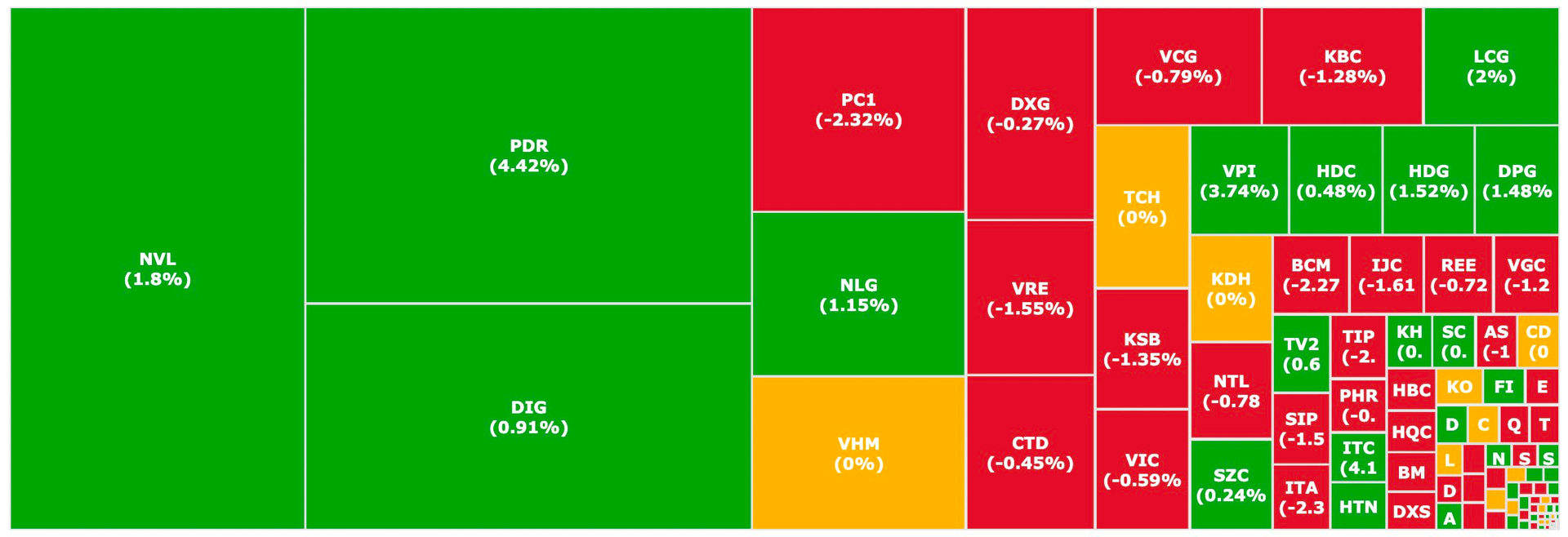

In recent sessions, money has started to flow back to the real estate stock group. As a convergence place for large-scale enterprises, high capitalization, but the real estate group has been “abandoned” in the past year due to a series of difficulties. New policies, especially the Land Law (amended) and the Credit Institutions Law (amended), were passed at the beginning of 2024.

Accordingly, with the majority of votes, the 5th extraordinary session of the 15th National Assembly passed the Land Law (amended), the Credit Institutions Law (amended), and closed the session. The Land Law 2024 with many new contents will take effect from January 1, 2025, except for Article 190 and Article 248, which will take effect from April 1, 2024, and Article 60, Clause 9, which will take effect from the date of Resolution No. 61/2022/QH15. The Credit Institutions Law (amended) will take effect from July 1, 2024, except for Clause 3 of Article 200 and Clause 15 of Article 210, which will take effect from January 1, 2025.

Especially, with the efforts of enterprises to reduce debt pressure and boost business growth, the motivation to bring back the “four pillars” group of the stock market (banks – real estate – steel – securities) is gradually returning to the game.

Recording the last session of the weekend (2/2/2024) despite the fluctuating general market, the real estate group continued to show a clear upward trend. In particular, PDR of Phat Dat was remarkable as it hit limit up early, although it cooled down afterwards, NLG of Nam Long also strong after business growth news, NVL, DIG… also performed well, liquidity improved.

Bright business picture, most are profitable

Up to now, most listed real estate companies have announced their business results for 2023 with a fairly bright overall picture. Strong growth should be mentioned that Urban Development of Tu Liem (Lideco, NTL) earned more than VND 914 billion in net revenue, up 134% and after-tax profit reached VND 367 billion, up 244% compared to 2022.

There are also impressive profits such as Vinhomes (VHM): consolidated net revenue in 2023 reached VND 103,300 billion, up 66%, and consolidated after-tax profit reached VND 33,300 billion – up 14% compared to the previous year.

Or Novaland (NVL) unexpectedly recorded VND 1,600 billion in profit in the fourth quarter of 2023. Thanks to this, the company achieved a net profit of VND 805 billion for the whole year – a 63% decrease compared to the previous year. The company had a loss of more than VND 1,000 billion in the first half of the year.

Phat Dat Real Estate Development (PDR) has also announced its 2023 financial statements with after-tax profit of VND 682 billion – exceeding the assigned General Meeting of Shareholders plan although it decreased compared to 2022. Similarly, BCG Land (BCR) earned VND 140 billion in after-tax profit, Cen Land also returned to profit with over VND 1 billion, Saigonreal (SGR) earned over VND 105 billion after tax…

Efforts to eliminate bond debt

Another positive point in this year’s financial statements season is the debt balance, especially bond debt, which is being actively reduced.

