The market liquidity increased compared to the previous trading session, with the trading volume of VN-Index reaching nearly 771 million shares, equivalent to a value of over 16 thousand billion VND; HNX-Index reached nearly 64 million shares, equivalent to a value of nearly 1.2 thousand billion VND.

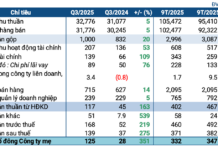

VN-Index opened the afternoon session with a pessimistic atmosphere as selling pressure emerged from the beginning, pulling the index down to the lowest level of the day. Then, buying pressure unexpectedly appeared, pushing the index to recover and close above the reference level. In terms of influence, HPG (1.8%), NVL (5.49%), and ACB (1.35%) are the most positive stocks affecting VN-Index with an increase of more than 1.5 points. On the contrary, VCB, GVR, and GAS are the stocks with the most negative impact on the index.

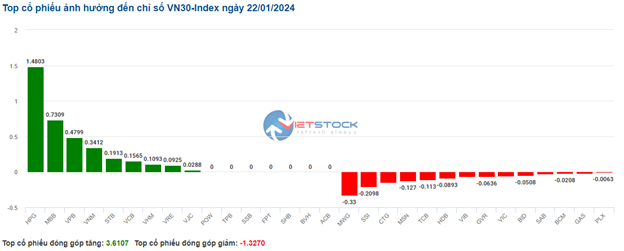

|

Top stocks impacting VN-Index on January 22nd In terms of points |

HNX-Index also had a similar trend, in which the index was positively affected by stocks such as NDN (4.81%), MBS (2.99%), SLS (2.68%), TNG (2.06%),…

|

Source: VietstockFinance

|

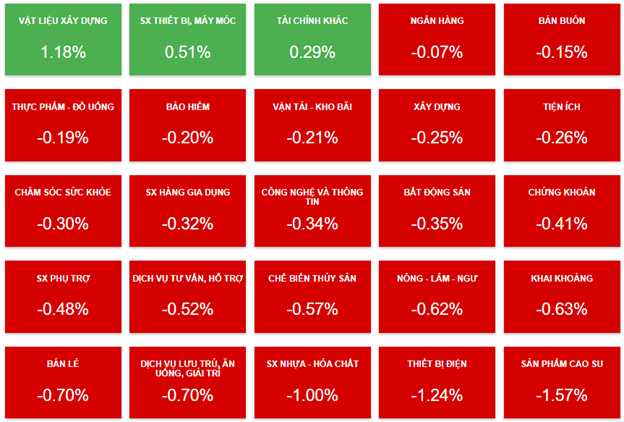

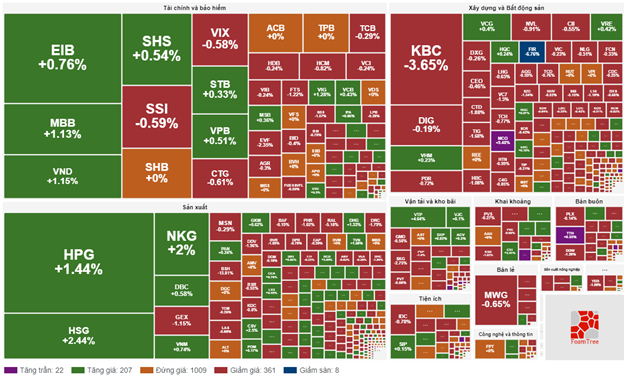

The construction material industry is the most robust sector, with a 1.62% growth mainly driven by stocks like HPG (+1.8%) and HSG (+2.44%). Following is the securities and manufacturing sector with growth rates of 0.99% and 0.79% respectively. On the contrary, the rubber product industry experienced the sharpest decline in the market with -0.62%, mainly due to stocks like DRC (-0.71%), CSM (-0.83%), and BRC (-1.93%).

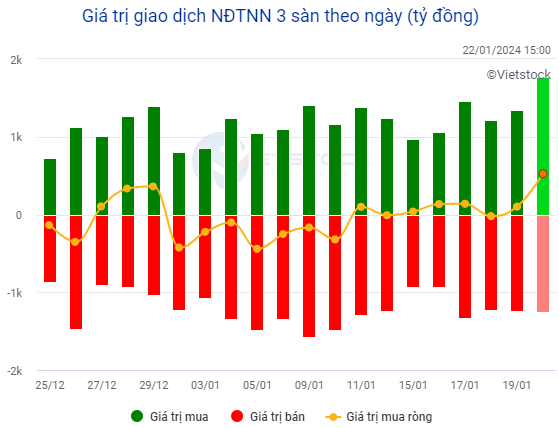

In terms of foreign trading, this group continued to net buy over 475 billion VND on HOSE, focusing on stocks like PC1 (138.5 billion), CTG (66.34 billion), VCG (61.75 billion), and HPG (56.94 billion). On HNX, foreigners net sold more than 7.5 billion VND, focusing on stocks like PVS (6.61 billion), SHS (5.23 billion), and EID (2.25 billion).

