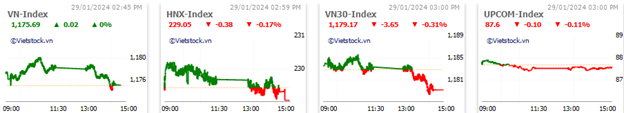

Market liquidity increased compared to the previous trading session, with the trading volume of VN-Index reaching nearly 553 million shares, equivalent to a value of over 11.5 trillion dong; HNX-Index reached nearly 52 million shares, equivalent to a value of nearly 1 trillion dong.

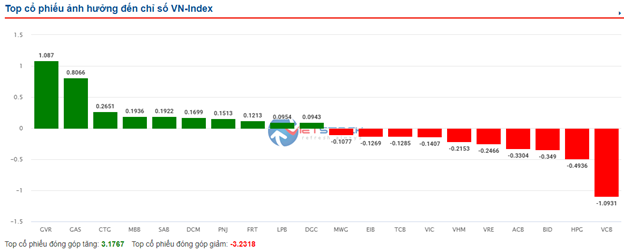

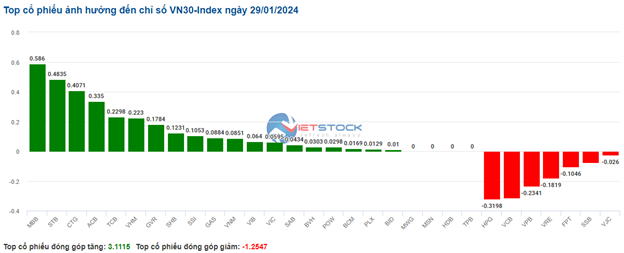

VN-Index opened the afternoon session with an optimistic atmosphere, maintaining a green color from the start of the session. Then buying pressure appeared, pulling the index gradually down to near the reference level by the end of the session. In terms of impact, GVR, GAS, and CTG were the most positive contributors to the VN-Index with a gain of more than 2 points. In contrast, VCB, HPG, and BID had the most negative impact, causing a decrease of more than 1.9 points on the index.

Source: VietstockFinance

|

HNX-Index also had a similar trend, with the index negatively affected by NVB (-0.88%), TIG (-0.83%), DXP (-0.76%), NTP (-0.69%),…

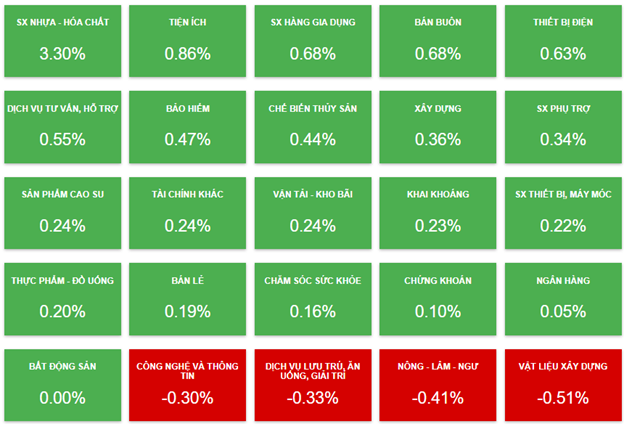

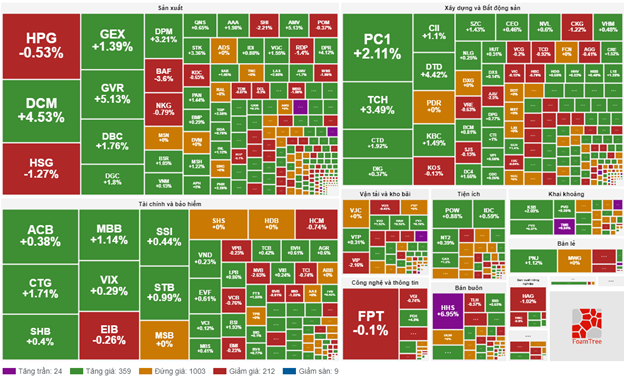

At the end of the session, the market slightly increased by 0.02 points. In which, the plastic-chemical industry had the strongest recovery with a gain of 3.07%, mainly driven by GVR (+4.9%), DGC (+1.12%), DCM (+4.05%), and DPM (+2.6%). The consulting and utilities sectors followed with gains of 1.22% and 1% respectively. On the other hand, the construction materials industry had the largest decline with -1.15%, mainly due to HPG (-1.23%), HSG (-2.97%), and NKG (-2.56%).

