increase of about 40% from its low point at the end of October 2023. As of January 22, 2024, the stock price of BID is at VND 49,800 per share – the highest price since listing – before falling to around VND 48,950 per share (26/01).

Similarly, ACB has also increased 25% in market value since the end of October 2023, bringing the price to VND 26,300 per share (26/01). The stock price of CTG has also increased over 30% since November 2023 and is currently trading around VND 32,100 per share (26/01)…

|

Some bank stocks have increased by 20 – 30% compared to early November 2023

Source: VietstockFinance

|

Mr. Bui Nguyen Khoa – Head of Macro and Stock Market Analysis Group at BIDV (BSC) commented that the increase in bank stock prices has been supported by many factors in recent months.

Due to the low valuation throughout the year, there is a basis for investors to shift their capital into bank stocks compared to other sectors that have already seen increases. Additionally, the information of a 15% credit growth target for 2024 provides further positive outlook. The credit growth target allows banks to be more proactive in lending, providing additional positive information for bank stocks.

Although bank stocks are performing much better than other sectors and driving the index higher, it seems that some retail investors have yet to participate in this group of stocks. An experienced investor – Ms. T.L – shared: “Although the VN-Index has performed well recently, I have observed market differentiation, mainly focusing on the banking sector and not spreading to other sectors. Personally, my investment portfolio has not increased, and some stocks have even decreased while the VN-Index has recovered quite well. It seems that funds are stuck in the Mid Cap group or have limited participation in the banking group. I also worry that if this situation continues, there is likely to be a correction.”

Will the trend continue or fade?

Prof. Nguyen Huu Huan – Lecturer at the University of Economics Ho Chi Minh City (UEH) believes that investors are expecting a recovery in bank profits in 2024. Economic growth will create a wave for bank stocks, but the underlying risk for banks is bad debt.

On the contrary, the business activities of banks depend heavily on the economic and social situation, especially the economic growth rate. If the economy in 2024 is similar to 2023 without any unexpected events, banking activities will be more difficult rather than better, especially regarding bad debts.

However, if the economy recovers quickly, the banking sector will benefit as the non-performing loan ratio decreases and bank profits increase again.

Mr. Phan Dung Khanh – Director of Investment Advisory at Maybank Investment Bank believes that investors have had high expectations for bank growth recently, and disappointing business results will definitely affect investor sentiment.

It should be noted, the recent rise in bank stocks was based on future market expectations, not past results.

“The business results of banks in 2023 were not promising as forecasted, so the specific figures after the financial statements are announced will only partially affect investor sentiment, without many surprises. Of course, this will not have a significant impact on bank stock prices” – Mr. Khanh commented.

Because investors expect a recovery in bank profits this year and next year, when central banks worldwide lower interest rates, economic prospects will improve, and businesses will perform better. When businesses perform well, banks will benefit more.

Mr. Tran Truong Manh Hieu – Head of Strategic Analysis Department at KIS Vietnam Securities predicted that considering the story of 2024, the economy is expected to recover. In that case, businesses will certainly recover, and the financial sector will also grow accordingly.

From January to November 2023, the credit growth rate was very low, resulting in poor profit for the banking sector. A low credit growth rate implies low profit growth.

However, in December 2023, the credit growth rate surged, with the full-year growth rate reaching 13.5%, meaning an increase of 3-4% in just one month. An acceleration of credit growth in the last month of the year is normal, but it was especially significant last year.

“In 2024, the State Bank of Vietnam (SBV) expects credit growth to be 15% for the whole year. This is quite a high figure considering the current conditions. Part of the lingering effect is from the Sacombank – VTP incident. If we disregard this part, other banks will have to grow more to match the SBV’s expectations. This story will provide momentum for bank stocks to rise,” Hieu expected.

In the short term, the Amended Law on Credit Institutions contains some additional provisions to prevent cross-ownership in banks. Therefore, some shareholders will reduce their ownership stakes in banks with large amounts of shares. If they only sell at market-determined prices, it will have a significant impact on bank stock prices.

“It should be noted that bank stocks are not small-cap stocks that can be pushed up by small sums of money but rather large volumes of money from large stocks.

In the short term, bank stock prices have increased by about 20-30% compared to December 2023, so there will surely be a correction soon.