Vinacomin Northern Coal Trading JSC (stock code: TMB) announced its business results for the fourth quarter of 2023 with revenue of VND 8,238 billion, a decrease of nearly 5% compared to the same period last year. However, thanks to the sharp decline in cost of goods sold, which is nearly 6% to VND 7,843 billion, gross profit increased by 17.6% to VND 395 billion.

During the period, the company recorded financial revenue of negative VND 24 billion. Although not clearly explained, this could potentially be due to the exchange rate loss. Financial expenses stood at negative VND 22.5 billion, including negative borrowing costs of VND 63 billion. Other expenses of the company did not have much change.

As a result, TMB achieved a net profit of over VND 145 billion, an increase of 27.2% compared to the same period last year. EPS increased from VND 7,617 to VND 9,677.

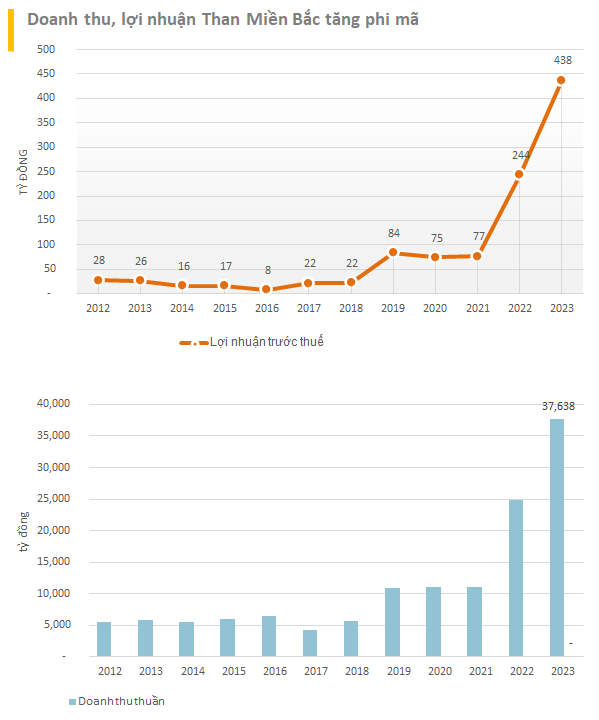

For the full year of 2023, TMB reported revenue of VND 37,113 billion, an increase of nearly 50% compared to the same period last year.

Pre-tax profit increased by an additional VND 200 billion to reach VND 438 billion. This profit level is equivalent to the profits of many giant real estate and infrastructure companies such as Dat Xanh Group (VND 458 billion), CII (VND 428 billion), and Deo Ca Infrastructure Investment JSC (VND 424 billion).

After-tax profit reached VND 343.4 billion, an increase of 76% compared to the same period last year. EPS skyrocketed from VND 12,981 to VND 22,893. This is also a record level of profit for the company since its establishment.

As of December 31, 2023, TMB’s total assets reached VND 3,940 billion, an increase of VND 1,672 billion compared to the beginning of the year. Among them, the largest proportion in the company’s assets (70%) is inventory, which amounts to VND 2,755 billion, an increase of VND 755 billion compared to the beginning of the year. However, the company only has over VND 27 billion in cash.

The company’s capital is mainly funded by loans. Specifically, TMB’s financial borrowing is at VND 2,420 billion. Equity is at VND 734 billion.

Vinacomin Northern Coal Trading JSC was formerly known as the General Coal Management and Distribution Company, established in 1974 with the mission of managing the state’s coal inventory and distributing coal consumption according to the state’s planned targets for the needs of the national economy. The company is currently a member unit of the Vietnam National Coal and Mineral Industries Group (Vinacomin). Its main activity is selling coal in the northern provinces from Ha Tinh and onwards.

In the stock market, after about six months of sideways movement, TMB shares of Vinacomin Northern Coal Trading JSC suddenly experienced a strong upward trend with five consecutive sessions of increasing prices (January 29 – February 2), three of which had the entire range of price increase. Accordingly, TMB’s price increased by nearly 38% from VND 43,300 per share to VND 59,800 per share. This is the new peak price of TMB since its listing on the Hanoi Stock Exchange in mid-January 2017. Looking further, the stock has increased by 130% in the past six months.