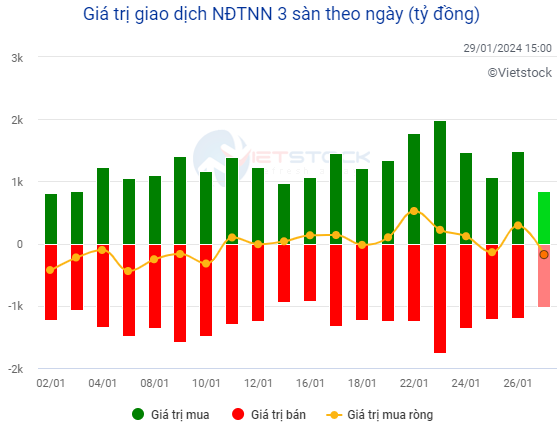

In terms of foreign trading, foreign investors net sold over 147 billion dong on HOSE, mainly focusing on PC1 (142.5 billion dong), VNM (57.13 billion dong), MSN (32.82 billion dong) and MWG (27.71 billion dong). On HNX, foreign investors net sold over 4 billion dong, focusing on TIG (1.3 billion dong), PVS (1.15 billion dong), EID (1.04 billion dong), and PGS (1.02 billion dong).

12 PM: Plastic-chemical group continues to lead

The market closed the morning session with a positive gain from the start of the session, with VN-Index increasing by 3.03 points to reach 1,178.7 points; HNX-Index increased by 0.25 points to reach 229.68 points. The overall market tilted towards buyers with 339 increasing stocks and 270 decreasing stocks. Most stocks in the VN30 basket were in the green: 18 stocks gained, 9 stocks decreased, and 3 stocks remained unchanged.

The trading volume of VN-Index recorded in the morning session reached over 282 million units, with a value of nearly 6 trillion dong. HNX-Index recorded a trading volume of over 30 million units, with a trading value of nearly 509 billion dong.

Source: VietstockFinance

|

At the end of the morning session, stocks of VCB, HPG, and VPB had the most negative impact, subtracting nearly 1.5 points from the index. In contrast, stocks of GVR, GAS, and CTG had the most positive impact, adding more than 2.2 points to the index.

The plastic-chemical industry continues to lead and make a breakthrough as most stocks in this sector increased significantly, especially stocks like GVR (+4.9%), DGC (+1.69%), DCM (+4.37%), DPM (+3.06%), PHR (+2.26%), LIX (+6.92%),…

In addition, the utilities sector also contributed positively, although not all stocks in this sector increased. GAS and SIP still maintained gains of 1.6% and 1.53%, respectively.

Sector performance at the end of the morning session on January 29th. Source: VietstockFinance

|

At the end of the morning session, the market temporarily leaned towards the green side when looking at the overall market. In which, the plastic-chemical industry had the strongest performance with a gain of 3.3%. In contrast, the construction materials industry had the most negative performance with a decline of 0.51%.

10:35 AM: Tending to increase

VN-Index increased by 3.54 points, trading around 1,179 points. HNX-Index increased by 0.5 points, trading around 230 points.

Most stocks in the VN30 basket showed a strong increase. Particularly, 4 banking stocks like MBB, ACB, STB, and TCB contributed with gains of 0.59 points, 0.48 points, 0.41 points, and 0.34 points, respectively. On the other hand, VCB, HPG, and VPB experienced selling pressure, subtracting more than 1 point from the index.

|

The plastic-chemical sector stood out from the beginning of the session. Specifically, GVR increased by 4.9%, DGC increased by 2.02%, DCM increased by 4.53%, and DPM increased by 3.36%… Other stocks were unchanged and some stocks experienced slight selling pressure, such as BMP, CSV, ADP, and HCD.

The securities sector also made a positive contribution to the overall market, with most stocks like SSI increasing by 0.44%, VND increasing by 0.23%, VCI increasing by 0.24%, and MBS increasing by 0.81%…

Meanwhile, the agriculture-forestry-fishery sector had mixed results, with slight increases in stocks like HAG (0.68%) and HNG (1%).

Compared to the beginning of the session, buyers still had an advantage. There were more than 360 increasing stocks and more than 220 decreasing stocks.

Source: VietstockFinance

|

Opening: Plastic-chemical stocks gain strongly

At the beginning of January 29, as of 9:30 AM, VN-Index recorded positive growth, reaching 1,177 points. HNX-Index slightly increased. Worth mentioning is the strong contribution of the plastic-chemical sector to the index.

In particular, stocks in the chemical sector showed positive signs and were among the top gainers at the start of the session, with GVR increasing by 1.4%, DGC increasing by 1.12%, DCM increasing by 4.37%, DPM increasing by 3.52%, AAA increasing by 1.49%,…

The mining sector also made a significant contribution as all stock prices turned green, such as PVS increasing by 0.54%, PVD increasing by 0.36%, PVC increasing by 0.69%, and PVB increasing by 0.49%.

In addition to those two sectors, many Large Cap stocks also had positive movements. GVR, SAB, GAS, TCB, BCM, MBB, VHM all contributed to the index.