At An Gia Real Estate Investment and Development Corporation (AGG), the total bond debt of the Company as of the current time is only about VND 300 billion. The Company expects to settle all by the first half of this year, bringing the debt to 0. The source of funds for payment comes from the collection of money according to the progress for the products sold in the Westgate Project (Binh Chanh).

AGG started mobilizing from the bond channel in 2020, most of which were secured by assets and the mobilized capital was used to invest in some real estate projects or M&A land funds. In the period 2020 – 2023, the Company bought back ahead or on time a total of over VND 2,000 billion of bonds.

Prior to that, Phat Dat in the last month of 2023 spent nearly VND 459 billion to repurchase the remaining value of 2 bond lots with a face value of VND 800 billion, officially bringing bond debt to 0. Accordingly, Phat Dat spent over VND 2,200 billion in the past year, of which nearly VND 1,000 billion was bought back ahead of time, in 7 bond lots with a total face value of VND 2,225 billion.

In addition to Phat Dat, as of December 2023, real estate businesses such as Dien Phat Land, Vinh An Dien, Hoa Kim Anh, Minh Khang Dien, City Garden, Hong Lim Land, Downtown, Nam Bay Bay, CEO, Ha Do Group, etc. have invested from VND 157 billion to VND 770 billion to buy back bonds ahead of time, while canceling all bond debts.

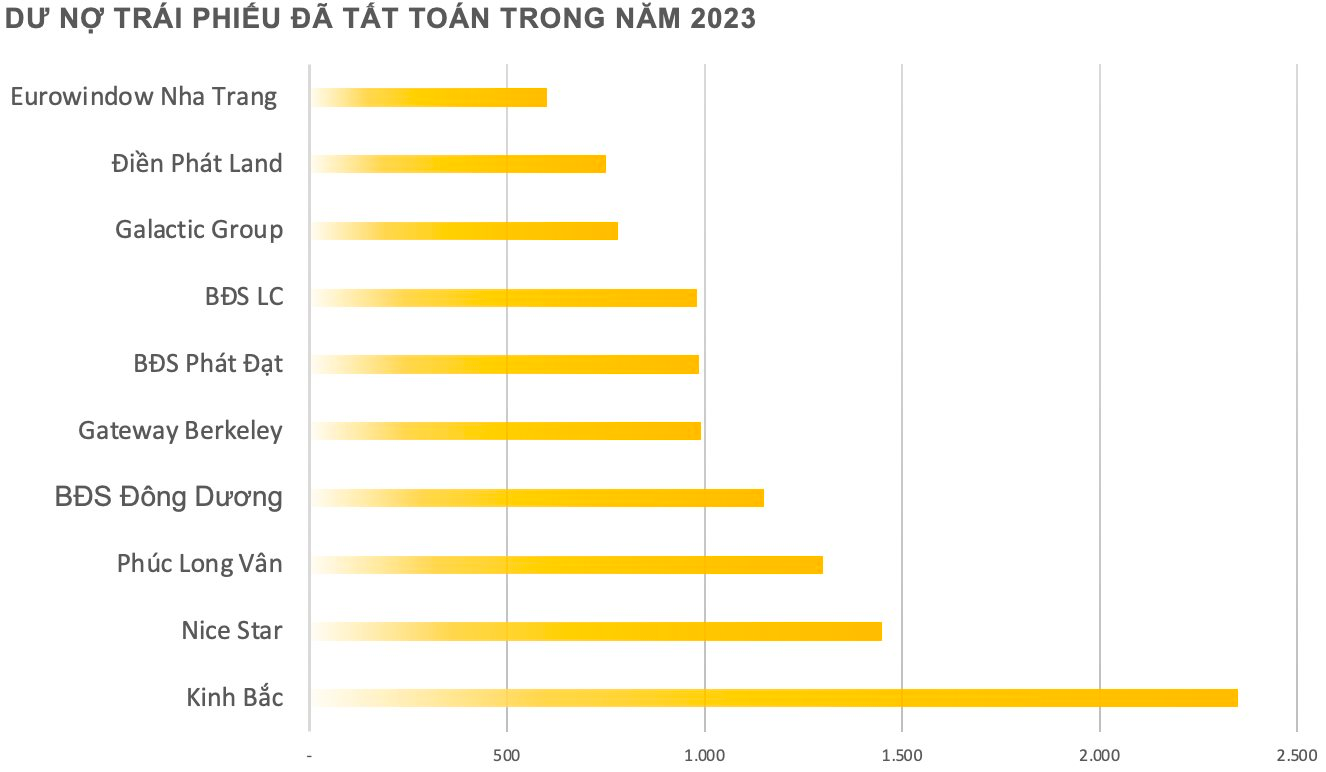

Statistics from the Hanoi Stock Exchange (HNX) also show that in 2023, 35 real estate enterprises completely cleared bond debts, mainly repurchasing ahead of time, with a total payment to bondholders of over VND 20,000 billion.

However, the pressure is still significant. The latest report from FiinGroup on the bond market shows that the total value of bond payments (including principal and interest) due throughout 2024 is at a high level, reaching VND 376,500 billion. Bonds of non-bank issuing entities due amount to VND 282,000 billion, of which real estate bonds have the highest value, reaching VND 154,800 billion (bond face value is VND 122,200 billion and bond interest expense is expected to be VND 32,600 billion).

In addition, the report by FiinGroup also points out a significantly higher ratio of real estate bond default, at 22.67% as of mid-November 2023, of the total VND 422,000 billion of real estate bonds in circulation (including both separate and public bonds).