Source: Vietstock Finance

|

Morning session: VN-Index returns to a declining trend

At the end of the morning session, the green color no longer maintained, leading to a reversal of the declining trend of the main indexes. VN-Index decreased by 2.22 points, to the level of 1,179.28 points; HNX-Index decreased by 0.81 points, to 228.67 points. The number of temporary declining stocks dominated with 218 gainers and 398 losers.

The trading volume of VN-Index recorded nearly 364 million units in the morning session, with a value of nearly 7.6 thousand billion VND. HNX-Index recorded a trading volume of over 34 million units, with a trading value of over 621 billion VND.

At the end of the morning session, stocks like CTG, BID, and GVR had the most negative impact, taking away over 1.2 points from the index. On the contrary, stocks like VCB, HPG, and MBB had the most positive impact by adding more than 1.2 points to the index.

The construction material industry contributed the most positive growth to the index at the end of the morning session. In particular, steel stocks recorded a good increase, with HPG up 1.26%, HSG up 2%, and NKG up 1.8%.

Foreign investors continued their net buying streak in the morning session. This somewhat contributed to the recent growth of VN-Index. Among them, HPG was the most strongly net-bought stock, with outstanding proportions compared to other stocks below like STB, VCB, VCG, HDB, MWG,…

Stock group performance at the end of the morning session on January 22nd. Source: VietstockFinance

|

Most industry groups are immersed in the red color, including the banking and securities sectors, which are affected even though they started strong in the early session. Even some sectors like retail, plastic-chemical, electrical equipment, and rubber experienced even more negative declines.

At the end of the morning session, the red color temporarily dominated when looking at the overall industry. Among them, the construction material industry was the most shining sector with a growth rate of 1.18%. Conversely, the rubber product industry was the most negative sector, with a decrease of 1.57%.

10:30 am: Tug of war around the reference level

The market has a relatively balanced buying and selling force, so the main indexes have not been able to break out. As of 10:30, VN-Index decreased by more than 1 point, trading around 1,180 points. HNX-Index decreased by 0.30 points, trading around 229 points.

The stocks in the VN30 basket have fluctuated, but selling pressure has somewhat dominated. Specifically, MWG, SSI, FPT, and CTG took away 0.33 points, 0.21 points, 0.14 points, and 0.13 points from the general index, respectively. On the contrary, HPG, MBB, VCB, and SSB are being strongly purchased and contribute more than 2 points to the VN30-Index.

Source: VietstockFinance

|

The retail and real estate groups are facing strong selling pressure, with large-cap stocks like MWG down 1.41%, PNJ down 0.45%, FRT down 0.1%, VHM down 0.12%, BCM down 0.65%, VRE down 0.42%, and NVL down 1.22%.

On the contrary, the construction material industry is the rare group that is leading the market with a positive contribution from 3 major steel industry stocks: HPG up 1.8%, HSG up 2.44%, and NKG up 2%.

The banking sector is also showing impressive growth in the market. In particular, VCB is up 0.43%, MBB is up 1.13%, VPB is up 0.51%, HDB is up 0.24%, and SSB is up 0.65%.

Compared to the opening, the selling side is dominating as the number of declining stocks is 369 (8 stocks are limit-down) while the number of gainers is 229 (22 stocks reach the limit-up).

Source: VietstockFinance

|

Opening: Positive at the beginning of the session

At the beginning of January 22nd, as of 9:30 am, VN-Index increased slightly by over 2 points, to the level of 1,183 points. HNX-Index also increased slightly above the reference level, reaching 230 points.

Green color has an advantage in the morning session, in which some construction material stocks have shown positive growth since the beginning such as HPG up 0.18%, HSG up 1.11%, and NKG up 0.8%.

Large-cap stocks like VCB, MBB, and VNM led the index-pulling group with an increase of nearly 1.8 points. On the contrary, CTG, IMP, and TMP are currently putting pressure on the market with a total pull of nearly 0.4 points.

Ly Hoa